Australia Digital Marketing Software Market Overview

- The Australia Digital Marketing Software Market is valued at USD 1.8 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of digital marketing strategies by businesses, the rise of e-commerce, and the growing importance of data analytics in marketing decisions. Companies are investing in software solutions such as marketing automation, customer relationship management, email marketing, social media management, and web analytics to enhance customer engagement and optimize marketing campaigns, leading to robust market expansion.

- Key cities such as Sydney, Melbourne, and Brisbane dominate the market due to their status as economic hubs with a high concentration of businesses and tech startups. These cities benefit from advanced digital infrastructure, a skilled workforce, and a vibrant ecosystem of agencies, SaaS vendors, and startups, making them attractive locations for digital marketing software providers and users alike. The strong presence of retail, financial services, technology, and media enterprises in these metropolitan regions further accelerates the deployment of cloud-based and data-driven marketing platforms.

- The Australian Government’s Digital Economy Strategy, announced by the Department of the Prime Minister and Cabinet in 2021, sets out a framework to make Australia a leading digital economy and society by 2030 and includes a funding package of around AUD 1.2 billion to support digital transformation initiatives for businesses. This strategy, alongside related measures such as the Technology Investment Roadmap and support for small and medium-sized enterprises to adopt digital tools, encourages companies to deploy innovative marketing technologies, cloud-based software, and data analytics solutions to strengthen their online presence, thereby fostering growth in the digital marketing software sector.

Australia Digital Marketing Software Market Segmentation

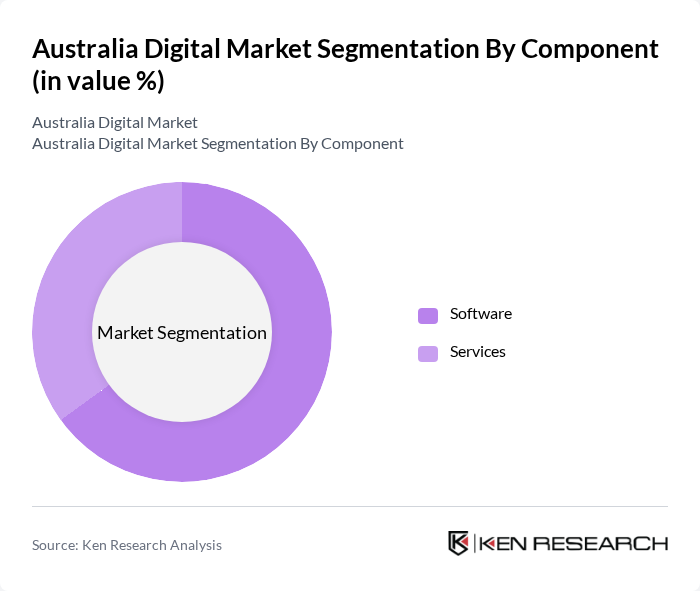

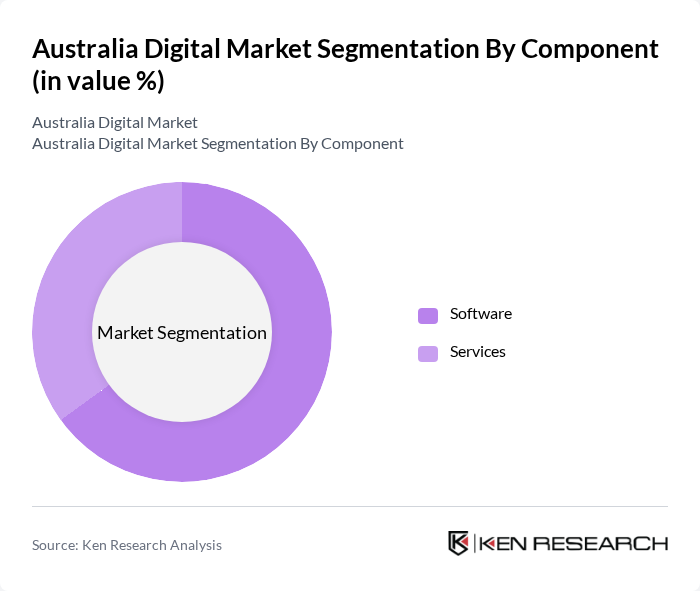

By Component:The market is segmented into Software and Services. The Software segment includes applications such as customer relationship management, email marketing, social media and social CRM tools, search and content marketing, web and marketing analytics, marketing automation platforms, campaign management, and e-commerce enablement solutions that facilitate digital marketing efforts. The Services segment encompasses professional and managed services, including consulting, implementation, integration, training, and ongoing support. The Software segment is currently leading the market due to the increasing demand for automated, cloud-based, and AI-enabled solutions that enhance marketing efficiency, personalization, and omnichannel campaign execution.

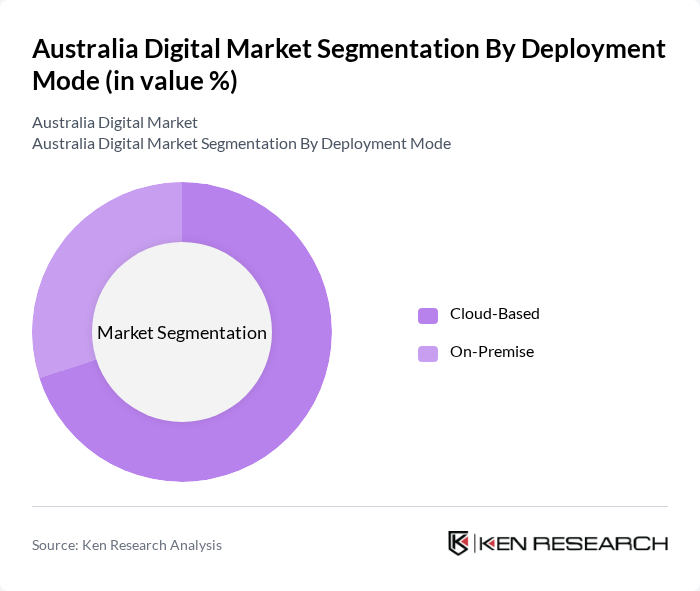

By Deployment Mode:The market is divided into Cloud-Based and On-Premise deployment modes. Cloud-Based solutions are gaining traction due to their scalability, subscription-based pricing, faster implementation, and ease of access for distributed and remote teams, while On-Premise solutions are preferred by organizations with strict data residency, integration, or compliance requirements. The Cloud-Based segment is currently the dominant mode, supported by accelerated cloud migration among small and medium-sized enterprises, the growing use of software-as-a-service marketing platforms, and government incentives that encourage adoption of cloud and digital tools.

Australia Digital Marketing Software Market Competitive Landscape

The Australia Digital Marketing Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adobe Inc., HubSpot Inc., Salesforce Inc., Mailchimp (Intuit Inc.), Semrush Holdings Inc., Hootsuite Inc., Canva Pty Ltd, Google Marketing Platform (Alphabet Inc.), Marketo Engage (Adobe Inc.), Sprout Social Inc., Buffer Inc., Zoho Corporation Pvt. Ltd., ClickFunnels LLC, ActiveCampaign LLC, Crazy Egg Inc. contribute to innovation, geographic expansion, and service delivery in this space.

Australia Digital Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:As of future, Australia boasts an internet penetration rate of approximately 91%, with around 24 million users accessing the web. This widespread connectivity fosters digital engagement, enabling businesses to reach a broader audience. The Australian Bureau of Statistics reported that 91% of households have internet access, which significantly enhances opportunities for digital marketing strategies. This robust infrastructure supports the growth of online platforms and e-commerce, driving the digital market forward.

- Rise of E-commerce:The Australian e-commerce sector is projected to reach AUD 55 billion in future, reflecting a significant increase from previous years. Factors contributing to this growth include changing consumer behaviors, with 85% of Australians shopping online regularly. The convenience of digital transactions and the expansion of delivery services have further fueled this trend. As more businesses transition to online sales, the demand for digital marketing solutions continues to rise, creating a dynamic market environment.

- Demand for Data Analytics:In future, the data analytics market in Australia is expected to exceed AUD 2.5 billion, driven by businesses seeking to leverage insights for competitive advantage. Companies are increasingly investing in analytics tools to understand consumer behavior and optimize marketing strategies. According to Deloitte, 75% of Australian businesses recognize data analytics as crucial for decision-making. This growing emphasis on data-driven strategies is propelling the digital marketing landscape, enhancing targeting and personalization efforts.

Market Challenges

- Data Privacy Concerns:With the implementation of the Privacy Act and increasing scrutiny on data handling practices, Australian businesses face significant challenges in maintaining consumer trust. In future, 65% of Australians express concerns about how their data is used, impacting their willingness to engage with digital platforms. Companies must navigate complex regulations while ensuring compliance, which can hinder marketing initiatives and increase operational costs, ultimately affecting market growth.

- High Competition:The Australian digital market is characterized by intense competition, with over 350,000 registered businesses operating online. This saturation makes it challenging for new entrants to establish a foothold. In future, the average cost of customer acquisition is projected to rise by 20%, as companies invest heavily in marketing to differentiate themselves. This competitive landscape necessitates innovative strategies and significant investment, posing a challenge for sustained growth in the sector.

Australia Digital Market Future Outlook

The future of the Australian digital market appears promising, driven by technological advancements and evolving consumer preferences. As businesses increasingly adopt omnichannel marketing strategies, the focus will shift towards enhancing customer experiences through personalized interactions. Additionally, the integration of artificial intelligence in marketing will streamline operations and improve targeting. With a growing emphasis on sustainability, companies will likely adopt eco-friendly practices, aligning their marketing strategies with consumer values, thus fostering long-term growth in the digital landscape.

Market Opportunities

- Expansion of Digital Payment Solutions:The digital payment market in Australia is projected to reach AUD 120 billion by future, driven by the increasing adoption of contactless payments. This growth presents opportunities for businesses to enhance customer convenience and streamline transactions, ultimately boosting online sales and customer satisfaction.

- Increased Investment in AI Technologies:In future, Australian businesses are expected to invest over AUD 1.5 billion in AI technologies for marketing purposes. This investment will enable companies to leverage machine learning for better customer insights and predictive analytics, enhancing marketing effectiveness and driving revenue growth in the digital space.