Region:Middle East

Author(s):Geetanshi

Product Code:KRAA6575

Pages:81

Published On:January 2026

By Type:The market can be segmented into various types of digital badges, including Educational Badges, Professional Badges, Organizational Badges, Community Badges, and Others. Each type serves distinct purposes and caters to different audiences, reflecting the diverse applications of digital badges in education and professional development.

The Educational Badges segment is currently leading the market, driven by the increasing number of educational institutions adopting digital credentialing systems. These badges are used to recognize student achievements, skills, and competencies, making them essential for learners in a competitive job market. The trend towards personalized learning and the need for continuous skill development further bolster the demand for educational badges, as they provide a tangible way for students to showcase their learning outcomes.

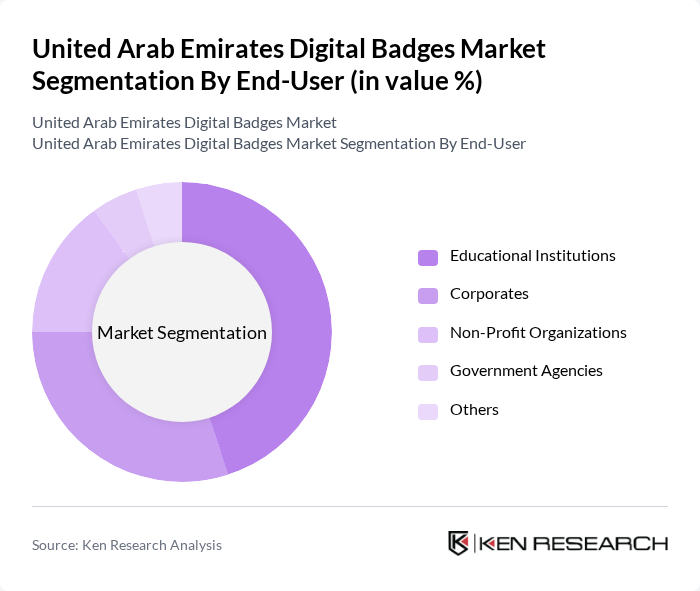

By End-User:The market can also be segmented by end-users, which include Educational Institutions, Corporates, Non-Profit Organizations, Government Agencies, and Others. Each end-user category utilizes digital badges for different purposes, such as skill recognition, employee training, and community engagement.

Educational Institutions represent the largest end-user segment, as they increasingly adopt digital badges to enhance student engagement and provide a modern approach to credentialing. Higher education institutions particularly lead adoption, capturing over 38 percent of the digital badges market share. The shift towards competency-based education and the need for institutions to demonstrate the value of their programs have led to a surge in the use of digital badges. Corporates are also significant users, leveraging badges for employee training and development, but the educational sector remains the primary driver of market growth.

The United Arab Emirates Digital Badges Market is characterized by a dynamic mix of regional and international players. Leading participants such as Credly, BadgeCert, Open Badges, Digitalme, Pearson, Accredible, Skillshare, LinkedIn Learning, Mozilla Open Badges, Badgr, Eduventures, Learning Machine, Acclaim, IBM Digital Badges, University of Phoenix contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital badges market in the UAE appears promising, driven by increasing collaboration between educational institutions and technology providers. As the demand for micro-credentials rises, more organizations are likely to adopt digital badges as a standard practice for skill recognition. Additionally, the integration of advanced technologies, such as blockchain for verification, will enhance the security and trustworthiness of digital credentials, paving the way for broader acceptance and utilization in various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Educational Badges Professional Badges Organizational Badges Community Badges Others |

| By End-User | Educational Institutions Corporates Non-Profit Organizations Government Agencies Others |

| By Industry | Education Healthcare Technology Retail Others |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Ajman Others |

| By Purpose | Skill Recognition Career Advancement Community Engagement Personal Development Others |

| By Delivery Method | Online Platforms Mobile Applications In-Person Workshops Hybrid Models Others |

| By Certification Authority | Educational Institutions Professional Organizations Government Bodies Private Companies Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 100 | University Administrators, Curriculum Developers |

| Corporate Training Programs | 80 | HR Managers, Training Coordinators |

| K-12 Schools | 70 | Teachers, School Principals |

| EdTech Companies | 60 | Product Managers, Educational Consultants |

| Students and Learners | 90 | Undergraduate Students, Adult Learners |

The United Arab Emirates Digital Badges Market is valued at approximately USD 50 million, reflecting significant growth driven by the increasing adoption of digital learning platforms and the demand for skill recognition across various sectors.