Region:Middle East

Author(s):Geetanshi

Product Code:KRAA6582

Pages:84

Published On:January 2026

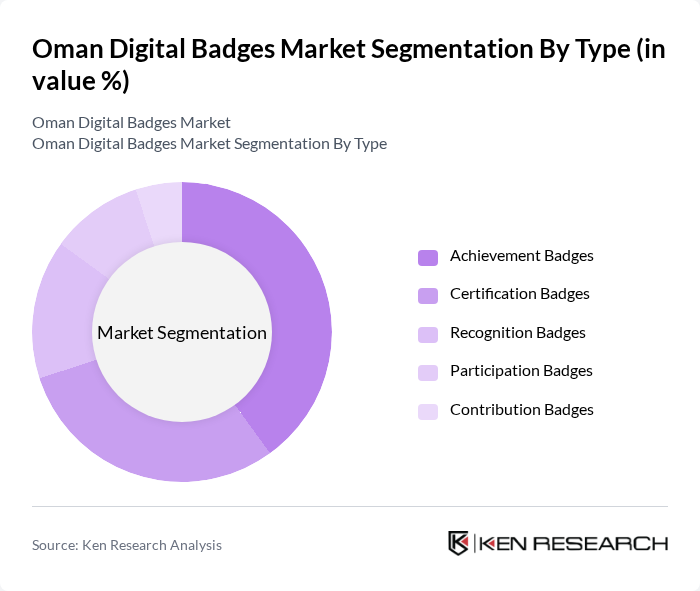

By Type:The market can be segmented into various types of digital badges, including Achievement Badges, Certification Badges, Recognition Badges, Participation Badges, and Contribution Badges. Among these, Achievement Badges are currently leading the market due to their widespread use in educational settings to motivate learners and validate their skills. Certification Badges follow closely, as they are essential for professional development and career advancement. The demand for Recognition Badges is also growing, particularly in corporate environments where employee contributions need to be acknowledged.

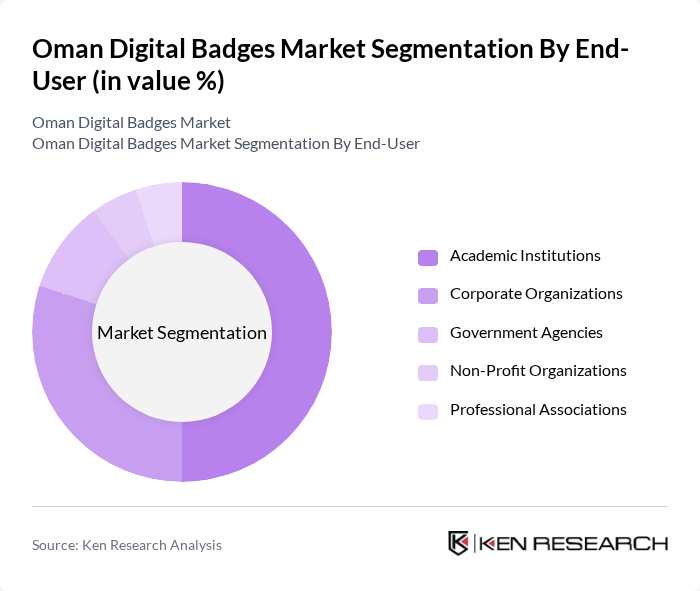

By End-User:The digital badges market is segmented by end-users, including Academic Institutions, Corporate Organizations, Government Agencies, Non-Profit Organizations, and Professional Associations. Academic Institutions are the dominant segment, leveraging digital badges to enhance student engagement and track learning outcomes. Corporate Organizations are also significant users, employing badges for employee training and development programs. Government Agencies are increasingly adopting digital badges to recognize skills and qualifications in public service roles.

The Oman Digital Badges Market is characterized by a dynamic mix of regional and international players. Leading participants such as Pearson, PeopleCert, Accredible, Skillsoft, Instructure, Inc., Certif-ID International GmbH, Sertifier Inc., BadgeCert, Digitary Australia Pty Ltd, BadgeList, Credly, Badgr, Learning Machine, Parchment, Coursera contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman digital badges market appears promising, driven by increasing acceptance of digital credentials and ongoing government support for digital education. As more educational institutions adopt digital badge systems, the recognition of these credentials is likely to grow in future. Additionally, the integration of advanced technologies, such as blockchain for security, will enhance trust in digital badges. This evolving landscape suggests a shift towards a more flexible and inclusive approach to credentialing, aligning with global trends in education and workforce development.

| Segment | Sub-Segments |

|---|---|

| By Type | Achievement Badges Certification Badges Recognition Badges Participation Badges Contribution Badges |

| By End-User | Academic Institutions Corporate Organizations Government Agencies Non-Profit Organizations Professional Associations |

| By Offering | Platform Solutions Professional Services Managed Services |

| By Deployment Mode | Cloud-based Solutions On-premises Solutions |

| By Application | Skill Development Employee Recognition Learning and Development Certification and Training Gamification |

| By Technology Used | Blockchain Technology Cloud-based Solutions Mobile Applications Learning Management Systems Artificial Intelligence Integration |

| By Geographic Distribution | Urban Areas Rural Areas |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 45 | University Administrators, Curriculum Developers |

| Vocational Training Centers | 40 | Training Coordinators, Program Managers |

| K-12 Schools | 35 | Teachers, School Principals |

| Corporate Training Programs | 20 | HR Managers, Learning and Development Specialists |

| Government Educational Bodies | 15 | Policy Makers, Educational Consultants |

The Oman Digital Badges Market is valued at approximately USD 42 million, reflecting a significant growth trend driven by the increasing adoption of digital credentialing in educational institutions and corporate training programs.