Region:Asia

Author(s):Dev

Product Code:KRAD1598

Pages:93

Published On:November 2025

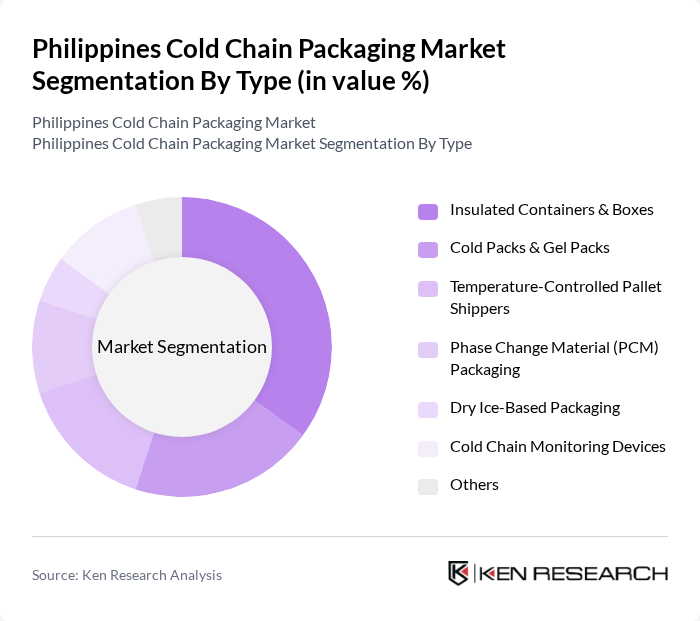

By Type:The cold chain packaging market can be segmented into various types, including Insulated Containers & Boxes, Cold Packs & Gel Packs, Temperature-Controlled Pallet Shippers, Phase Change Material (PCM) Packaging, Dry Ice-Based Packaging, Cold Chain Monitoring Devices, and Others. Among these, Insulated Containers & Boxes are leading the market due to their widespread use in transporting perishable goods, ensuring temperature stability during transit. The adoption of phase change materials and advanced insulation technologies is further enhancing the performance of these packaging types .

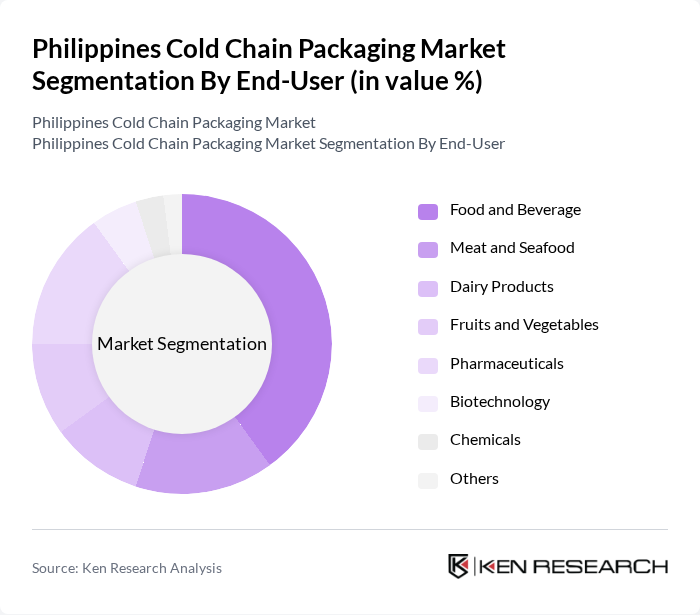

By End-User:The end-user segmentation includes Food and Beverage, Meat and Seafood, Dairy Products, Fruits and Vegetables, Pharmaceuticals, Biotechnology, Chemicals, and Others. The Food and Beverage sector is the dominant segment, driven by the increasing demand for fresh and frozen products, which require effective cold chain solutions to maintain quality and safety during distribution. The pharmaceutical segment is also growing rapidly due to the expansion of vaccine distribution and specialty drug logistics .

The Philippines Cold Chain Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jentec Storage Inc., Glacier Megafridge Inc., Royal Cargo Inc., Big Blue Logistics Corporation, Mets Logistics, Inc., Cold Chain Solutions, Inc., A.P. Moller - Maersk, Kuehne + Nagel, DB Schenker, DHL Supply Chain, Agility Logistics, CEVA Logistics, Kintetsu World Express, C.H. Robinson, Cold Chain Technologies contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain packaging market in the Philippines appears promising, driven by technological advancements and increasing consumer demand for quality food products. As the government continues to invest in infrastructure improvements, the market is likely to see enhanced logistics capabilities. Additionally, the rise of e-commerce will further necessitate efficient cold chain solutions, ensuring that perishable goods are delivered safely and promptly. This evolving landscape presents opportunities for innovation and growth within the sector, particularly in sustainable practices and smart technologies.

| Segment | Sub-Segments |

|---|---|

| By Type | Insulated Containers & Boxes Cold Packs & Gel Packs Temperature-Controlled Pallet Shippers Phase Change Material (PCM) Packaging Dry Ice-Based Packaging Cold Chain Monitoring Devices Others |

| By End-User | Food and Beverage Meat and Seafood Dairy Products Fruits and Vegetables Pharmaceuticals Biotechnology Chemicals Others |

| By Packaging Material | Expanded Polystyrene (EPS) Polyurethane (PUR) Plastic Glass Metal Paper and Paperboard Others |

| By Temperature Range | Ambient Temperature (15°C to 25°C) Refrigerated Temperature (2°C to 8°C) Frozen Temperature (-20°C and below) Others |

| By Distribution Channel | Direct Sales Online Sales Distributors Retail Others |

| By Region | Luzon Visayas Mindanao Others |

| By Application | Food Storage Transportation Retail Display Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Cold Chain | 120 | Supply Chain Managers, Quality Assurance Officers |

| Pharmaceutical Cold Chain | 90 | Logistics Coordinators, Regulatory Affairs Specialists |

| Chemical Products Cold Storage | 60 | Operations Managers, Safety Compliance Officers |

| Retail Cold Chain Management | 50 | Inventory Managers, Distribution Supervisors |

| Cold Chain Packaging Solutions | 40 | Product Development Managers, Packaging Engineers |

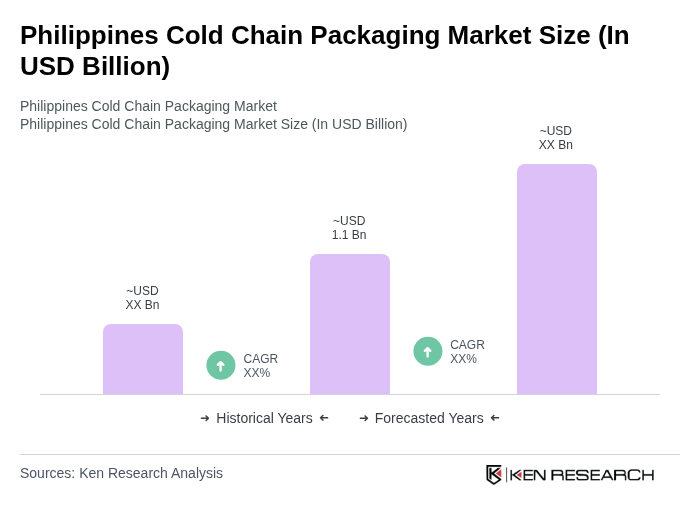

The Philippines Cold Chain Packaging Market is valued at approximately USD 1.1 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, as well as the growth of e-commerce and logistics services.