Region:Middle East

Author(s):Rebecca

Product Code:KRAD8484

Pages:88

Published On:December 2025

Market.png)

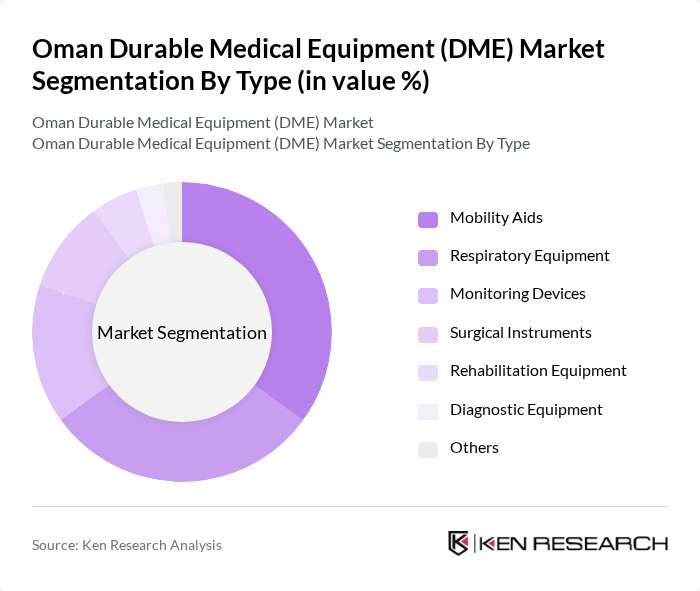

By Type:The market is segmented into various types of durable medical equipment, including mobility aids, respiratory equipment, monitoring devices, surgical instruments, rehabilitation equipment, diagnostic equipment, and others. Among these, mobility aids and respiratory equipment are the most prominent segments, driven by the increasing need for assistance among the aging population and the rise in respiratory diseases.

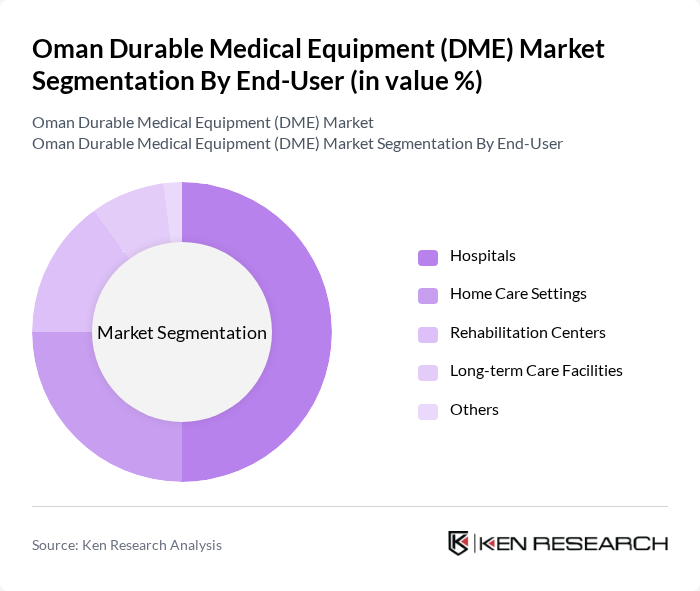

By End-User:The end-user segmentation includes hospitals, home care settings, rehabilitation centers, long-term care facilities, and others. Hospitals are the leading end-users, as they require a wide range of durable medical equipment to provide comprehensive care to patients. The growing trend of home healthcare is also notable, as more patients prefer receiving care in the comfort of their homes.

The Oman Durable Medical Equipment (DME) Market is characterized by a dynamic mix of regional and international players. Leading participants such as **Medtronic**, **Philips Healthcare**, **Siemens Healthineers**, **GE Healthcare**, **Stryker Corporation**, **Hill-Rom Holdings**, **Invacare Corporation**, **Drive DeVilbiss Healthcare**, **B. Braun Melsungen AG**, **Cardinal Health**, **Gulf Medical Supplies LLC**, **Intramedica**, **Oman Medical Supplies Company (OMSC)**, **Al Shifa Medical Equipment LLC**, **Noblesse Healthcare LLC** contribute to innovation, geographic expansion, and service delivery in this space.

The future of the DME market in Oman appears promising, driven by demographic changes and technological advancements. As the population ages and chronic diseases become more prevalent, the demand for innovative medical equipment will continue to rise. Additionally, the government's commitment to improving healthcare infrastructure and promoting digital health solutions will likely enhance market growth. Stakeholders must remain agile to adapt to evolving regulations and consumer needs, ensuring they capitalize on emerging trends in telehealth and personalized medical devices.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobility Aids Respiratory Equipment Monitoring Devices Surgical Instruments Rehabilitation Equipment Diagnostic Equipment Others |

| By End-User | Hospitals Home Care Settings Rehabilitation Centers Long-term Care Facilities Others |

| By Distribution Channel | Direct Sales Online Retail Medical Supply Stores Wholesalers Others |

| By Region | Muscat Dhofar Al Batinah Al Dakhiliyah Others |

| By Product Class | Class I Devices Class II Devices Class III Devices Others |

| By Usage Type | Single-use Equipment Reusable Equipment Others |

| By Technology | Digital Devices Analog Devices Hybrid Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Equipment Procurement | 100 | Procurement Managers, Hospital Administrators |

| Home Care Equipment Usage | 80 | Patients, Caregivers, Home Health Aides |

| Rehabilitation Equipment Insights | 70 | Physical Therapists, Rehabilitation Center Managers |

| Respiratory Equipment Demand | 60 | Respiratory Therapists, Pulmonologists |

| Market Trends in Mobility Aids | 90 | Occupational Therapists, Geriatric Care Specialists |

The Oman Durable Medical Equipment (DME) Market is valued at approximately USD 280 million, reflecting growth driven by an aging population, increased chronic diseases, and advancements in medical technology.