Region:Asia

Author(s):Rebecca

Product Code:KRAD4236

Pages:89

Published On:December 2025

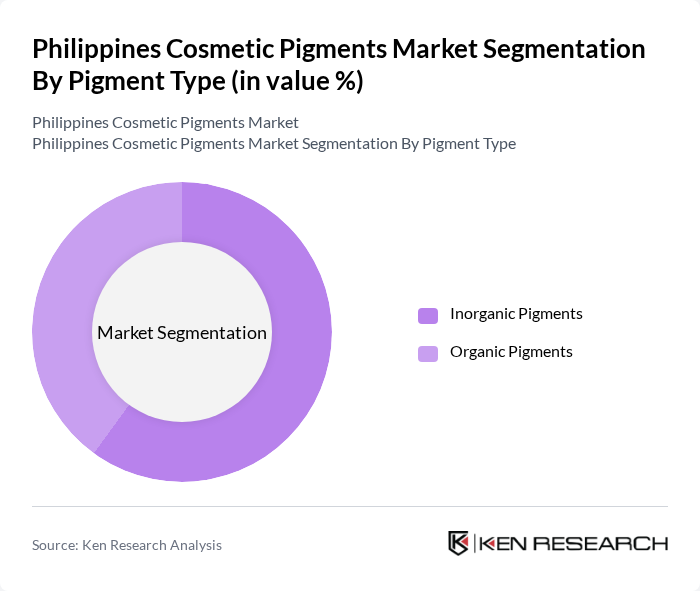

By Pigment Type:

The market is segmented into Inorganic Pigments and Organic Pigments, in line with the structure used in the Philippines colour cosmetics market. Inorganic pigments are widely used due to their stability, opacity, and good UV resistance, making them suitable for foundations, face powders, and products where coverage and durability are critical. Organic pigments, on the other hand, are gaining popularity due to their vibrant colours and higher chroma, and are often preferred in high?end and trend?driven cosmetic products such as lipsticks, lip tints, and eyeshadows. The demand for organic pigments is particularly driven by the trend towards natural and eco?friendly cosmetics, as well as vegan and cruelty?free claims, appealing to environmentally conscious and ingredient?aware consumers.

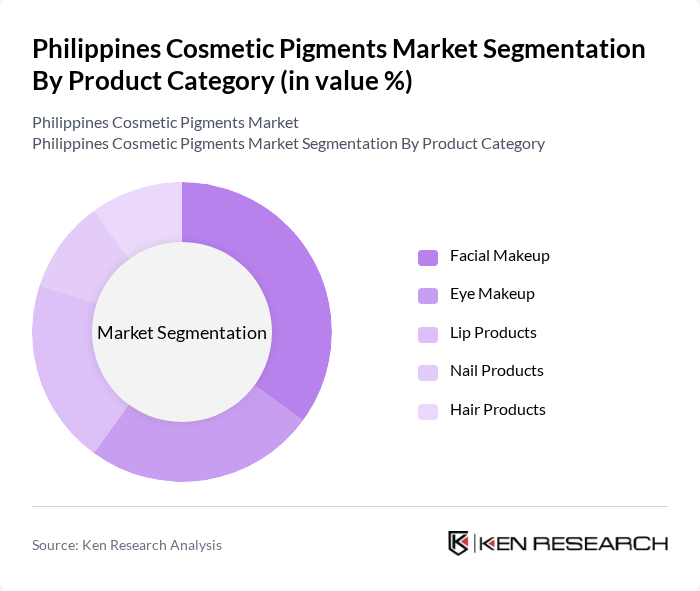

By Product Category:

The product categories include Facial Makeup, Eye Makeup, Lip Products, Nail Products, and Hair Products, consistent with the structure of the Philippines colour cosmetics market. Facial makeup dominates the market, supported by strong demand for foundations, BB/CC creams, concealers, and setting powders, which are key revenue contributors in the country’s colour cosmetics segment. Eye makeup is also significant, driven by the rising popularity of eyeliners, mascaras, and eyeshadows amplified by social media tutorials and K?beauty/J?beauty trends. The lip products segment is growing, fueled by the trend of long?wear, matte, and glossy bold lip colours, as well as multipurpose lip?and?cheek tints, while nail and hair products are expanding as consumers seek diverse options for personal expression, including nail gels, nail art, hair dyes, and temporary colour treatments.

The Philippines Cosmetic Pigments Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Clariant AG, Merck KGaA, Huntsman Corporation, Sensient Technologies Corporation, Chromaflo Technologies Corp., DIC Corporation, Lanxess AG, Pidilite Industries Limited, Aakash Chemicals & Dye-Stuffs, Colorcon, Inc., Toyal Group, Kremer Pigments GmbH & Co. KG, Faber-Castell AG, The Shepherd Color Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines cosmetic pigments market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for sustainable and innovative products continues to rise, local brands are likely to invest in research and development to create unique formulations. Additionally, the integration of digital marketing strategies will enhance brand visibility, allowing companies to connect with consumers more effectively. This dynamic environment is expected to foster growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Pigment Type | Inorganic Pigments Organic Pigments |

| By Product Category | Facial Makeup Eye Makeup Lip Products Nail Products Hair Products |

| By Target Market Segment | Mass Products Prestige Products |

| By Packaging Type | Bottles & Jars Tubes Containers Pouches Dispensers |

| By Product Form | Liquid Powder Spray |

| By Distribution Channel | E-commerce Supermarket/Hypermarkets Direct Sales/B2B Specialty Stores |

| By End-User | Parlour Household Modelling & Fashion Industries Media Houses |

| By Region | Luzon Visayas Mindanao |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cosmetic Manufacturers | 120 | Product Managers, R&D Directors |

| Raw Material Suppliers | 90 | Sales Executives, Supply Chain Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Retailers and Distributors | 70 | Category Managers, Purchasing Agents |

| End-Users (Consumers) | 150 | Beauty Enthusiasts, Makeup Artists |

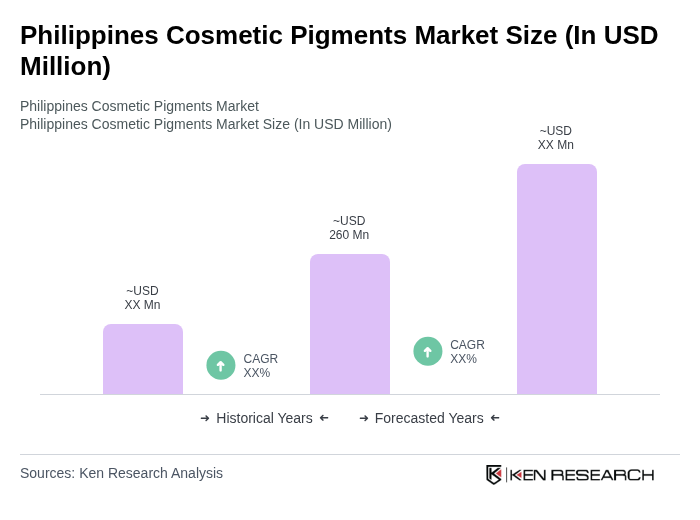

The Philippines Cosmetic Pigments Market is valued at approximately USD 260 million, reflecting a historical analysis of the country's colour cosmetics revenues and the share of pigment costs in finished cosmetic formulations.