Region:Europe

Author(s):Rebecca

Product Code:KRAA6867

Pages:83

Published On:September 2025

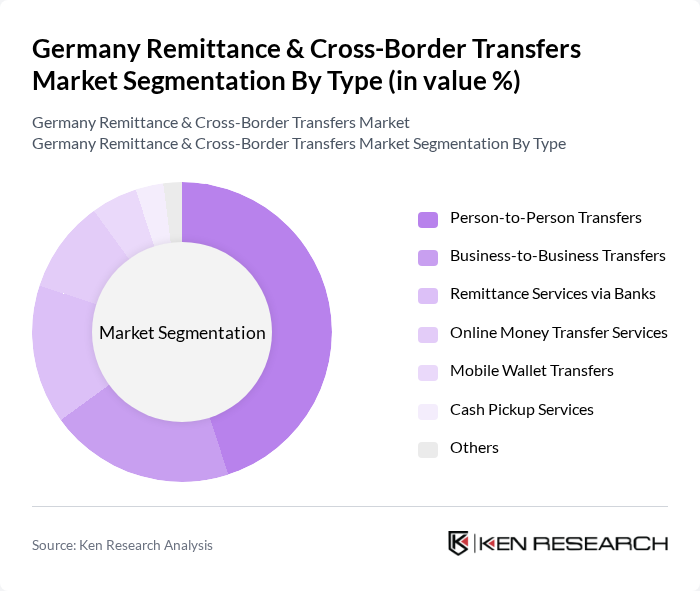

By Type:The market is segmented into various types of remittance and cross-border transfer services, including Person-to-Person Transfers, Business-to-Business Transfers, Remittance Services via Banks, Online Money Transfer Services, Mobile Wallet Transfers, Cash Pickup Services, and Others. Among these, Person-to-Person Transfers dominate the market due to the high volume of individual remittances sent by expatriates to their families and friends. The convenience and speed of these services have made them the preferred choice for many users.

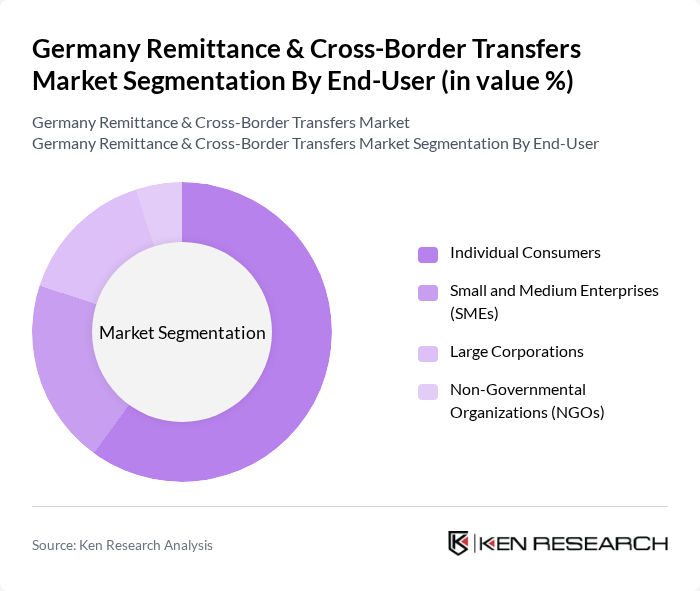

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers represent the largest segment, driven by the need for personal remittances among expatriates and migrant workers. The increasing reliance on digital platforms for personal transactions has further solidified this segment's dominance in the market.

The Germany Remittance & Cross-Border Transfers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Deutsche Bank AG, Western Union, MoneyGram International, Inc., TransferWise Ltd., Revolut Ltd., PayPal Holdings, Inc., Remitly, Inc., WorldRemit Ltd., Azimo Ltd., Skrill Limited, N26 GmbH, OFX Limited, Xoom Corporation, Wise Payments Ltd., CashSend contribute to innovation, geographic expansion, and service delivery in this space.

The future of the remittance and cross-border transfers market in Germany appears promising, driven by technological advancements and evolving consumer preferences. As digital payment solutions continue to gain traction, the market is likely to see increased adoption of mobile wallets and peer-to-peer transfer platforms. Additionally, the integration of blockchain technology may enhance transaction security and efficiency, further attracting users. Overall, the landscape is set for innovation, with a focus on improving user experience and reducing costs in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Transfers Remittance Services via Banks Online Money Transfer Services Mobile Wallet Transfers Cash Pickup Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards Mobile Payments Cash Payments |

| By Transfer Speed | Instant Transfers Same-Day Transfers Standard Transfers |

| By Geographic Destination | Transfers to Europe Transfers to Asia Transfers to Africa Transfers to the Americas |

| By Customer Segment | Domestic Customers International Customers Corporate Clients |

| By Service Provider Type | Traditional Banks Fintech Companies Money Transfer Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Remittance Services | 150 | Individuals using remittance services, aged 18-65 |

| Business Cross-Border Transfers | 100 | Finance Managers, CFOs of SMEs engaged in international trade |

| Digital Payment Platforms | 80 | Product Managers, Marketing Directors from fintech companies |

| Regulatory Compliance Insights | 60 | Compliance Officers, Legal Advisors in financial institutions |

| Consumer Behavior Analysis | 90 | Market Researchers, Consumer Insights Analysts |

The Germany Remittance & Cross-Border Transfers Market is valued at approximately USD 30 billion, reflecting a significant growth driven by the increasing number of expatriates and the rise of digital payment solutions that facilitate faster and cheaper transactions.