Region:Asia

Author(s):Shubham

Product Code:KRAD2558

Pages:99

Published On:January 2026

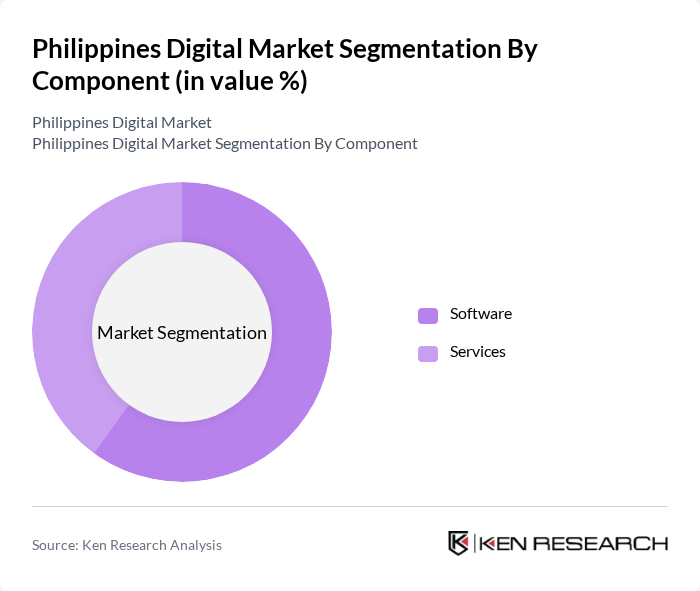

By Component:The market is segmented into Software and Services. Software includes various tools and platforms that facilitate digital marketing activities, such as campaign management, social media, email, analytics, and content management. Services encompass consulting, implementation, integration, managed services, and ongoing support provided to businesses to design strategies, deploy platforms, and optimize digital campaigns.

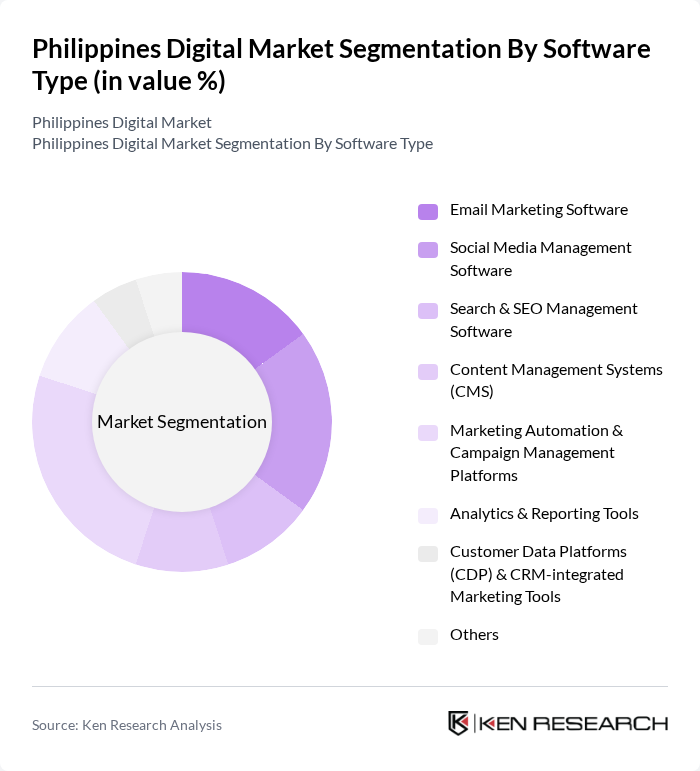

By Software Type:The software segment is further divided into Email Marketing Software, Social Media Management Software, Search & SEO Management Software, Content Management Systems (CMS), Marketing Automation & Campaign Management Platforms, Analytics & Reporting Tools, Customer Data Platforms (CDP) & CRM-integrated Marketing Tools, and Others. This structure aligns with global digital marketing software taxonomies that group tools around campaign execution, customer data, and performance measurement. Each of these software types plays a crucial role in enhancing digital marketing efforts, from automating multichannel campaigns and nurturing leads to tracking user journeys and enabling data-driven optimization across channels.

The Philippines Digital Marketing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as HubSpot, Salesforce Marketing Cloud, Adobe Experience Cloud, Oracle Marketing Cloud, Zoho Marketing Plus, Mailchimp, Google Marketing Platform, Meta (Facebook) Business Suite, Canva, Hootsuite, Sprout Social, Local & Regional Providers (e.g., Truelogic, Propelrr, DMCI Digital), Telecom-affiliated Platforms (e.g., Globe Business Solutions, PLDT Enterprise Digital Platforms), E-commerce-linked Martech Solutions (e.g., Lazada Marketing Solutions, Shopee Ads Tools), Other Emerging SaaS Marketing Platforms contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines digital market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As mobile usage continues to rise, businesses will increasingly adopt mobile-first strategies, enhancing user engagement. Furthermore, the integration of artificial intelligence in marketing will enable personalized experiences, fostering customer loyalty. With a growing emphasis on sustainability, brands will likely align their marketing strategies with eco-friendly practices, appealing to the environmentally conscious consumer base emerging in the region.

| Segment | Sub-Segments |

|---|---|

| By Component | Software Services |

| By Software Type | Email Marketing Software Social Media Management Software Search & SEO Management Software Content Management Systems (CMS) Marketing Automation & Campaign Management Platforms Analytics & Reporting Tools Customer Data Platforms (CDP) & CRM-integrated Marketing Tools Others |

| By Deployment Mode | Cloud-based On-premise Hybrid |

| By Enterprise Size | Small and Medium Enterprises (SMEs) Large Enterprises |

| By End-User Industry | Retail & E-commerce BFSI IT & Telecom Healthcare Media & Entertainment Travel and Hospitality Education Others |

| By Marketing Channel Supported | Social Media Search (Paid & Organic) Display & Video SMS & Messaging Apps Omnichannel / Cross-channel |

| By Region | Metro Manila Luzon (excluding Metro Manila) Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Online Retail Sector | 120 | E-commerce Managers, Marketing Directors |

| Consumer Electronics Market | 90 | Product Managers, Sales Executives |

| Travel and Hospitality Services | 80 | Operations Managers, Customer Experience Heads |

| Food Delivery Services | 70 | Logistics Coordinators, Business Development Managers |

| Digital Payment Solutions | 75 | Finance Officers, Technology Leads |

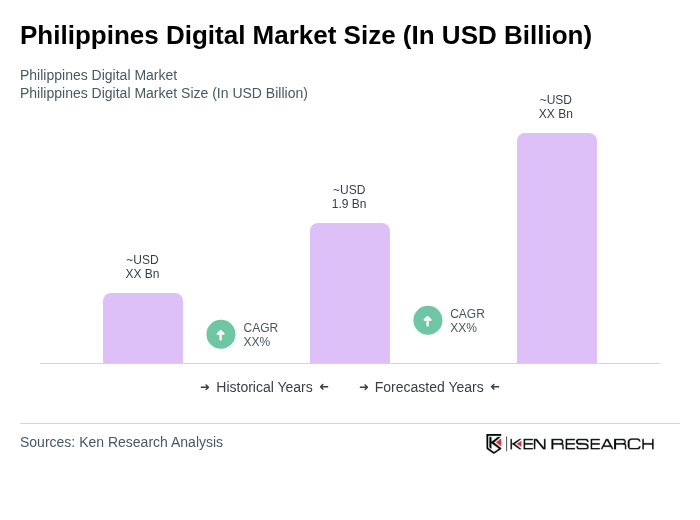

The Philippines Digital Marketing Software Market is valued at approximately USD 1.9 billion. This valuation reflects a significant growth trend driven by the increasing adoption of digital technologies and the expansion of e-commerce in the country.