Region:Asia

Author(s):Dev

Product Code:KRAD3447

Pages:93

Published On:November 2025

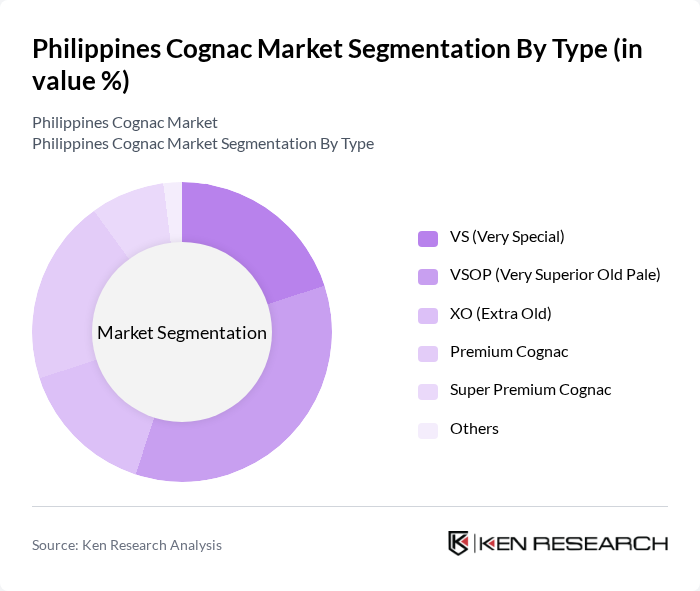

By Type:The cognac market in the Philippines is segmented into various types, including VS (Very Special), VSOP (Very Superior Old Pale), XO (Extra Old), Premium Cognac, Super Premium Cognac, and Others. Among these, the VSOP segment is currently leading the market due to its balance of quality and price, appealing to both casual drinkers and connoisseurs. The increasing popularity of premium and super premium cognacs is also notable, driven by rising disposable incomes and changing consumer preferences towards luxury products.

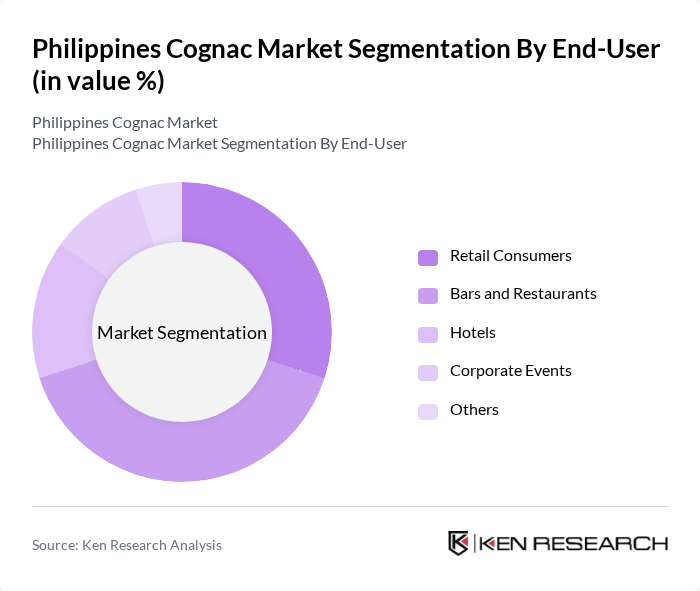

By End-User:The cognac market is also segmented by end-user categories, which include Retail Consumers, Bars and Restaurants, Hotels, Corporate Events, and Others. The Bars and Restaurants segment is the most significant contributor to the market, driven by the growing trend of cocktail culture and premium drink offerings in nightlife establishments. Retail consumers are also increasingly purchasing cognac for home consumption, particularly during celebrations and special occasions.

The Philippines Cognac Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hennessy, Rémy Martin, Martell, Courvoisier, Camus, Hine, Delamain, Louis Royer, Pierre Ferrand, Baron Otard, Frapin, A.E. Dor, Cognac Park, Drouet, Cognac Ferrand contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cognac market in the Philippines appears promising, driven by increasing consumer interest in premium spirits and a growing nightlife sector. As disposable incomes rise, more consumers are likely to explore high-quality options, including cognac. Additionally, the expansion of e-commerce platforms will facilitate access to a broader audience, enhancing brand visibility. Collaborations with local brands may also create unique offerings, further stimulating market growth and consumer engagement in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | VS (Very Special) VSOP (Very Superior Old Pale) XO (Extra Old) Premium Cognac Super Premium Cognac Others |

| By End-User | Retail Consumers Bars and Restaurants Hotels Corporate Events Others |

| By Distribution Channel | Online Retail Supermarkets and Hypermarkets Specialty Stores Duty-Free Shops Others |

| By Packaging Type | Glass Bottles Plastic Bottles Tetra Packs Others |

| By Price Range | Low Price Mid Price High Price Luxury Others |

| By Occasion | Celebrations Gifts Casual Consumption Others |

| By Consumer Demographics | Age Group (18-24, 25-34, 35-44, 45+) Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cognac Retailers | 100 | Store Managers, Beverage Buyers |

| Importers and Distributors | 80 | Sales Directors, Logistics Managers |

| Consumers of Premium Spirits | 150 | Affluent Consumers, Age 25-45 |

| Industry Experts | 50 | Market Analysts, Beverage Consultants |

| Hospitality Sector Professionals | 70 | Bar Managers, Restaurant Owners |

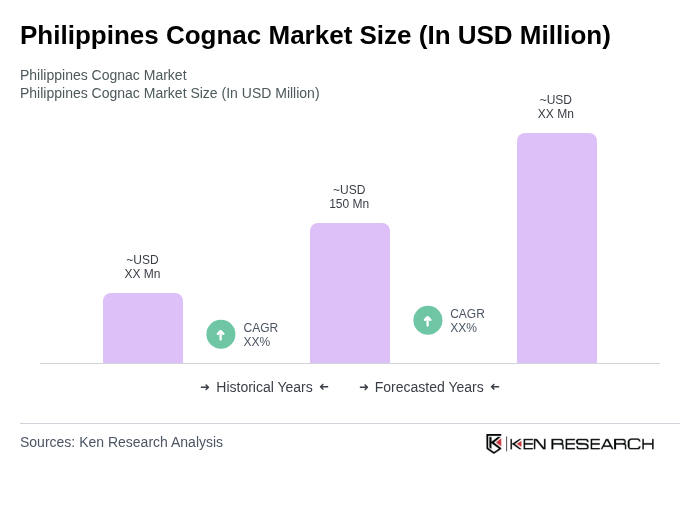

The Philippines Cognac Market is valued at approximately USD 150 million, reflecting a growing consumer interest in premium alcoholic beverages, particularly among younger demographics and urban areas where cocktail culture is on the rise.