Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0991

Pages:83

Published On:October 2025

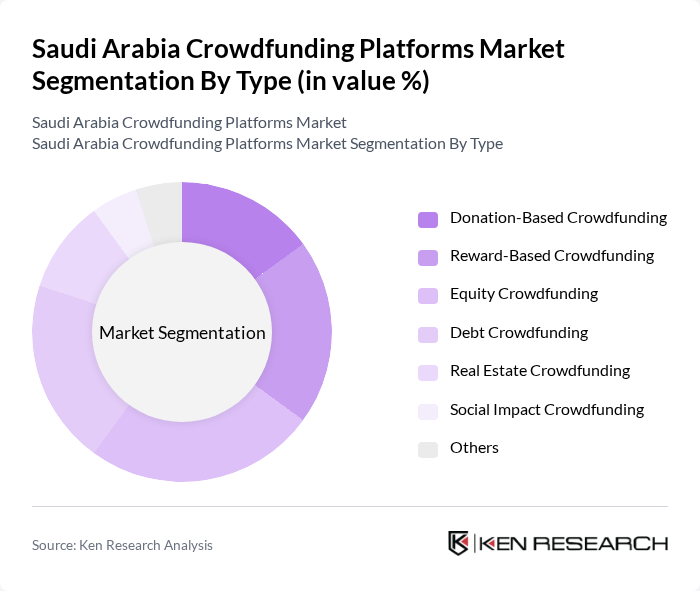

By Type:The crowdfunding platforms in Saudi Arabia can be categorized into several types, including Donation-Based Crowdfunding, Reward-Based Crowdfunding, Equity Crowdfunding, Debt Crowdfunding, Real Estate Crowdfunding, Social Impact Crowdfunding, and Others. Among these, Debt-Based Crowdfunding currently holds the largest revenue share, while Equity Crowdfunding is the fastest-growing segment due to increasing interest from investors in startup equity and the potential for high returns. This segment is particularly appealing to tech-savvy investors looking to diversify their portfolios and support innovative projects .

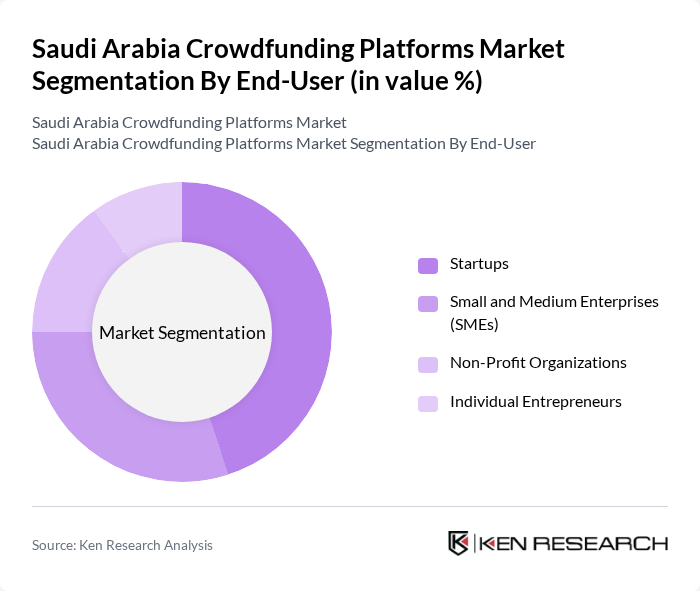

By End-User:The end-users of crowdfunding platforms in Saudi Arabia include Startups, Small and Medium Enterprises (SMEs), Non-Profit Organizations, and Individual Entrepreneurs. Startups are the leading end-user segment, driven by the need for capital to launch innovative products and services. The growing entrepreneurial spirit among the youth and the increasing number of incubators and accelerators have further fueled this trend, making startups the primary beneficiaries of crowdfunding .

The Saudi Arabia Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safqah Capital, Funding Souq, Beehive, Manafa Capital, Forus, Eureeca, Yomken, GoFundMe, Kickstarter, Indiegogo, Kiva, Fundly contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crowdfunding platforms market in Saudi Arabia appears promising, driven by increasing digital adoption and supportive government initiatives. As regulatory frameworks become clearer, more entrepreneurs are likely to leverage crowdfunding as a viable financing option. Additionally, the growing interest in social impact investing and sustainability will further enhance the appeal of crowdfunding platforms, attracting a diverse range of investors and projects that align with these values.

| Segment | Sub-Segments |

|---|---|

| By Type | Donation-Based Crowdfunding Reward-Based Crowdfunding Equity Crowdfunding Debt Crowdfunding Real Estate Crowdfunding Social Impact Crowdfunding Others |

| By End-User | Startups Small and Medium Enterprises (SMEs) Non-Profit Organizations Individual Entrepreneurs |

| By Investment Source | Individual Investors Institutional Investors Corporate Investors Government Grants |

| By Application | Technology Projects Creative Projects Community Projects Health and Wellness Projects |

| By Platform Type | Online Platforms Mobile Applications Hybrid Platforms |

| By Geographic Focus | Local Projects Regional Projects International Projects |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Crowdfunding Platforms | 60 | Platform Founders, Investment Analysts |

| Reward-based Crowdfunding Initiatives | 50 | Project Creators, Marketing Managers |

| Donation-based Crowdfunding Campaigns | 40 | Non-profit Executives, Community Leaders |

| Investor Sentiment Analysis | 70 | Individual Investors, Financial Advisors |

| Regulatory Impact Assessment | 40 | Legal Advisors, Compliance Officers |

The Saudi Arabia Crowdfunding Platforms Market is valued at approximately USD 70 million, reflecting a growing interest in digital financial solutions and supportive government initiatives aimed at fostering innovation and investment in startups.