Region:Middle East

Author(s):Geetanshi

Product Code:KRAC4518

Pages:83

Published On:October 2025

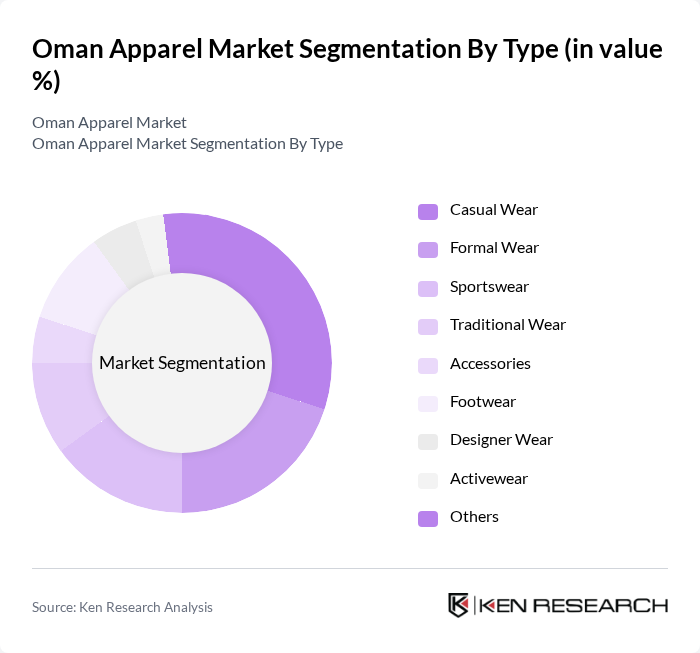

By Type:The apparel market in Oman can be segmented into various types, including Casual Wear, Formal Wear, Sportswear, Traditional Wear, Accessories, Footwear, Designer Wear, Activewear, and Others. Among these, Casual Wear is the most dominant segment, driven by the increasing trend of relaxed dressing styles and the growing preference for comfort among consumers. The rise of e-commerce has also facilitated the accessibility of casual apparel, making it a popular choice for everyday wear.

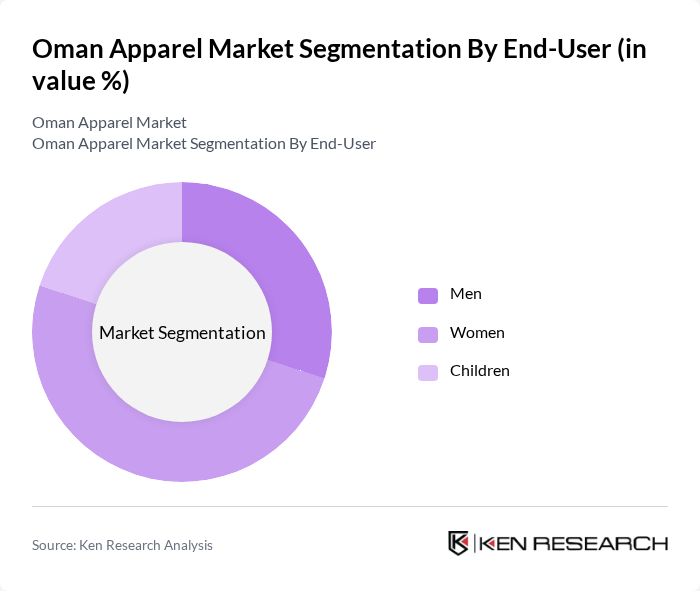

By End-User:The market can also be segmented by end-user categories, which include Men, Women, and Children. The Women’s segment is currently the largest, driven by a growing emphasis on fashion and personal style among female consumers. This segment has seen a surge in demand for both casual and formal wear, reflecting changing societal norms and increased participation of women in the workforce.

The Oman Apparel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ounass, Al Shaya Group, Oman Textile Mills Co. SAOG, Al Harithy Company, Al Ahlia Trading Co., Muscat Clothing Company, Al Jazeera Group, Al Mufeed Trading, Al Muna Fashion, Al Noor Textiles, Al Fawaz Group, Al Jood Clothing, Al Sadiq Fashion, Al Waha Apparel, Al Ruwad Clothing contribute to innovation, geographic expansion, and service delivery in this space.

The Oman apparel market is poised for dynamic growth, driven by increasing disposable incomes and a burgeoning interest in fashion among the youth. As e-commerce continues to expand, local brands are likely to enhance their online presence, catering to a tech-savvy consumer base. Additionally, sustainability trends will shape product offerings, with eco-friendly materials gaining traction. The combination of these factors suggests a vibrant future for the apparel sector, fostering innovation and competitiveness in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Casual Wear Formal Wear Sportswear Traditional Wear Accessories Footwear Designer Wear Activewear Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Department Stores Wholesale Distributors |

| By Price Range | Budget Mid-Range Premium High-End Ultra-Luxury |

| By Fabric Type | Cotton Polyester Wool Blends Eco-Friendly Materials |

| By Occasion | Everyday Wear Special Events Workwear Seasonal Wear |

| By Region | Muscat Salalah Sohar Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Apparel Preferences | 100 | General Consumers, Fashion Enthusiasts |

| Retail Sector Insights | 60 | Store Managers, Retail Buyers |

| Manufacturing Trends | 40 | Production Managers, Supply Chain Managers |

| Online Shopping Behavior | 80 | eCommerce Shoppers, Digital Marketing Specialists |

| Sustainability Practices in Apparel | 50 | Sustainability Officers, Brand Managers |

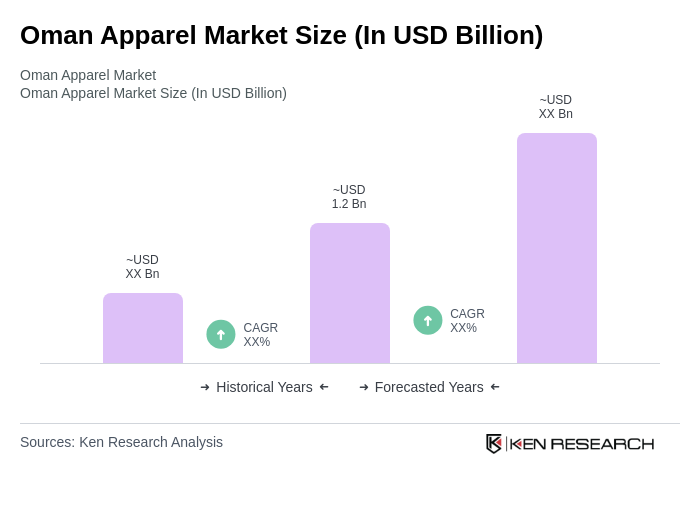

The Oman Apparel Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing consumer spending, a growing population, and heightened fashion consciousness, particularly among the youth demographic.