Region:Middle East

Author(s):Rebecca

Product Code:KRAC1104

Pages:95

Published On:October 2025

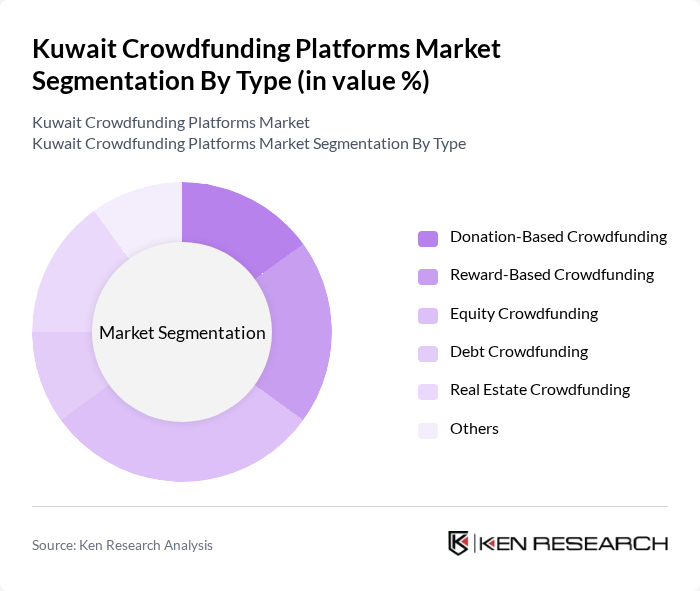

By Type:The crowdfunding market can be segmented into various types, including Donation-Based Crowdfunding, Reward-Based Crowdfunding, Equity Crowdfunding, Debt Crowdfunding, Real Estate Crowdfunding, and Others. Each type serves different purposes and attracts distinct investor profiles. Among these, Equity Crowdfunding has gained significant traction due to its potential for high returns and the growing interest in startup investments. Private platforms benefit from the nation's wealth concentration and cultural preference for tangible funding, with high-net-worth individuals and corporate entities preferring equity-dependent platforms that promise returns and ownership support.

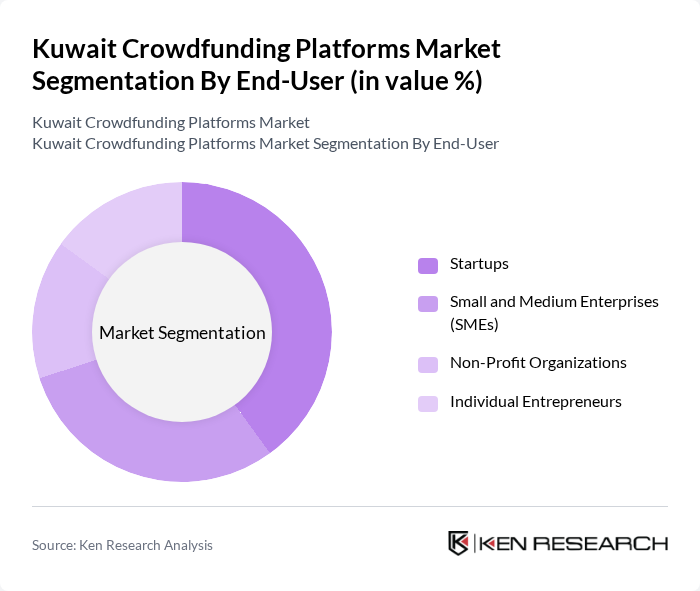

By End-User:The end-user segmentation includes Startups, Small and Medium Enterprises (SMEs), Non-Profit Organizations, and Individual Entrepreneurs. Startups are the leading end-users, leveraging crowdfunding to secure initial funding and validate their business ideas. The entrepreneurship segment dominated the market due to both government initiatives and a competitive youth population eager to innovate, with the Kuwaiti government reinforcing entrepreneurship through various schemes such as the National Fund for Small and Medium Enterprises Development, which offers financial support and consulting services to contemporary businesses. The trend of entrepreneurship among the youth has significantly contributed to the growth of this segment.

The Kuwait Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as StartEngine Crowdfunding, Inc., Fundable, Seed&Spark, Wefunder, InspireMe.Fund, Eureeca, StartSomeGood, FasterCapital, Kickstarter PBC, Indiegogo, Inc., GoFundMe, RocketHub contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait crowdfunding market appears promising, driven by technological advancements and a growing emphasis on sustainability. As platforms increasingly integrate blockchain technology, transparency and security will enhance investor confidence. Furthermore, the rise of community-based funding initiatives is expected to foster local engagement, allowing projects to gain traction. With the government’s continued support and a focus on social impact investing, the market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Donation-Based Crowdfunding Reward-Based Crowdfunding Equity Crowdfunding Debt Crowdfunding Real Estate Crowdfunding Others |

| By End-User | Startups Small and Medium Enterprises (SMEs) Non-Profit Organizations Individual Entrepreneurs |

| By Investment Source | Individual Investors Institutional Investors Corporate Investors Government Grants |

| By Platform Type | Public Crowdfunding Platforms Private Crowdfunding Platforms |

| By Industry Focus | Technology Healthcare Arts and Culture Social Enterprises |

| By Geographic Focus | Local Projects Regional Projects International Projects |

| By Campaign Duration | Short-Term Campaigns Long-Term Campaigns Ongoing Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Startup Founders Utilizing Crowdfunding | 40 | Entrepreneurs, Business Owners |

| Investors in Crowdfunding Platforms | 40 | Angel Investors, Venture Capitalists |

| Regulatory Bodies and Financial Authorities | 20 | Policy Makers, Financial Regulators |

| Users of Crowdfunding Services | 40 | Project Creators, Backers |

| Industry Experts and Analysts | 20 | Market Analysts, Financial Advisors |

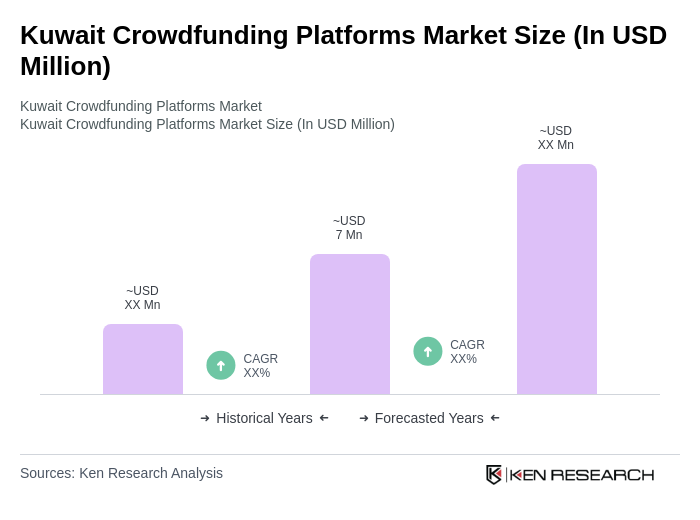

The Kuwait Crowdfunding Platforms Market is valued at approximately USD 7 million, reflecting a five-year historical analysis. This growth is driven by increased digital financial solutions and government initiatives supporting entrepreneurship.