Region:Middle East

Author(s):Rebecca

Product Code:KRAC1111

Pages:99

Published On:October 2025

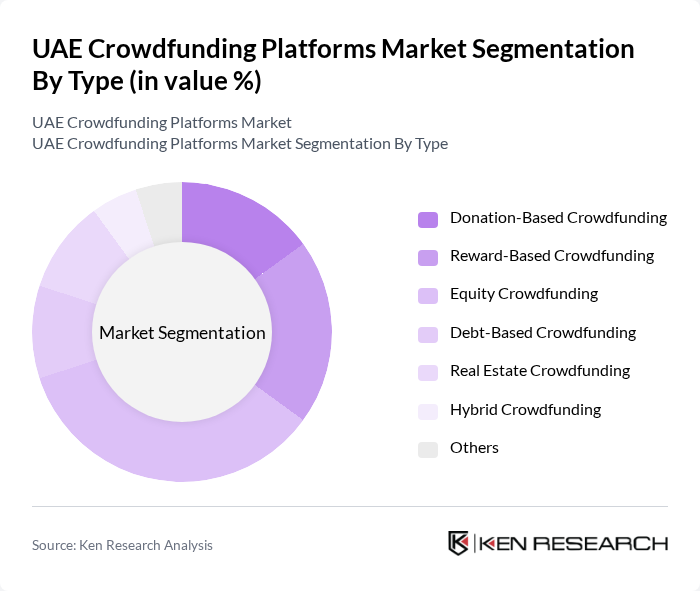

By Type:The crowdfunding platforms can be categorized into various types, including Donation-Based Crowdfunding, Reward-Based Crowdfunding, Equity Crowdfunding, Debt-Based Crowdfunding, Real Estate Crowdfunding, Hybrid Crowdfunding, and Others. Debt-Based Crowdfunding currently holds the largest revenue share, driven by SME demand for alternative financing and lower interest rates compared to traditional loans. However, Equity Crowdfunding is the fastest-growing sub-segment, propelled by investor interest in startup equity and the democratization of investment opportunities. Real estate crowdfunding is also expanding rapidly, reflecting the strength of the UAE property market .

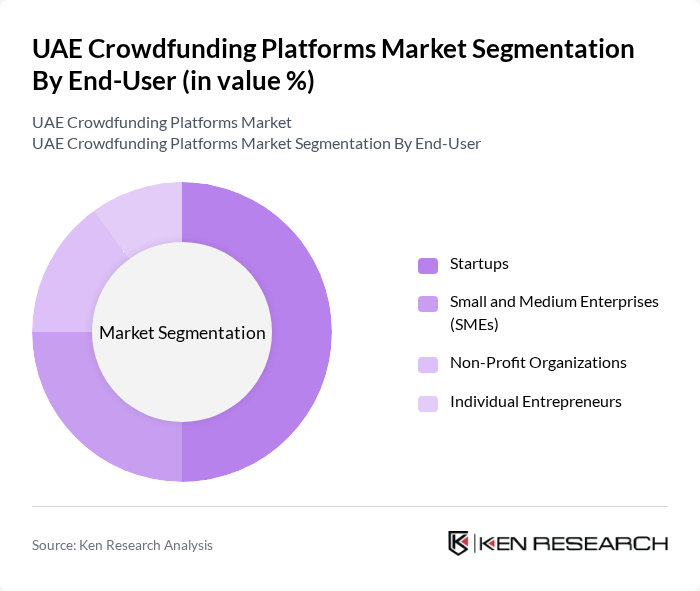

By End-User:The end-users of crowdfunding platforms include Startups, Small and Medium Enterprises (SMEs), Non-Profit Organizations, and Individual Entrepreneurs. Startups are the dominant end-user segment, leveraging crowdfunding to access capital for product development, market entry, and scaling operations. The increasing number of startups in the UAE, supported by government initiatives and a vibrant entrepreneurial ecosystem, has significantly contributed to the growth of this segment. SMEs also utilize crowdfunding for expansion, while Non-Profit Organizations and Individual Entrepreneurs tap into these platforms for community projects and personal ventures .

The UAE Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive, Eureeca, SmartCrowd, FundedHere, Zoomaal, Yomken, GoFundMe, Kickstarter, Indiegogo, Crowdcube, Seedrs, Fundrazr, StartSomeGood, Patreon, Crowdfunder contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE crowdfunding market appears promising, driven by increasing digitalization and government support for startups. As more entrepreneurs seek alternative funding sources, the integration of advanced technologies like blockchain is expected to enhance transparency and security in transactions. Additionally, the growing focus on social impact investments will likely attract a new wave of investors interested in supporting sustainable projects, further expanding the market's reach and potential.

| Segment | Sub-Segments |

|---|---|

| By Type | Donation-Based Crowdfunding Reward-Based Crowdfunding Equity Crowdfunding Debt-Based Crowdfunding Real Estate Crowdfunding Hybrid Crowdfunding Others |

| By End-User | Startups Small and Medium Enterprises (SMEs) Non-Profit Organizations Individual Entrepreneurs |

| By Investment Source | Individual Investors Institutional Investors Corporate Investors Government Grants |

| By Sector | Technology Healthcare Real Estate Creative Arts Social Enterprises Others |

| By Platform Type | Online Platforms Mobile Applications Hybrid Platforms |

| By Geographic Focus | Local Projects Regional Projects International Projects |

| By Policy Support | Government Initiatives Tax Incentives Regulatory Frameworks Public Awareness Campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Crowdfunding Platforms | 85 | Platform Founders, Investment Analysts |

| Debt-based Crowdfunding Platforms | 95 | Platform CEOs, Credit Risk Managers |

| Donation-based Crowdfunding Campaigns | 55 | Non-profit Executives, Community Leaders |

| Investor Sentiment Analysis | 75 | Individual Investors, Financial Advisors |

| Regulatory Impact Assessment | 50 | Legal Experts, Compliance Officers |

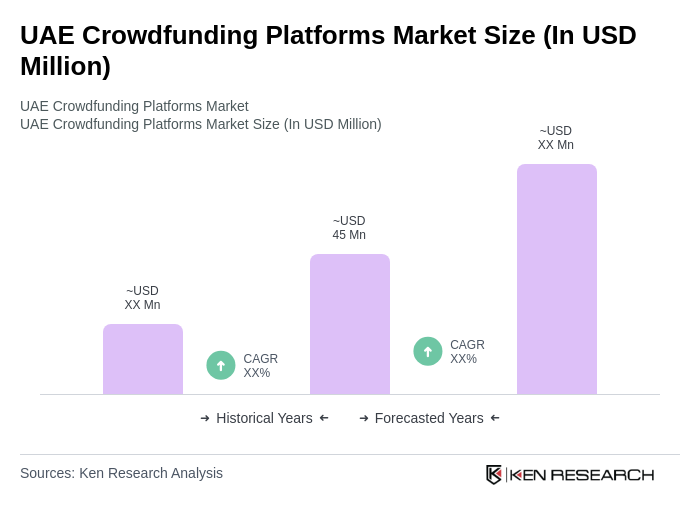

The UAE Crowdfunding Platforms Market is valued at approximately USD 45 million, driven by the increasing adoption of digital financial solutions and a growing startup ecosystem. This market is expected to continue expanding as awareness of alternative funding sources increases among entrepreneurs and investors.