Oman Hosiery Market Overview

- The Oman Hosiery Market is valued at USD 150 million, based on a five-year historical analysis. This growth is primarily driven by increasing consumer demand for comfortable and fashionable hosiery products, alongside a rise in disposable income among the population. The market has also benefited from the growing trend of online shopping, which has made hosiery products more accessible to consumers. In addition, rising adoption of international fashion trends, greater exposure to global brands, and the expansion of organized retail formats (including supermarkets, hypermarkets, and specialty fashion stores) are supporting higher per?capita spending on socks, stockings, and related hosiery items.

- Key cities such as Muscat and Salalah dominate the market due to their larger populations and higher purchasing power. Muscat, being the capital, serves as a commercial hub with numerous retail outlets, while Salalah attracts tourists, increasing the demand for hosiery products. The urbanization and lifestyle changes in these cities further contribute to their market dominance, supported by the concentration of modern retail infrastructure, higher internet penetration, and greater exposure to omnichannel shopping (online ordering combined with in?store pickup and returns).

- In 2023, the Omani government implemented regulations to promote local manufacturing of hosiery products. This initiative includes providing incentives for domestic producers and establishing quality standards to ensure that locally manufactured hosiery meets international benchmarks. The aim is to reduce reliance on imports and boost the local economy, while encouraging investment in more sustainable production methods, such as the use of eco?friendly fibers, improved waste management, and energy?efficient machinery in textile and garment facilities.

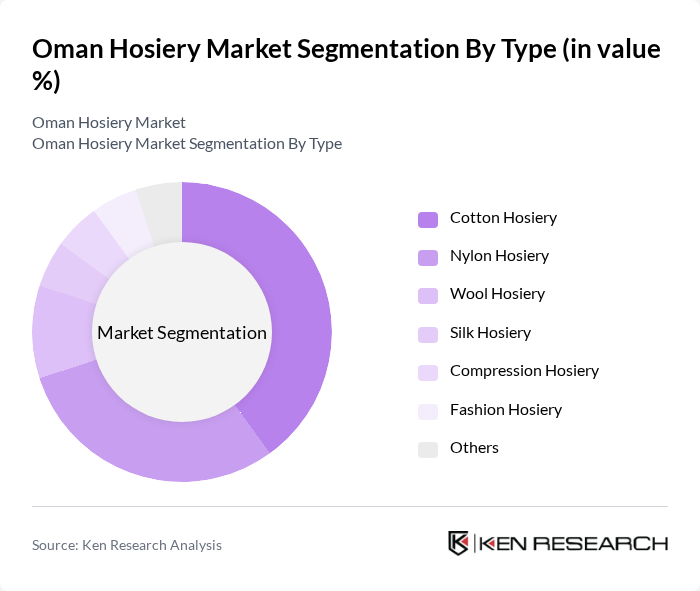

Oman Hosiery Market Segmentation

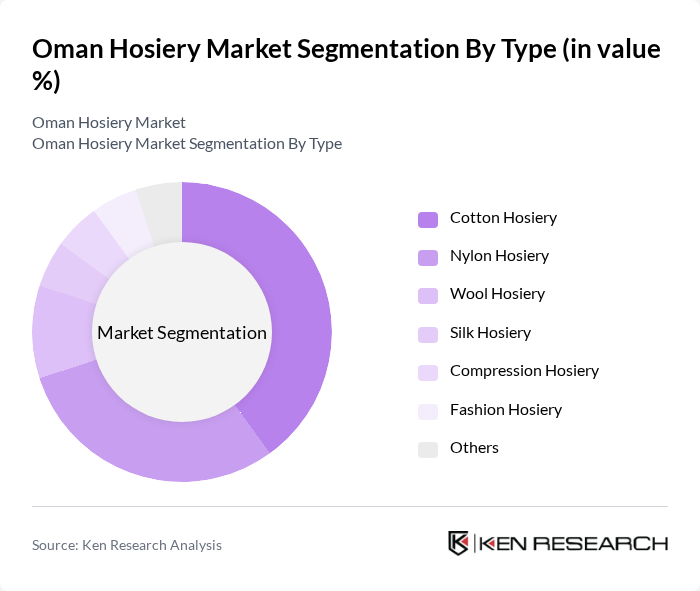

By Type:The market is segmented into various types of hosiery products, including Cotton Hosiery, Nylon Hosiery, Wool Hosiery, Silk Hosiery, Compression Hosiery, Fashion Hosiery, and Others. Among these, Cotton Hosiery is the most popular due to its comfort and breathability, making it a preferred choice for everyday wear. Nylon Hosiery follows closely, favored for its durability and stretchability, appealing to consumers looking for both style and functionality. Growing interest in performance and health?oriented products is also driving demand for compression and sports hosiery, especially among younger, fitness?conscious consumers and those with specific medical or circulation needs.

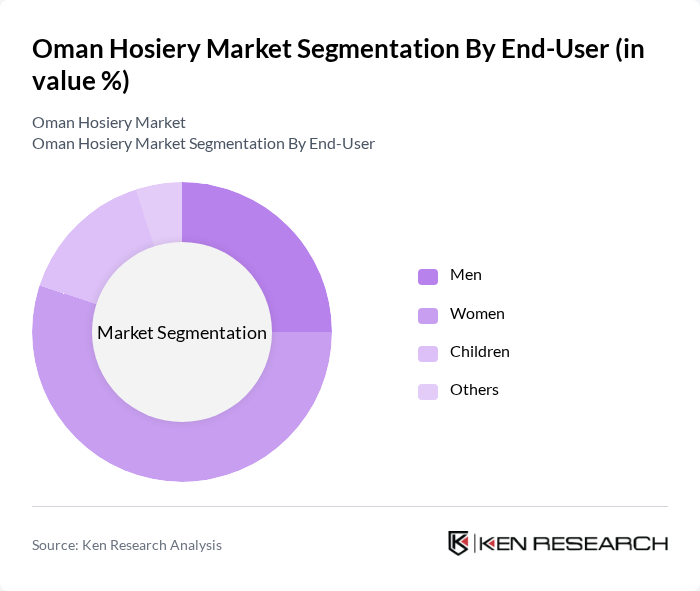

By End-User:The end-user segmentation includes Men, Women, Children, and Others. Women represent the largest segment due to their diverse range of hosiery needs, from everyday wear to fashion statements. The increasing trend of women participating in the workforce has also led to a higher demand for stylish and professional hosiery options. Men’s hosiery is gaining traction as well, particularly in the form of dress socks and athletic wear, with demand supported by rising awareness of premium materials, branded products, and comfort?driven designs suitable for office, leisure, and sports activities.

Oman Hosiery Market Competitive Landscape

The Oman Hosiery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Ahlia Hosiery, Al Mufeed Hosiery, Al Shams Hosiery, Al Noor Hosiery, Al Fajr Hosiery, Al Jazeera Hosiery, Al Maktoum Hosiery, Al Waha Hosiery, Al Huda Hosiery, Al Ruwad Hosiery, Al Muna Hosiery, Al Ameen Hosiery, Al Fawaz Hosiery, Al Qamar Hosiery, Al Zain Hosiery contribute to innovation, geographic expansion, and service delivery in this space. Competitive strategies typically include a focus on affordable price points, diversified product portfolios across cotton and synthetic blends, and collaboration with major retail chains and online platforms to improve brand visibility and consumer reach.

Oman Hosiery Market Industry Analysis

Growth Drivers

- Increasing Demand for Fashionable Hosiery:The Oman hosiery market is experiencing a surge in demand for fashionable products, driven by a growing population of young consumers. In future, the youth demographic (ages 15-29) is projected to reach approximately 1.6 million, representing 32% of the total population. This demographic shift is fostering a culture of fashion consciousness, with consumers increasingly seeking trendy hosiery options that align with global fashion standards, thus boosting sales and market growth.

- Rising Awareness of Health Benefits:There is a notable increase in consumer awareness regarding the health benefits of hosiery, particularly compression stockings. In future, the healthcare expenditure in Oman is expected to reach OMR 1.5 billion, with a significant portion allocated to preventive health measures. This trend is encouraging consumers to invest in hosiery that promotes better circulation and overall foot health, thereby driving demand for specialized hosiery products in the market.

- Growth in E-commerce Platforms:The expansion of e-commerce platforms in Oman is significantly influencing the hosiery market. In future, online retail sales are projected to reach OMR 400 million, reflecting a 33% increase from the previous year. This growth is attributed to increased internet penetration, which is expected to exceed 95%, allowing consumers to access a wider variety of hosiery products conveniently. E-commerce is thus becoming a vital channel for market players to reach consumers effectively.

Market Challenges

- Intense Competition:The Oman hosiery market is characterized by intense competition, with numerous local and international brands vying for market share. In future, the number of hosiery brands operating in Oman is expected to exceed 60, leading to price wars and reduced profit margins. This competitive landscape poses a challenge for new entrants and established players alike, as they must continuously innovate and differentiate their products to maintain market relevance.

- Fluctuating Raw Material Prices:The hosiery industry is facing challenges due to fluctuating raw material prices, particularly for nylon and cotton. In future, the price of cotton is projected to rise by 20% due to supply chain disruptions and increased global demand. This volatility can significantly impact production costs for manufacturers, forcing them to either absorb the costs or pass them on to consumers, which may affect overall sales and profitability.

Oman Hosiery Market Future Outlook

The future of the Oman hosiery market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands are likely to invest in eco-friendly materials and production methods. Additionally, the rise of digital marketing strategies will enhance brand visibility and consumer engagement. With the anticipated growth in disposable income, consumers are expected to spend more on premium hosiery products, further stimulating market expansion and innovation in the coming years.

Market Opportunities

- Introduction of Eco-friendly Products:There is a growing opportunity for brands to introduce eco-friendly hosiery made from sustainable materials. With the global market for sustainable textiles projected to reach OMR 300 million in future, companies that prioritize sustainability can attract environmentally conscious consumers, enhancing brand loyalty and market share.

- Expansion into Untapped Markets:The potential for expansion into untapped markets, particularly in rural areas, presents a significant opportunity. With approximately 35% of the Omani population residing in rural regions, brands can develop targeted marketing strategies to reach these consumers, thereby increasing their market presence and driving sales growth in previously underserved areas.