Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1021

Pages:84

Published On:October 2025

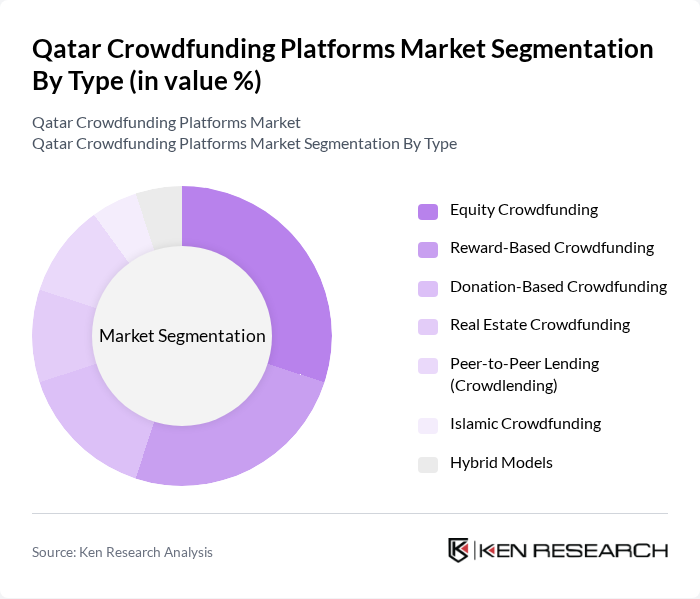

By Type:The crowdfunding platforms in Qatar can be categorized into several types, including Equity Crowdfunding, Reward-Based Crowdfunding, Donation-Based Crowdfunding, Real Estate Crowdfunding, Peer-to-Peer Lending (Crowdlending), Islamic Crowdfunding, and Hybrid Models. Each type serves different purposes and appeals to various investor preferences, with Equity Crowdfunding being particularly popular among startups seeking capital in exchange for equity stakes.

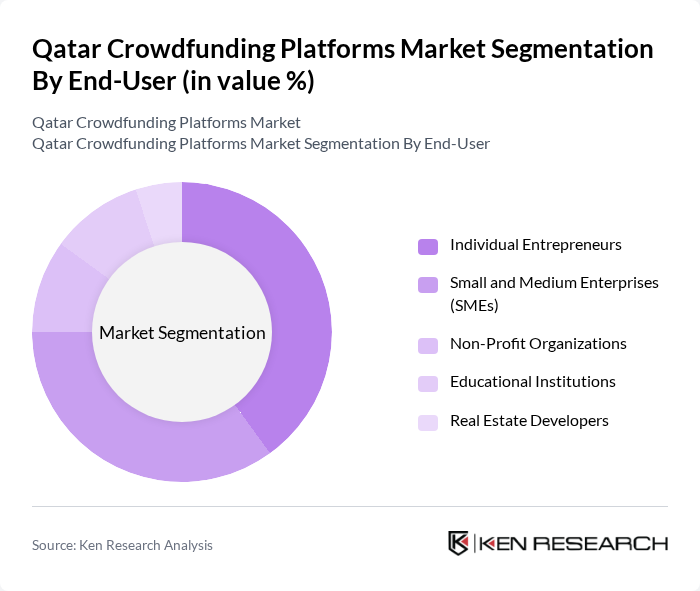

By End-User:The end-users of crowdfunding platforms in Qatar include Individual Entrepreneurs, Small and Medium Enterprises (SMEs), Non-Profit Organizations, Educational Institutions, and Real Estate Developers. Each of these segments utilizes crowdfunding for different purposes, with SMEs being the most significant users due to their need for flexible funding options to support growth and innovation.

The Qatar Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarFinTech Hub, Beehive, Eureeca, Qatar Development Bank (QDB) Crowdfunding Platform, Qatar Charity Crowdfunding, Yomken, Zoomaal, FundedByMe, Eureeca MENA, LaunchGood, GoGetFunding, Shekra, Afkarmena, Aflamnah, Crowd Analyzer contribute to innovation, geographic expansion, and service delivery in this space.

The future of the crowdfunding market in Qatar appears promising, driven by increasing digital literacy and a growing entrepreneurial ecosystem. As more startups emerge, the demand for innovative funding solutions will likely rise. Additionally, the integration of advanced technologies, such as blockchain, is expected to enhance transparency and security in transactions, attracting more investors. The government's continued support for SMEs will further bolster the crowdfunding landscape, creating a conducive environment for growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Equity Crowdfunding Reward-Based Crowdfunding Donation-Based Crowdfunding Real Estate Crowdfunding Peer-to-Peer Lending (Crowdlending) Islamic Crowdfunding Hybrid Models |

| By End-User | Individual Entrepreneurs Small and Medium Enterprises (SMEs) Non-Profit Organizations Educational Institutions Real Estate Developers |

| By Investment Source | Individual Investors Institutional Investors Corporate Investors Government Grants Family Offices |

| By Campaign Duration | Short-Term Campaigns (?3 months) Medium-Term Campaigns (3–6 months) Long-Term Campaigns (>6 months) |

| By Platform Type | Web-Based Platforms Mobile Applications Hybrid Platforms |

| By Geographic Focus | Domestic Projects (Qatar) GCC Regional Projects International Projects |

| By Policy Support | Government Subsidies Tax Exemptions Regulatory Support Shariah-Compliant Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Crowdfunding Platforms | 60 | Platform Founders, Investment Analysts |

| Donation-based Crowdfunding Initiatives | 50 | Non-profit Managers, Community Leaders |

| Rewards-based Crowdfunding Projects | 40 | Entrepreneurs, Product Developers |

| Investor Sentiment Analysis | 70 | Individual Investors, Venture Capitalists |

| Regulatory Impact Assessment | 40 | Legal Advisors, Compliance Officers |

The Qatar Crowdfunding Platforms Market is valued at approximately USD 150 million, reflecting a significant growth trend driven by the increasing demand for alternative financing solutions among startups and small businesses in the region.