Region:Middle East

Author(s):Dev

Product Code:KRAD7830

Pages:95

Published On:December 2025

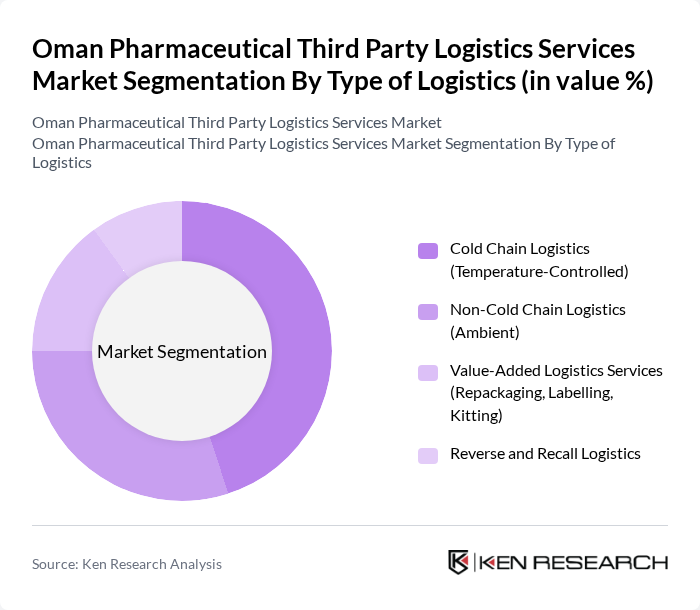

By Type of Logistics:

The subsegments under this category include Cold Chain Logistics (Temperature-Controlled), Non-Cold Chain Logistics (Ambient), Value-Added Logistics Services (Repackaging, Labelling, Kitting), and Reverse and Recall Logistics. Cold Chain Logistics is currently the leading subsegment due to the increasing demand for temperature-sensitive pharmaceuticals, particularly vaccines and biologics. The rise in chronic diseases and the need for specialized storage and transportation solutions have further propelled this segment. Non-Cold Chain Logistics also holds a significant share, catering to ambient pharmaceuticals that do not require temperature control. Value-Added Services are gaining traction as companies seek to enhance their offerings and improve operational efficiency.

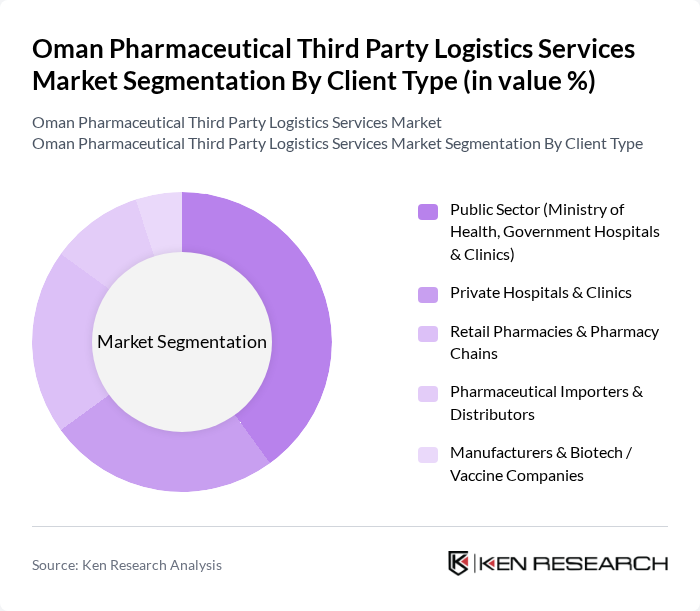

By Client Type:

This category includes Public Sector (Ministry of Health, Government Hospitals & Clinics), Private Hospitals & Clinics, Retail Pharmacies & Pharmacy Chains, Pharmaceutical Importers & Distributors, and Manufacturers & Biotech / Vaccine Companies. The Public Sector is the dominant client type, driven by government initiatives to improve healthcare access and the establishment of new healthcare facilities. Private Hospitals and Clinics are also significant clients, as they increasingly rely on third-party logistics for efficient supply chain management. Retail Pharmacies are expanding their logistics needs due to the growing demand for over-the-counter medications and health products.

The Oman Pharmaceutical Third Party Logistics Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asyad Group (Asyad Logistics & Oman Logistics Company), Al Madina Logistics Services Company SAOC, Oman Pharmaceutical Logistics, Premier Logistics Muscat, Marafi Asyad Company, DHL Supply Chain Oman, Aramex Oman, Gulf Warehousing Company (Oman Operations), Kuehne + Nagel Oman, DB Schenker Oman, CEVA Logistics (Oman Operations), FedEx Express / FedEx Logistics Oman, UPS Supply Chain Solutions Oman, Al Harithiya Cold Storage, Oman Cold Storage Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman pharmaceutical third-party logistics market appears promising, driven by ongoing investments in healthcare infrastructure and technological advancements. As the demand for efficient logistics solutions grows, companies are likely to adopt automation and AI-driven analytics to enhance operational efficiency. Additionally, the increasing focus on sustainability will push logistics providers to implement eco-friendly practices, aligning with global trends while meeting local regulatory requirements and consumer expectations.

| Segment | Sub-Segments |

|---|---|

| By Type of Logistics | Cold Chain Logistics (Temperature-Controlled) Non-Cold Chain Logistics (Ambient) Value-Added Logistics Services (Repackaging, Labelling, Kitting) Reverse and Recall Logistics |

| By Client Type | Public Sector (Ministry of Health, Government Hospitals & Clinics) Private Hospitals & Clinics Retail Pharmacies & Pharmacy Chains Pharmaceutical Importers & Distributors Manufacturers & Biotech / Vaccine Companies |

| By Service Type | Warehousing & Storage Transportation & Distribution Inventory & Order Management (Including VMI) Packaging, Secondary Packaging & Labelling Customs Clearance & Documentation |

| By Contract Model | Dedicated / Long-Term 3PL Contracts Shared-User / Multi-Client 3PL Contracts On-Demand / Spot Logistics Services |

| By Temperature Control Band | Ambient (15°C–25°C) Refrigerated / Chilled (2°C–8°C) Frozen (< -20°C) Deep-Frozen / Cryogenic (? -80°C, Vaccines & Biologics) |

| By Geography Within Oman | Muscat Governorate Dhofar Governorate (Including Salalah) Al Batinah North & South Al Dakhiliyah & Interior Regions Other Governorates (Sharqiyah, Dhahirah, Al Wusta, Musandam) |

| By Technology Utilization | Warehouse Management Systems (WMS) & Automation Real-Time Tracking, IoT Sensors & Temperature Monitoring Transportation Management Systems (TMS) & Route Optimization Data Analytics, Visibility Platforms & Compliance Systems |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical Distribution Logistics | 120 | Logistics Managers, Supply Chain Directors |

| Cold Chain Management | 90 | Operations Managers, Quality Assurance Heads |

| Regulatory Compliance in Logistics | 70 | Compliance Officers, Regulatory Affairs Managers |

| Last-Mile Delivery Solutions | 85 | Delivery Managers, Customer Service Representatives |

| Pharmaceutical Returns Management | 55 | Returns Managers, Inventory Control Specialists |

The Oman Pharmaceutical Third Party Logistics Services Market is valued at approximately USD 150 million, driven by the increasing demand for efficient supply chain solutions and the growth of the biopharmaceutical industry in the region.