Region:Middle East

Author(s):Rebecca

Product Code:KRAC9754

Pages:83

Published On:November 2025

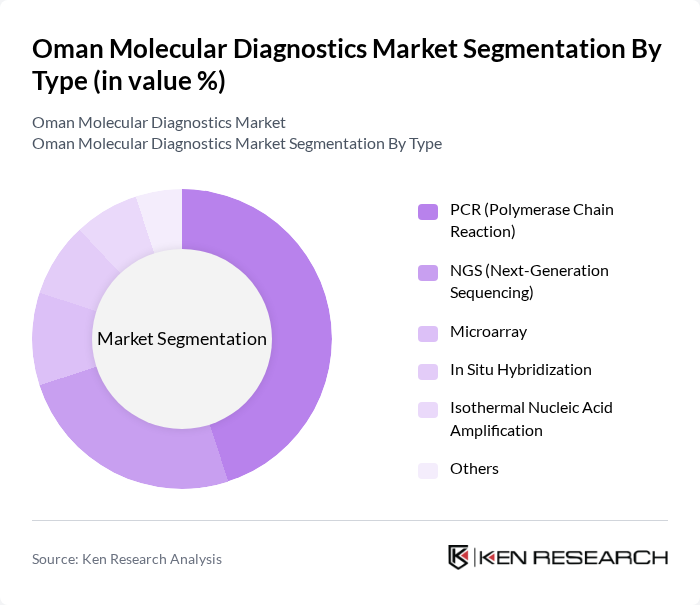

By Type:The market is segmented into various types of molecular diagnostic techniques, including PCR (Polymerase Chain Reaction), NGS (Next-Generation Sequencing), Microarray, In Situ Hybridization, Isothermal Nucleic Acid Amplification, and others. PCR remains the most widely used technique in Oman, attributed to its high sensitivity, rapid turnaround, and cost-effectiveness, making it the preferred choice for infectious disease detection, oncology, and genetic analysis. NGS is gaining traction for comprehensive genomic profiling, especially in cancer diagnostics and rare disease identification .

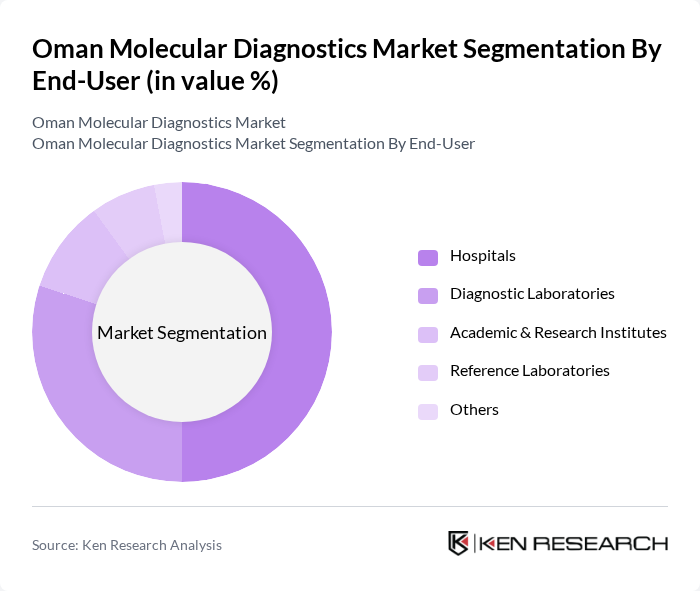

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Academic & Research Institutes, Reference Laboratories, and others. Hospitals are the leading end-users of molecular diagnostics in Oman, driven by the need for accurate and timely diagnosis in clinical settings, the expansion of oncology and infectious disease programs, and the adoption of personalized medicine. Diagnostic laboratories are also significant users, particularly for outsourced and high-throughput testing .

The Oman Molecular Diagnostics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, QIAGEN, Bio-Rad Laboratories, Siemens Healthineers, Agilent Technologies, PerkinElmer, Hologic, Illumina, BGI Genomics, Luminex Corporation, Cepheid, Mylab Discovery Solutions, Al Hayat Pharmaceuticals, National Oncology Center (Royal Hospital, Oman), Al Shifa Healthcare Services, Al Nahda Hospital, Al Borg Diagnostics, and Al Aman Medical Laboratory contribute to innovation, geographic expansion, and service delivery in this space.

The future of the molecular diagnostics market in Oman appears promising, driven by ongoing technological advancements and increased government support. As healthcare facilities expand and the population becomes more health-conscious, the demand for accurate and rapid diagnostic solutions is expected to rise. Additionally, the integration of artificial intelligence in diagnostics and the growing trend of telemedicine will likely enhance service delivery, making molecular diagnostics more accessible and efficient for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Type | PCR (Polymerase Chain Reaction) NGS (Next-Generation Sequencing) Microarray In Situ Hybridization Isothermal Nucleic Acid Amplification Others |

| By End-User | Hospitals Diagnostic Laboratories Academic & Research Institutes Reference Laboratories Others |

| By Application | Infectious Disease Testing Oncology Testing Genetic Testing Blood Screening Pharmacogenomics Others |

| By Technology | Real-Time PCR Digital PCR Sequencing Technologies Hybridization Techniques Microfluidics Others |

| By Sample Type | Blood Samples Tissue Samples Saliva Samples Urine Samples Swab Samples Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Pharmacies Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Laboratories | 60 | Laboratory Directors, Pathologists |

| Healthcare Providers | 50 | General Practitioners, Specialists |

| Diagnostic Equipment Manufacturers | 40 | Product Managers, Sales Executives |

| Regulatory Bodies | 40 | Health Policy Analysts, Regulatory Affairs Managers |

| Research Institutions | 45 | Research Scientists, Academic Professors |

The Oman Molecular Diagnostics Market is valued at approximately USD 1 million, driven by the increasing prevalence of infectious and chronic diseases, advancements in diagnostic technologies, and rising healthcare expenditure.