Region:Middle East

Author(s):Shubham

Product Code:KRAD2559

Pages:91

Published On:January 2026

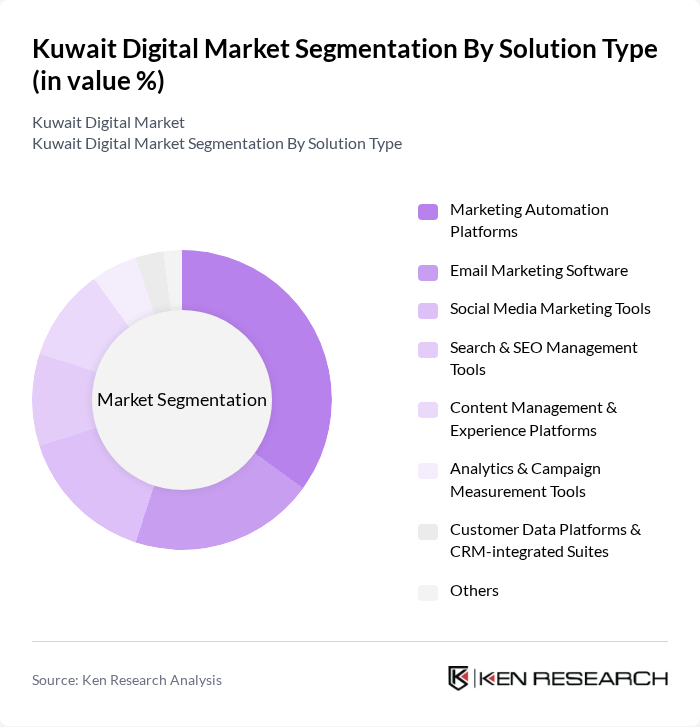

By Solution Type:The solution type segmentation includes various tools and platforms that cater to different aspects of digital marketing, consistent with regional breakdowns that classify digital marketing software into CRM, email, social media, search, content management, marketing automation, campaign management, and related solutions. The subsegments include Marketing Automation Platforms, Email Marketing Software, Social Media Marketing Tools, Search & SEO Management Tools, Content Management & Experience Platforms, Analytics & Campaign Measurement Tools, Customer Data Platforms & CRM-integrated Suites, and Others. Among these, Marketing Automation Platforms are leading the market due to their ability to streamline marketing processes, orchestrate omnichannel campaigns, and enhance customer engagement through personalized, data-driven campaigns, reflecting the broader Middle East trend toward automation and analytics-led marketing tools.

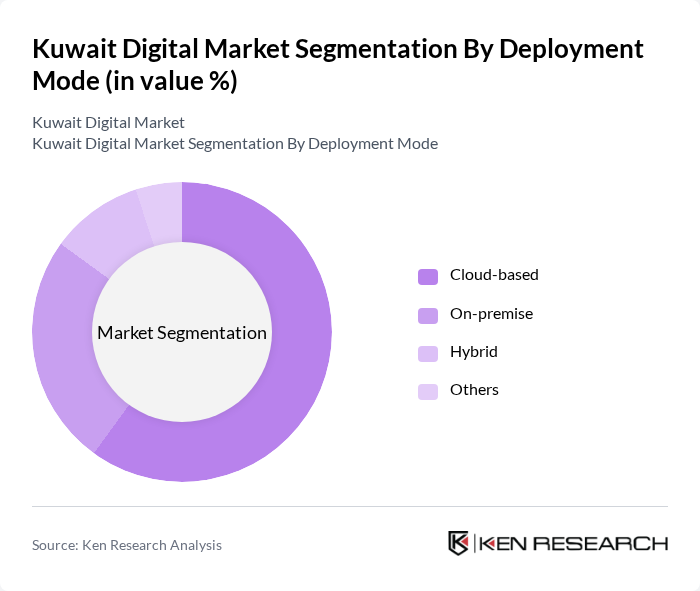

By Deployment Mode:The deployment mode segmentation includes Cloud-based, On-premise, Hybrid, and Others. The Cloud-based deployment mode is dominating the market due to its flexibility, scalability, and cost-effectiveness, in line with Middle East digital marketing software adoption patterns that show a strong preference for cloud-based deployment. Businesses prefer cloud solutions as they allow for easy access to marketing tools and data from anywhere, facilitate remote work and collaboration, and support AI- and automation-driven capabilities that are increasingly used by Kuwaiti organizations to optimize campaign management and customer engagement.

The Kuwait Digital Marketing Software market is characterized by a dynamic mix of regional and international players. Leading participants such as Zain Group, Ooredoo Kuwait, Kooora, Talabat, Alghanim Industries, Gulf Bank, Kuwait Finance House (KFH), Boubyan Bank, KNET (Kuwait Net), Al-Mazaya Holding Company, Mobile Telecommunications Company (MTC) / Zain Kuwait, Al-Futtaim Group, Al-Homaizi Group, Al-Sayer Group, Al-Manshar Real Estate Company contribute to innovation, geographic expansion, and service delivery in this space, often leveraging advanced digital channels, customer analytics, and marketing technologies to enhance engagement and service quality.

The future of the Kuwait digital market appears promising, driven by technological advancements and evolving consumer behaviors. As businesses increasingly adopt AI-driven marketing tools, the efficiency and effectiveness of campaigns are expected to improve significantly. Additionally, the rise of personalized marketing strategies will enhance customer engagement, leading to higher conversion rates. With a focus on sustainability and ethical marketing practices, companies are likely to align their strategies with consumer values, fostering brand loyalty and long-term growth in the digital landscape.

| Segment | Sub-Segments |

|---|---|

| By Solution Type | Marketing Automation Platforms Email Marketing Software Social Media Marketing Tools Search & SEO Management Tools Content Management & Experience Platforms Analytics & Campaign Measurement Tools Customer Data Platforms & CRM-integrated Suites Others |

| By Deployment Mode | Cloud-based On-premise Hybrid Others |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) Start-ups Others |

| By Industry Vertical | Retail & E-commerce Banking, Financial Services and Insurance (BFSI) Telecommunications Government & Public Sector Healthcare Education Media & Entertainment Others |

| By Marketing Objective | Customer Acquisition Customer Retention & Loyalty Brand Awareness & Reach Performance Marketing / Conversion Market & Audience Analytics Others |

| By Sales / Commercial Model | Subscription-based (SaaS) Pay-per-use / Consumption-based Freemium Perpetual License Others |

| By Channel Integration | Omnichannel Campaign Management Single-channel (Email / Social / Search) Mobile-first Marketing Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Sector | 120 | E-commerce Managers, Marketing Directors |

| Digital Payment Solutions | 100 | Product Managers, Financial Analysts |

| Social Media Marketing | 80 | Social Media Strategists, Brand Managers |

| Consumer Electronics E-commerce | 70 | Sales Managers, Customer Experience Leads |

| Food Delivery Services | 90 | Operations Managers, Marketing Executives |

The Kuwait Digital Marketing Software Market is valued at approximately USD 140 million, reflecting significant growth driven by the increasing adoption of digital marketing strategies among businesses in the region.