Saudi Arabia Brandy Market Overview

- The Saudi Arabia Brandy Market is valued at USD 275 million, based on a five-year historical analysis. This market size reflects the segment's position within the broader alcoholic drinks and craft spirits landscape, which has seen robust growth due to evolving consumer preferences and the expansion of premium beverage offerings. Growth is primarily driven by rising demand for premium and luxury alcoholic beverages, an increase in social gatherings, and the influence of international hospitality standards. The shift toward high-quality, globally recognized brands and the growing expatriate population have further contributed to market expansion.

- Key cities such as Riyadh, Jeddah, and Dammam are focal points for market activity due to their large populations, expanding hospitality infrastructure, and the presence of international communities. The development of upscale hotels, restaurants, and exclusive venues—particularly in Riyadh's diplomatic quarter—has supported demand for premium spirits, including brandy, among non-Muslim residents and visitors.

- The Regulation for Alcoholic Beverage Control, 2024, issued by the Saudi Food and Drug Authority, governs the import, distribution, and sale of alcoholic beverages for non-Muslim diplomats and expatriates. This regulation mandates strict licensing, quality control, and traceability requirements, with sales limited to designated outlets in diplomatic zones. Compliance with labeling, safety, and reporting standards is required to ensure consumer protection and adherence to local laws.

Saudi Arabia Brandy Market Segmentation

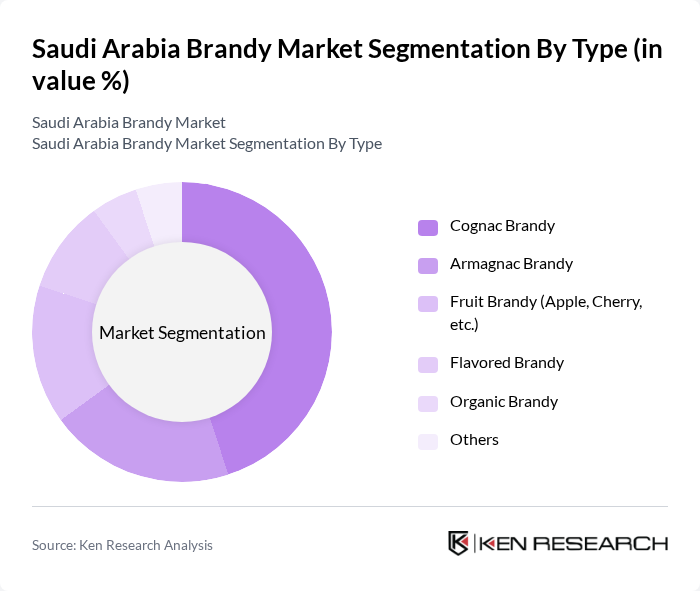

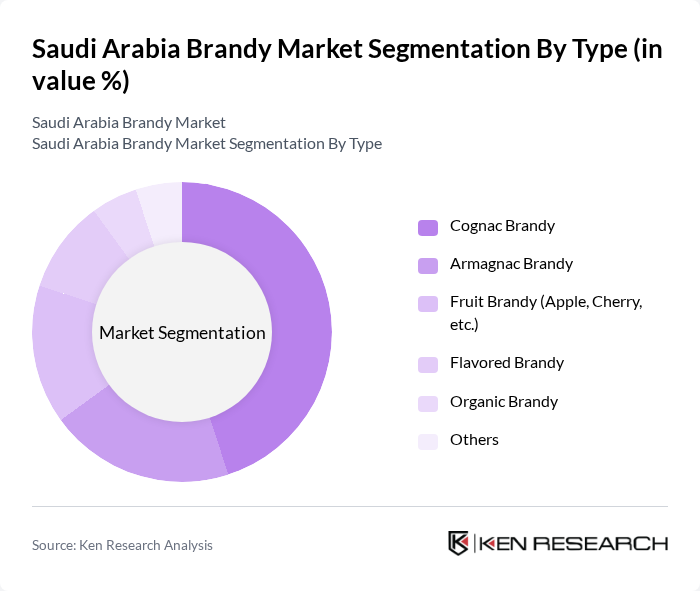

By Type:The brandy market is segmented into Cognac Brandy, Armagnac Brandy, Fruit Brandy (Apple, Cherry, etc.), Flavored Brandy, Organic Brandy, and Others. Cognac Brandy remains the most sought-after type, driven by its association with luxury and established heritage. The demand for Armagnac and flavored brandies is increasing, particularly among younger and cosmopolitan consumers who seek novel taste experiences and premiumization. Fruit and organic brandies are also gaining visibility as consumers explore artisanal and health-conscious options.

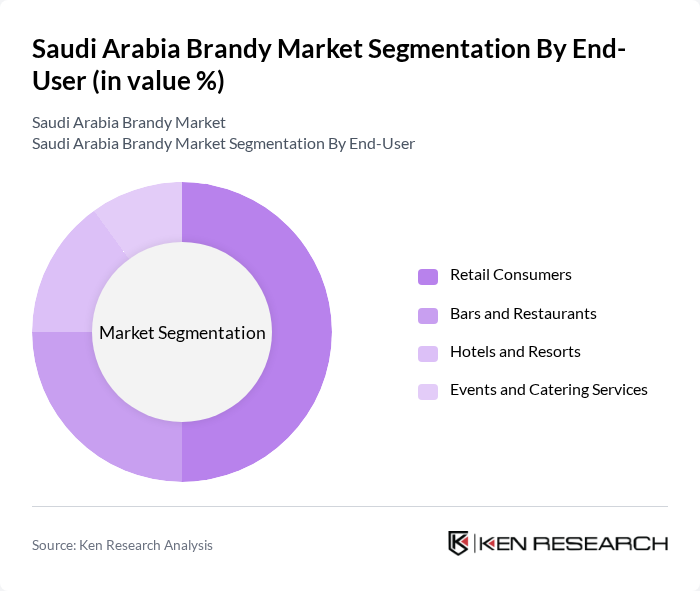

By End-User:The brandy market is segmented by end-users: Retail Consumers, Bars and Restaurants, Hotels and Resorts, and Events and Catering Services. Retail Consumers account for the largest share, reflecting the growing trend of home consumption and gifting among expatriate and diplomatic communities. Bars and restaurants are significant channels, especially in international hotels and private clubs, while the hospitality sector’s expansion continues to drive demand from hotels, resorts, and event venues.

Saudi Arabia Brandy Market Competitive Landscape

The Saudi Arabia Brandy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hennessy (LVMH), Rémy Martin (Rémy Cointreau), Martell (Pernod Ricard), Courvoisier (Beam Suntory), Camus, Torres Brandy, Diageo (Brandy Portfolio), Brown-Forman (Brandy Portfolio), E&J Gallo Winery, St-Rémy, Bardinet, Sula Vineyards (India, Exported Brands), Beam Suntory (Brandy Portfolio), KWV (South Africa, Exported Brands), Alvisa (Spain, Exported Brands) contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Brandy Market Industry Analysis

Growth Drivers

- Increasing Consumer Demand for Premium Beverages:The Saudi Arabian market has witnessed a significant shift towards premium alcoholic beverages, with sales of high-end brandy increasing by 15% annually. This trend is driven by a growing middle class, which is projected to reach 5.5 million households in future, according to the Saudi Arabian Monetary Authority. The rise in disposable income, estimated to average around SAR 14,000 per month, has led consumers to seek quality over quantity in their beverage choices.

- Growth of the Hospitality and Tourism Sector:The hospitality sector in Saudi Arabia is expanding rapidly, with the number of hotel rooms expected to increase by 30% in future, reaching approximately 130,000 rooms. This growth is fueled by the government's Vision 2030 initiative, which aims to boost tourism. As more international tourists visit, the demand for premium brandy in hotels and restaurants is anticipated to rise, contributing to a projected increase in brandy sales by 20% in the hospitality sector alone.

- Expansion of Retail Distribution Channels:The retail landscape for alcoholic beverages in Saudi Arabia is evolving, with a 25% increase in the number of licensed retail outlets over the past two years. This expansion includes both physical stores and online platforms, which have seen a 50% growth in sales. The increasing accessibility of brandy through diverse channels is expected to enhance consumer reach, making premium products more available to a broader audience, thus driving market growth.

Market Challenges

- Stringent Regulations on Alcohol Sales:The Saudi Arabian government enforces strict regulations on the sale of alcoholic beverages, including brandy. Only licensed establishments can sell alcohol, and there are severe penalties for violations. In future, over 300 establishments have been fined for non-compliance, highlighting the challenges businesses face. These regulations limit market entry and can deter potential investors, impacting overall market growth and accessibility.

- Cultural and Religious Restrictions:Saudi Arabia's cultural and religious landscape poses significant challenges for the brandy market. Alcohol consumption is generally frowned upon due to Islamic laws, which restrict its sale and consumption. This cultural barrier limits the target market, with only a small percentage of the population engaging in brandy consumption. As of now, estimates suggest that less than 5% of the population consumes alcoholic beverages, significantly constraining market potential.

Saudi Arabia Brandy Market Future Outlook

The future of the Saudi Arabia brandy market appears cautiously optimistic, driven by increasing consumer interest in premium products and the expansion of the hospitality sector. As the government continues to promote tourism and economic diversification, brandy sales are likely to benefit from enhanced distribution channels and marketing strategies. However, the market must navigate cultural sensitivities and regulatory challenges to fully capitalize on growth opportunities, particularly among younger consumers who are gradually embracing premium alcoholic beverages.

Market Opportunities

- Introduction of New Product Variants:There is a growing opportunity for brands to introduce innovative product variants tailored to local tastes. By developing flavors that resonate with Saudi consumers, companies can tap into a niche market. The introduction of limited-edition or seasonal products could attract attention and drive sales, particularly among younger demographics seeking unique experiences.

- Growth in Online Sales Channels:The rise of e-commerce presents a significant opportunity for brandy sales in Saudi Arabia. With online retail expected to grow by 40% in future, brands can leverage digital platforms to reach consumers directly. This shift allows for targeted marketing and personalized shopping experiences, which can enhance brand loyalty and increase overall sales in a traditionally restrictive market.