Region:Middle East

Author(s):Shubham

Product Code:KRAE0411

Pages:100

Published On:December 2025

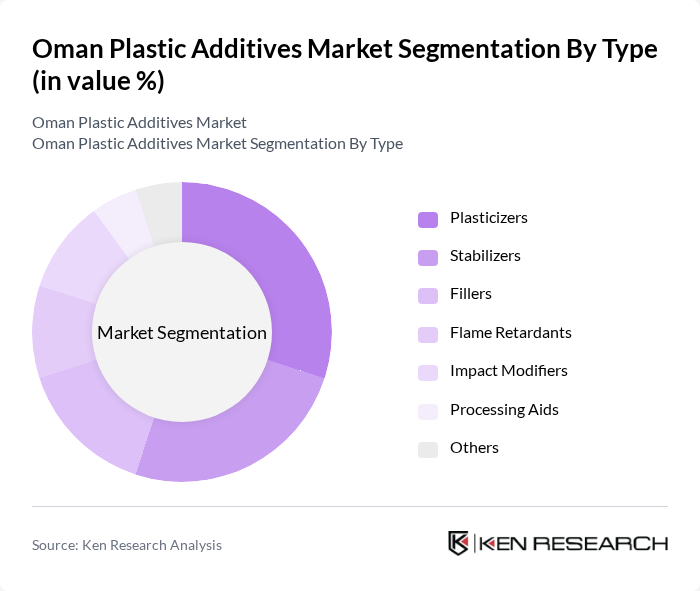

By Type:The plastic additives market is segmented into various types, including plasticizers, stabilizers, fillers, flame retardants, impact modifiers, processing aids, and others. Among these, plasticizers and stabilizers are the most significant due to their essential roles in enhancing the flexibility and durability of plastics. The demand for these additives is driven by their widespread application in industries such as packaging and automotive, where performance and safety are paramount.

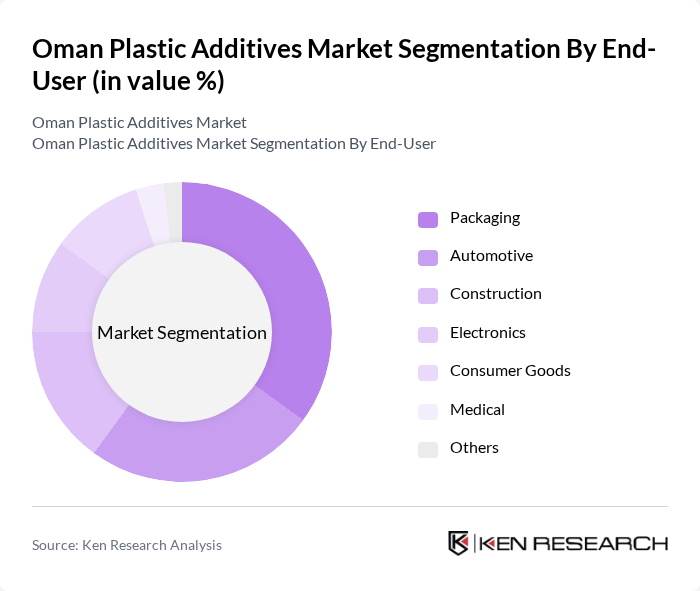

By End-User:The end-user segmentation includes packaging, automotive, construction, electronics, consumer goods, medical, and others. The packaging sector is the largest consumer of plastic additives, driven by the need for lightweight, durable, and flexible materials. The automotive industry follows closely, where additives are crucial for enhancing the performance and safety of automotive components.

The Oman Plastic Additives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oman Plastic Industry, Gulf Plastic Industries, Al Hodaifi Group, Oman Chemical Company, National Plastic Factory, Al Harthy Plastic Factory, Muscat Polymers, Oman Polypropylene Company, Al Jazeera Plastics, Oman Plastics and Chemicals, Al Mufeed Plastic Industries, Al Fajr Plastic Factory, Oman Petrochemicals, Al Muna Plastic Factory, Oman Additives Company contribute to innovation, geographic expansion, and service delivery in this space.

The Oman plastic additives market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. In the future, the integration of smart technologies in manufacturing processes is expected to enhance efficiency and product customization. Additionally, the growing emphasis on eco-friendly materials will likely lead to increased investments in research and development, fostering innovation. As the market adapts to these trends, it will create new avenues for growth and collaboration among industry stakeholders, ensuring a competitive edge in the evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Plasticizers Stabilizers Fillers Flame Retardants Impact Modifiers Processing Aids Others |

| By End-User | Packaging Automotive Construction Electronics Consumer Goods Medical Others |

| By Application | Rigid Plastics Flexible Plastics Coatings Adhesives Films Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Wholesale Others |

| By Geography | Muscat Salalah Sohar Nizwa Others |

| By Product Form | Granules Powders Liquids Others |

| By Regulatory Compliance | REACH Compliance RoHS Compliance FDA Approval Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Additives | 100 | Product Managers, Procurement Specialists |

| Automotive Plastic Additives | 80 | R&D Engineers, Quality Assurance Managers |

| Construction Material Additives | 70 | Construction Project Managers, Material Suppliers |

| Consumer Goods Plastic Additives | 90 | Marketing Managers, Product Development Leads |

| Industrial Applications of Plastic Additives | 60 | Operations Managers, Supply Chain Analysts |

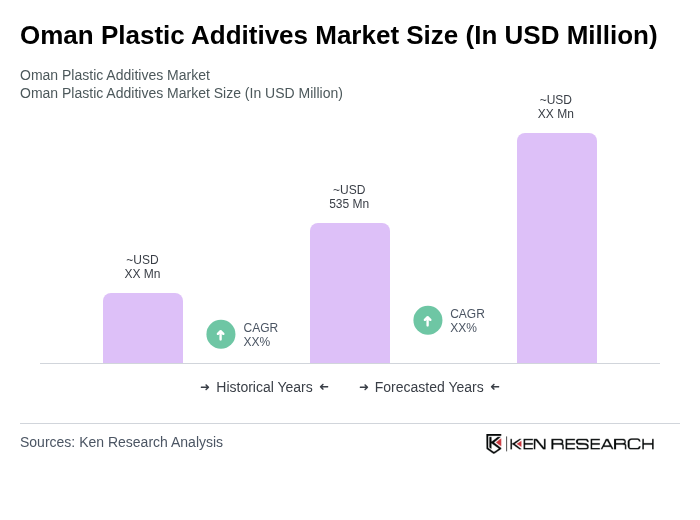

The Oman Plastic Additives Market is valued at approximately USD 535 million, reflecting a five-year historical analysis. This growth is driven by increasing demand from key industries such as packaging, automotive, and construction.