Region:Middle East

Author(s):Shubham

Product Code:KRAD2560

Pages:80

Published On:January 2026

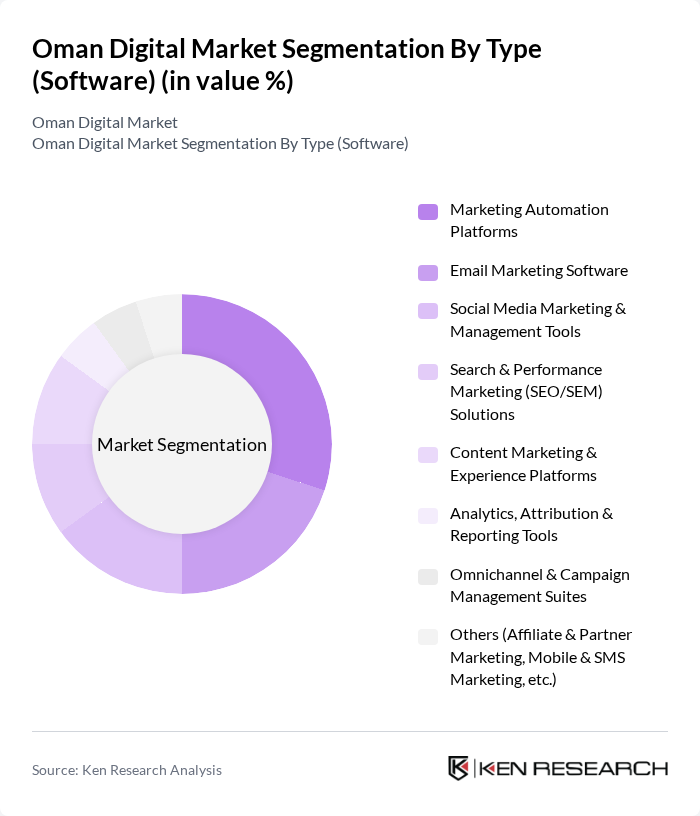

By Type (Software):The digital marketing software market in Oman is segmented into various types, including Marketing Automation Platforms, Email Marketing Software, Social Media Marketing & Management Tools, Search & Performance Marketing (SEO/SEM) Solutions, Content Marketing & Experience Platforms, Analytics, Attribution & Reporting Tools, Omnichannel & Campaign Management Suites, and Others (Affiliate & Partner Marketing, Mobile & SMS Marketing, etc.). This structure is consistent with global digital marketing software categorization, where marketing automation, email, social, content, analytics, and campaign management form the core solution clusters. Among these, Marketing Automation Platforms are leading the market due to their ability to streamline marketing efforts, orchestrate omnichannel campaigns, and improve efficiency for enterprises and SMEs adopting data?driven and personalized engagement strategies.

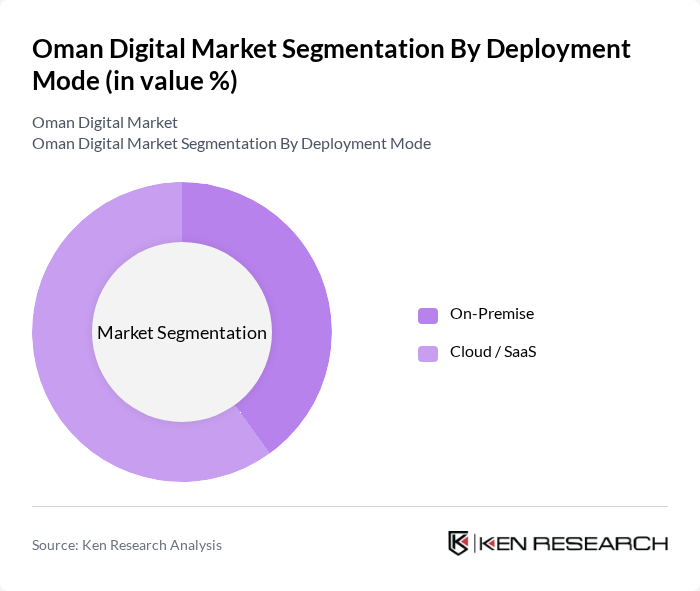

By Deployment Mode:The market is also segmented based on deployment modes, which include On-Premise and Cloud/SaaS solutions. The Cloud/SaaS deployment mode is gaining traction due to its flexibility, scalability, and cost-effectiveness, mirroring the global shift in digital marketing software toward cloud delivery models for easier integration, faster updates, and lower upfront investment for organizations in Oman.

The Oman Digital Marketing Software market is characterized by a dynamic mix of regional and international players. Leading participants such as Omantel, Ooredoo Oman, Vodafone Oman, Awasr, Oman Data Park, Gulf CyberTech, Bahwan CyberTek, Muscat Media Group, United Media Services (UMS), Zeenah Group, Impact Integrated, Qurum Business Group, Oman Web Solutions, ODP Marketing & Cloud Services, and selected global MarTech vendors active in Oman (e.g., HubSpot, Salesforce, Adobe Experience Cloud) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman digital market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As businesses increasingly adopt omnichannel strategies, the integration of AI and machine learning will enhance customer experiences and operational efficiencies. Furthermore, the rise of localized content and mobile marketing will cater to the unique preferences of Omani consumers, fostering deeper engagement. These trends indicate a dynamic landscape where adaptability and innovation will be crucial for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type (Software) | Marketing Automation Platforms Email Marketing Software Social Media Marketing & Management Tools Search & Performance Marketing (SEO/SEM) Solutions Content Marketing & Experience Platforms Analytics, Attribution & Reporting Tools Omnichannel & Campaign Management Suites Others (Affiliate & Partner Marketing, Mobile & SMS Marketing, etc.) |

| By Deployment Mode | On-Premise Cloud / SaaS |

| By Enterprise Size | Large Enterprises Small & Medium Enterprises (SMEs) |

| By Industry Vertical | Retail & E-commerce Healthcare & Pharmaceuticals Education & Training Travel, Tourism & Hospitality Banking, Financial Services & Insurance (BFSI) Government & Public Sector Telecom & ICT Others (Manufacturing, Real Estate, Media & Entertainment, etc.) |

| By Marketing Channel | Web & Search Social & Influencer Email & Messaging Mobile App & In-App Others (Events, Experiential & OOH-Linked Digital) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-commerce User Experience | 120 | Online Shoppers, Digital Marketing Managers |

| Fintech Adoption Trends | 100 | Banking Customers, Fintech Product Managers |

| Digital Media Consumption | 80 | Content Creators, Media Analysts |

| SME Digital Transformation | 70 | Business Owners, IT Managers |

| Telecommunications Usage Patterns | 90 | Telecom Subscribers, Customer Service Representatives |

The Oman Digital Marketing Software Market is valued at approximately USD 130 million, reflecting significant growth driven by increased digital technology adoption, e-commerce expansion, and the need for enhanced online brand visibility.