Region:North America

Author(s):Rebecca

Product Code:KRAD2332

Pages:86

Published On:January 2026

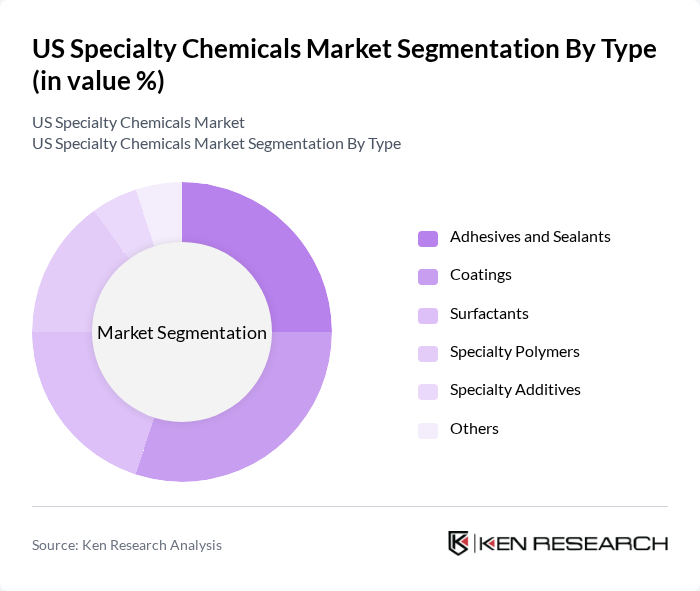

By Type:The specialty chemicals market can be segmented into various types, including adhesives and sealants, coatings, surfactants, specialty polymers, specialty additives, and others. Each of these subsegments plays a crucial role in different applications across industries. Adhesives and sealants are widely used in construction and automotive sectors, while coatings are essential for protection and aesthetics in various products. Surfactants are vital in personal care and cleaning products, and specialty polymers are increasingly utilized in advanced manufacturing processes.

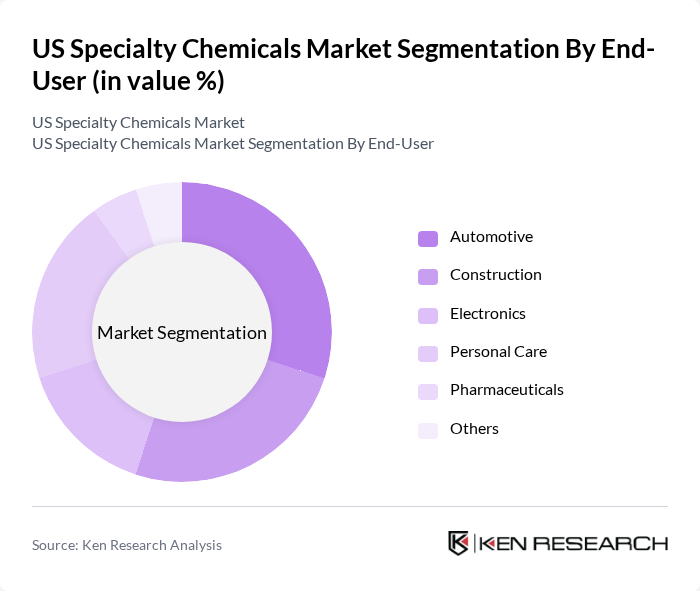

By End-User:The end-user segmentation of the specialty chemicals market includes automotive, construction, electronics, personal care, pharmaceuticals, and others. The automotive sector is a significant consumer of specialty chemicals, utilizing them for coatings, adhesives, and sealants. The construction industry also heavily relies on these chemicals for various applications, including insulation and surface treatments. Personal care products, which require surfactants and specialty additives, are witnessing a surge in demand due to changing consumer preferences towards sustainable and high-performance products.

The US Specialty Chemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF Corporation, Dow Chemical Company, Eastman Chemical Company, Huntsman Corporation, Solvay S.A., AkzoNobel N.V., Clariant AG, Lanxess AG, Covestro AG, DuPont de Nemours, Inc., Albemarle Corporation, FMC Corporation, LyondellBasell Industries N.V., INEOS Group, Mitsubishi Chemical Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The US specialty chemicals market is poised for transformative growth, driven by the increasing emphasis on sustainability and technological innovation. As industries adapt to environmental regulations, the demand for eco-friendly products will continue to rise, fostering new opportunities for manufacturers. Additionally, advancements in digital technologies will enhance operational efficiencies, enabling companies to respond swiftly to market changes. The focus on circular economy practices will further reshape the landscape, encouraging sustainable production and consumption patterns in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Adhesives and Sealants Coatings Surfactants Specialty Polymers Specialty Additives Others |

| By End-User | Automotive Construction Electronics Personal Care Pharmaceuticals Others |

| By Application | Industrial Cleaning Water Treatment Agriculture Food Processing Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Geography | Northeast Midwest South West Others |

| By Product Form | Liquid Solid Powder Others |

| By Regulatory Compliance | REACH OSHA FDA Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Chemicals | 100 | Product Managers, Agronomists |

| Coatings and Adhesives | 80 | Manufacturing Engineers, R&D Directors |

| Personal Care Ingredients | 70 | Formulation Chemists, Brand Managers |

| Plastics Additives | 90 | Procurement Managers, Technical Sales Representatives |

| Specialty Polymers | 75 | Product Development Managers, Market Analysts |

The US Specialty Chemicals Market is valued at approximately USD 182 billion, reflecting significant growth driven by demand across various industries, including automotive, construction, and personal care, alongside advancements in technology and a shift towards eco-friendly products.