Region:Middle East

Author(s):Shubham

Product Code:KRAD5443

Pages:88

Published On:December 2025

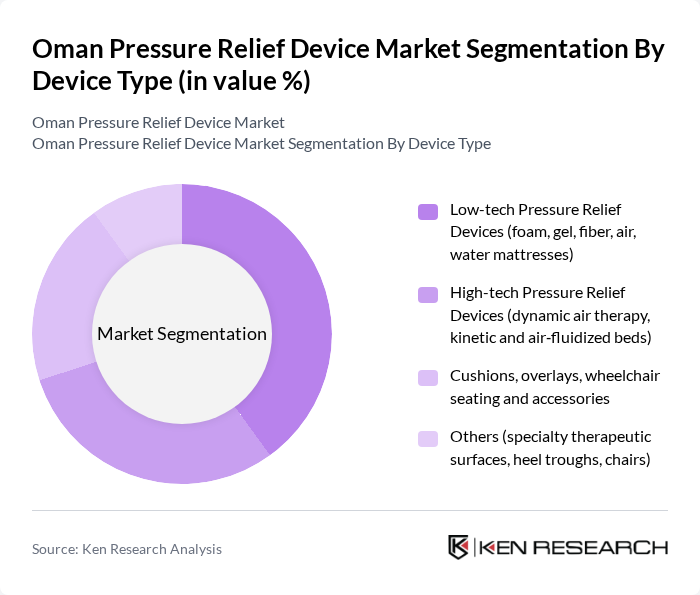

By Device Type:The device type segmentation includes various categories of pressure relief devices that cater to different patient needs and healthcare settings. The subsegments are as follows:

The Low-tech Pressure Relief Devices segment is currently dominating the market due to their affordability and widespread availability. These devices, including foam and gel mattresses, are commonly used in hospitals, primary care hospitals, and home care settings, making them accessible to a larger patient population. The increasing awareness of pressure ulcer prevention, standardization of risk assessment (such as Braden scale use in regional protocols), and the need for cost-effective solutions further drive the demand for these devices. Additionally, the simplicity of use, low maintenance requirements, and compatibility with existing hospital beds make low-tech devices attractive to both healthcare providers and patients.

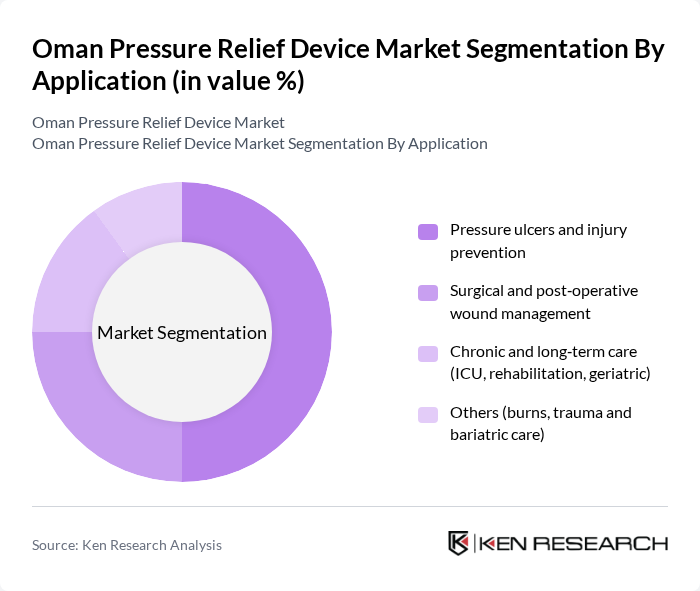

By Application:The application segmentation focuses on the various medical needs that pressure relief devices address. The subsegments are as follows:

The Pressure ulcers and injury prevention application segment leads the market, driven by the rising incidence of pressure ulcers among immobile patients and the elderly, particularly those with chronic conditions such as diabetes, cardiovascular disease, and stroke. Healthcare facilities are increasingly adopting pressure relief devices as a standard practice to mitigate the risk of pressure injuries, in line with quality indicators and hospital accreditation requirements, thereby enhancing patient care. The focus on preventive measures in hospitals, ICUs, and long-term care facilities, as well as in home care and palliative care settings, has significantly contributed to the growth of this segment, as it aligns with the overall goal of improving patient outcomes and reducing the cost burden associated with treating advanced pressure injuries.

The Oman Pressure Relief Device Market is characterized by a dynamic mix of regional and international players. Leading participants such as Arjo AB, Hill-Rom Holdings, Inc. (Baxter International Inc.), Stryker Corporation, Invacare Corporation, Medline Industries, LP, Drive DeVilbiss Healthcare, GF Health Products, Inc. (Graham-Field), Talley Group Ltd. (Talley Medical), LINET Group SE, Apex Medical Corp., Paramount Bed Co., Ltd., Rober Limited, Joerns Healthcare LLC, Sidhil Ltd. (part of Drive DeVilbiss Healthcare), and major Oman distributors and integrators (e.g., Muscat Pharmacy & Stores LLC, National Medical Supplies Co.) contribute to innovation, geographic expansion, and service delivery in this space.

The Oman pressure relief device market is poised for significant growth, driven by increasing safety regulations and technological advancements. As industries prioritize safety, the demand for innovative solutions will rise, particularly in the oil and gas and healthcare sectors. Furthermore, the integration of IoT technology in safety devices will enhance operational efficiency. With government incentives promoting advanced safety technologies, the market is expected to evolve rapidly, creating a robust environment for investment and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Low-tech Pressure Relief Devices (foam, gel, fiber, air, water mattresses) High-tech Pressure Relief Devices (dynamic air therapy, kinetic and air?fluidized beds) Cushions, overlays, wheelchair seating and accessories Others (specialty therapeutic surfaces, heel troughs, chairs) |

| By Application | Pressure ulcers and injury prevention Surgical and post?operative wound management Chronic and long?term care (ICU, rehabilitation, geriatric) Others (burns, trauma and bariatric care) |

| By End-User | Public and private hospitals Long?term care and nursing homes Home healthcare and community care settings Rehabilitation centers and specialty clinics |

| By Material | Foam-based Gel and fiber-filled Air and fluid-filled systems Hybrid and advanced composite materials |

| By Technology | Static (non?powered) systems Dynamic (powered alternating pressure) systems Smart/IoT?enabled monitoring systems Others |

| By Distribution Channel | Direct tenders to hospitals and government entities Local medical device distributors and dealers Online and e?procurement platforms Others (group purchasing organizations, international OEM supply) |

| By Region | Muscat Salalah Sohar Other governorates (Nizwa, Sur, Duqm, Buraimi, etc.) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil and Gas Sector | 100 | Safety Managers, Operations Directors |

| Manufacturing Industry | 80 | Plant Managers, Maintenance Engineers |

| Construction Sector | 60 | Project Managers, Safety Compliance Officers |

| Healthcare Facilities | 50 | Facility Managers, Biomedical Engineers |

| Research and Development | 40 | R&D Managers, Product Development Engineers |

The Oman Pressure Relief Device market is valued at approximately USD 12 million, reflecting a growing demand driven by factors such as chronic diseases, an aging population, and increased awareness of patient safety in healthcare settings.