Region:Europe

Author(s):Geetanshi

Product Code:KRAA6833

Pages:91

Published On:September 2025

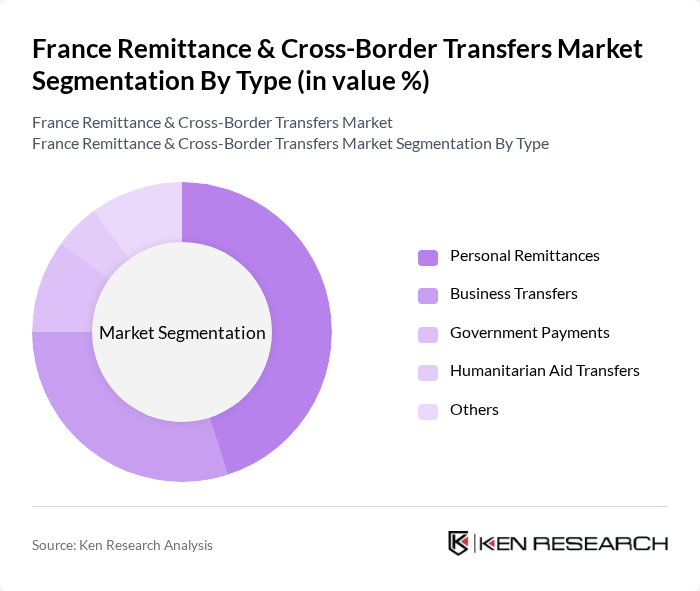

By Type:The market can be segmented into various types, including Personal Remittances, Business Transfers, Government Payments, Humanitarian Aid Transfers, and Others. Personal remittances are the most significant segment, driven by the large expatriate community in France sending money back to their home countries. Business transfers are also substantial, reflecting the growing international trade and investment activities. Government payments and humanitarian aid transfers play a crucial role in supporting various initiatives, while other types encompass a range of miscellaneous transactions.

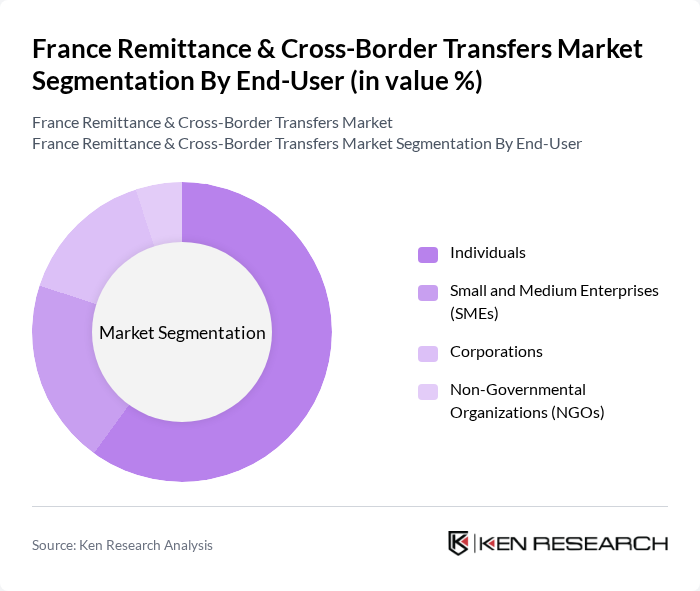

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporations, and Non-Governmental Organizations (NGOs). Individuals dominate the market, primarily due to the high volume of personal remittances sent by expatriates. SMEs also represent a significant portion, as they engage in cross-border transactions for trade and services. Corporations utilize remittance services for international business operations, while NGOs rely on these services for funding and aid distribution.

The France Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Wise (formerly TransferWise), Revolut, PayPal, WorldRemit, Remitly, Azimo, OFX, Ria Money Transfer, Skrill, Xoom, Cash App, N26, WiseAlpha contribute to innovation, geographic expansion, and service delivery in this space.

The future of the France remittance and cross-border transfers market appears promising, driven by ongoing digitalization and the increasing adoption of mobile payment solutions. As the expatriate population continues to grow, the demand for efficient and cost-effective remittance services will likely rise. Additionally, advancements in technology, such as blockchain, are expected to enhance transaction security and speed, further attracting users to formal channels and fostering market expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Remittances Business Transfers Government Payments Humanitarian Aid Transfers Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Services Prepaid Cards |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | One-time Transfers Recurring Transfers |

| By Geographic Destination | Europe Africa Asia Americas |

| By Service Provider Type | Banks Non-Bank Financial Institutions Online Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Behavior | 150 | Regular Remitters, Migrant Workers |

| Service Provider Insights | 100 | Product Managers, Marketing Directors |

| Regulatory Compliance Perspectives | 80 | Compliance Officers, Legal Advisors |

| Technological Adoption in Transfers | 70 | IT Managers, Digital Transformation Leads |

| Consumer Preferences in Transfer Methods | 90 | End Users, Financial Service Users |

The France Remittance & Cross-Border Transfers Market is valued at approximately USD 30 billion, reflecting a significant increase driven by the growing expatriate population and the rise of digital payment solutions facilitating cross-border transactions.