Region:Middle East

Author(s):Rebecca

Product Code:KRAC1164

Pages:93

Published On:October 2025

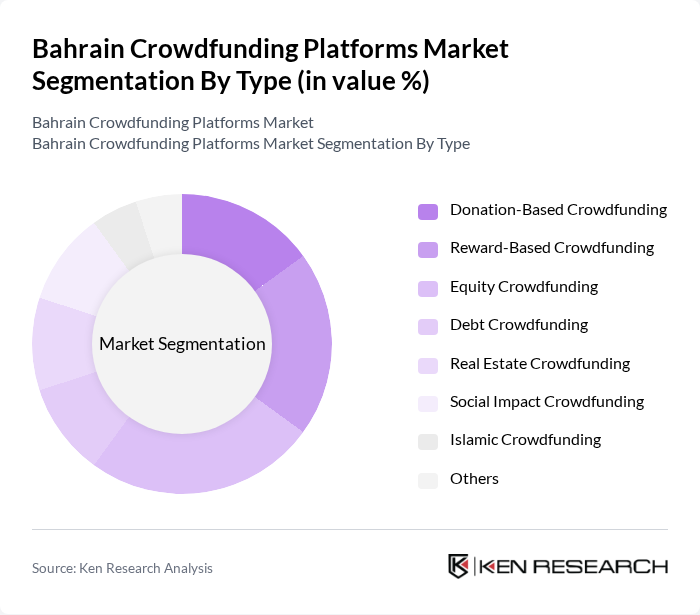

By Type:The crowdfunding platforms can be categorized into various types, each serving different purposes and target audiences. The primary types include Donation-Based Crowdfunding, Reward-Based Crowdfunding, Equity Crowdfunding, Debt Crowdfunding, Real Estate Crowdfunding, Social Impact Crowdfunding, Islamic Crowdfunding, and Others. Each type caters to specific needs, with some focusing on charitable causes while others facilitate investment opportunities .

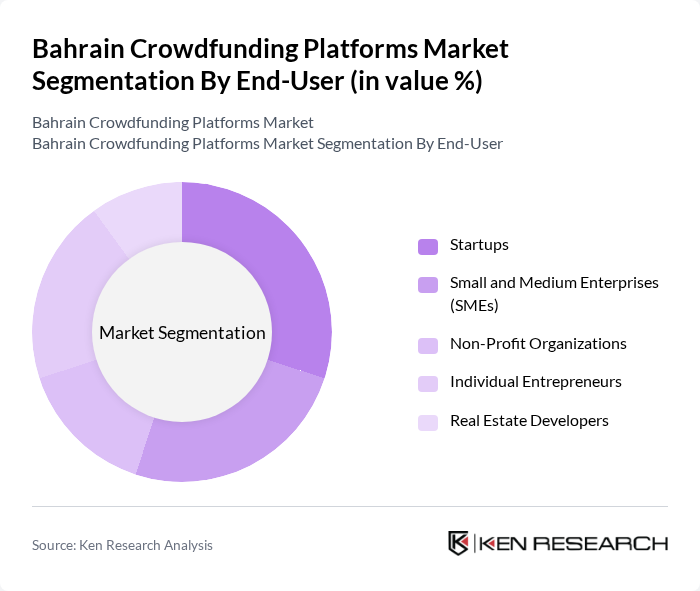

By End-User:The end-users of crowdfunding platforms include various segments such as Startups, Small and Medium Enterprises (SMEs), Non-Profit Organizations, Individual Entrepreneurs, and Real Estate Developers. Each of these segments utilizes crowdfunding for different purposes, from raising initial capital to funding community projects .

The Bahrain Crowdfunding Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Beehive Bahrain, Eureeca, Malaeb, Zoomaal, Afkarmena, LaunchGood, Kickstarter, Indiegogo, Crowdcube, Seedrs, Fundable, StartSomeGood, Patreon, Fundrazr, Crowdfunder contribute to innovation, geographic expansion, and service delivery in this space .

The Bahrain crowdfunding market is poised for significant growth, driven by increasing entrepreneurial activity and a supportive regulatory environment. As digital payment adoption continues to rise, more individuals are likely to engage with crowdfunding platforms. Additionally, the integration of innovative technologies, such as blockchain, is expected to enhance transparency and security, further attracting investors. The focus on sustainable projects will also shape the market, aligning with global trends towards responsible investing and social impact.

| Segment | Sub-Segments |

|---|---|

| By Type | Donation-Based Crowdfunding Reward-Based Crowdfunding Equity Crowdfunding Debt Crowdfunding Real Estate Crowdfunding Social Impact Crowdfunding Islamic Crowdfunding Others |

| By End-User | Startups Small and Medium Enterprises (SMEs) Non-Profit Organizations Individual Entrepreneurs Real Estate Developers |

| By Investment Source | Individual Investors Institutional Investors Crowdfunding Networks Government Grants Family Offices |

| By Project Type | Technology Projects Creative Projects Community Projects Environmental Projects Social Enterprises |

| By Platform Type | Online Platforms Mobile Applications Hybrid Platforms |

| By Geographic Focus | Local Projects Regional Projects International Projects |

| By Policy Support | Government-Backed Initiatives Tax Incentives Regulatory Support Programs Shariah-Compliant Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Equity Crowdfunding Users | 100 | Investors, Startup Founders |

| Donation-based Crowdfunding Campaigns | 60 | Non-profit Organizations, Community Leaders |

| Rewards-based Crowdfunding Projects | 50 | Creative Entrepreneurs, Product Developers |

| Regulatory Stakeholders | 40 | Policy Makers, Financial Regulators |

| Market Analysts and Researchers | 40 | Financial Analysts, Market Researchers |

The Bahrain Crowdfunding Platforms Market is valued at approximately USD 1.2 million, reflecting a five-year historical analysis. This growth is attributed to the increasing adoption of digital financial solutions and a burgeoning entrepreneurial ecosystem.