Region:Middle East

Author(s):Rebecca

Product Code:KRAE0931

Pages:96

Published On:December 2025

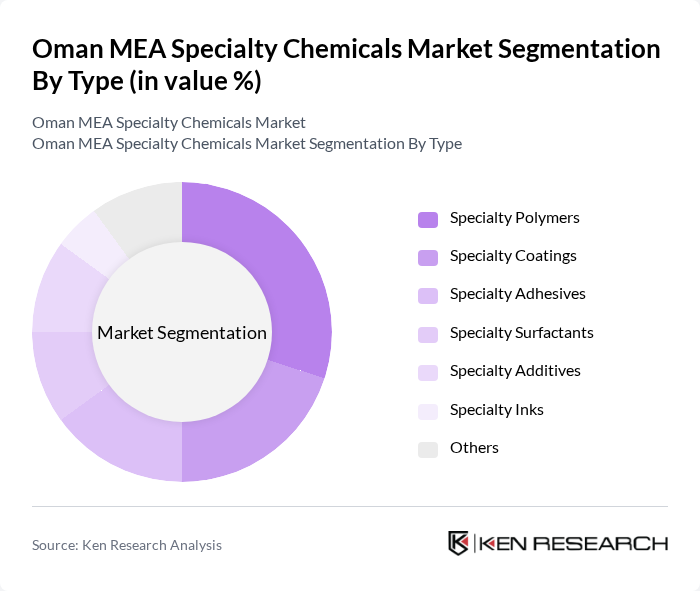

By Type:The specialty chemicals market is segmented into various types, including specialty polymers, coatings, adhesives, surfactants, additives, inks, and others. Among these, specialty polymers dominate the market due to their extensive applications in industries such as automotive, construction, and electronics. The increasing demand for lightweight and high-performance materials drives the growth of this segment, as manufacturers seek innovative solutions to enhance product performance and sustainability.

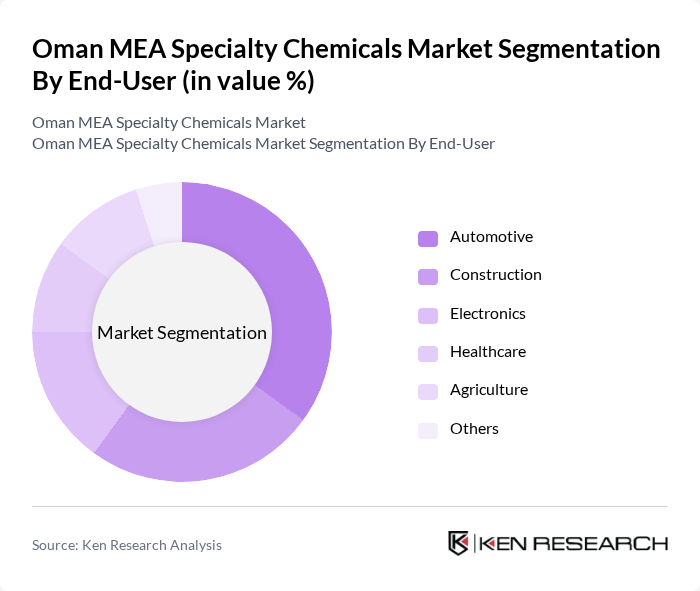

By End-User:The end-user segmentation includes automotive, construction, electronics, healthcare, agriculture, and others. The automotive sector is the leading end-user of specialty chemicals, driven by the increasing demand for advanced materials that enhance vehicle performance and safety. The shift towards electric vehicles and sustainable practices further propels the growth of this segment, as manufacturers seek innovative chemical solutions to meet evolving consumer preferences.

The Oman MEA Specialty Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Oil Refineries and Petroleum Industries Company, Gulf Petrochemicals Industries Company, Oman Chemical Company, Al Jazeera Chemical Industries, Oman Cables Industry, Dhofar Canning Company, Oman Chlorine, National Chemical Company, Oman Polypropylene Company, Oman Methanol Company, Oman Oil Marketing Company, Oman Fertilizer Company, Oman Plastic Industry, Oman Trading Establishment, Al-Futtaim Group contribute to innovation, geographic expansion, and service delivery in this space.

The Oman MEA specialty chemicals market is poised for significant transformation driven by sustainability and technological advancements. As the demand for eco-friendly products continues to rise, companies are likely to invest in research and development to innovate bio-based chemicals. Additionally, the integration of digital technologies in manufacturing processes will enhance efficiency and reduce costs. These trends, coupled with government support for industrial growth, will create a dynamic environment for market participants, fostering long-term growth and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Specialty Polymers Specialty Coatings Specialty Adhesives Specialty Surfactants Specialty Additives Specialty Inks Others |

| By End-User | Automotive Construction Electronics Healthcare Agriculture Others |

| By Application | Personal Care Food & Beverage Pharmaceuticals Textile Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Liquid Powder Granules Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oilfield Chemicals Usage | 100 | Procurement Managers, Operations Directors |

| Construction Additives Demand | 80 | Project Managers, Material Engineers |

| Agricultural Chemicals Insights | 70 | Agronomists, Farm Managers |

| Coatings and Adhesives Market | 60 | Product Development Managers, Quality Control Specialists |

| Specialty Polymers Applications | 90 | Research Scientists, Technical Managers |

The Oman MEA Specialty Chemicals Market is valued at approximately USD 22 billion, driven by strong demand from sectors such as oil and gas, infrastructure expansion, and investments in sustainable chemical solutions.