Region:Asia

Author(s):Geetanshi

Product Code:KRAD5949

Pages:92

Published On:December 2025

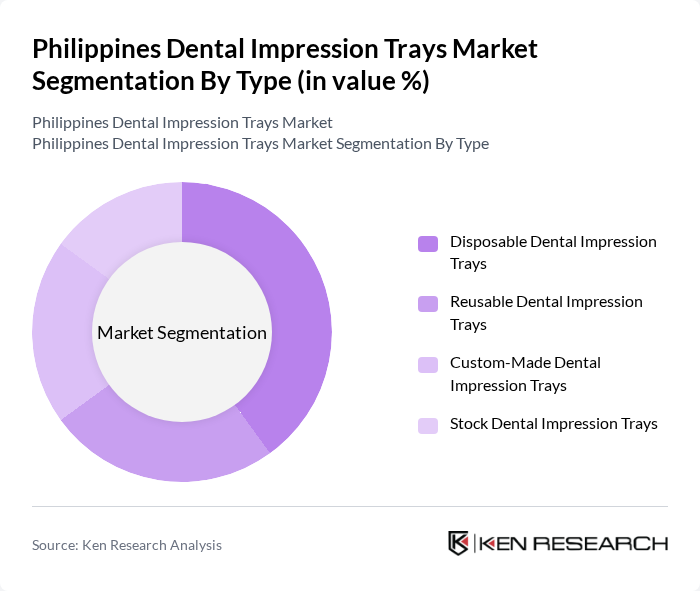

By Type:The market is segmented into four types of dental impression trays: Disposable Dental Impression Trays, Reusable Dental Impression Trays, Custom-Made Dental Impression Trays, and Stock Dental Impression Trays. Among these, Disposable Dental Impression Trays are gaining significant traction due to their convenience and hygiene benefits, especially in private dental clinics. Reusable options are also popular among dental laboratories for their cost-effectiveness. Custom-made trays are preferred for specialized dental procedures, while stock trays are widely used for general applications.

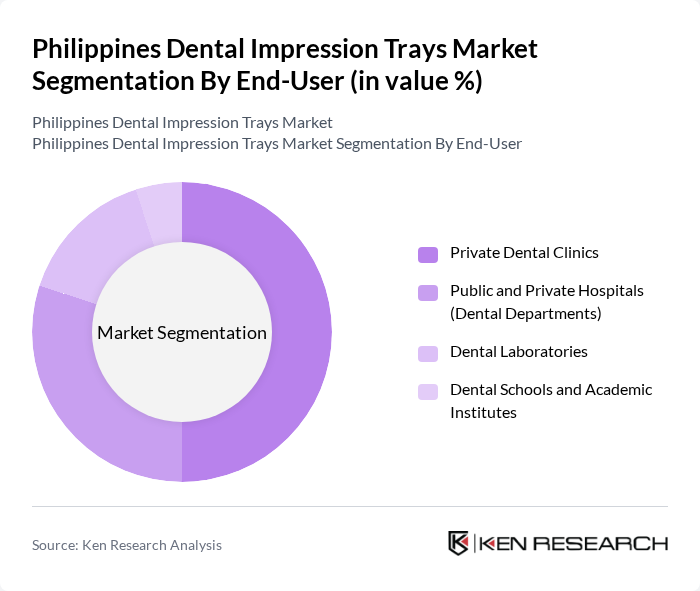

By End-User:The market is segmented based on end-users, including Private Dental Clinics, Public and Private Hospitals (Dental Departments), Dental Laboratories, and Dental Schools and Academic Institutes. Private Dental Clinics dominate the market due to the increasing number of dental practitioners and the rising demand for dental services. Public and private hospitals also contribute significantly, especially in urban areas, while dental laboratories are essential for producing customized solutions. Dental schools play a crucial role in educating future professionals and influencing market trends.

The Philippines Dental Impression Trays Market is characterized by a dynamic mix of regional and international players. Leading participants such as 3M Philippines, Inc., Dentsply Sirona, Inc., GC Corporation, Henry Schein, Inc., Ivoclar Vivadent AG, Kettenbach GmbH & Co. KG, Kulzer GmbH, Nobel Biocare Services AG, Straumann Group, Zhermack S.p.A., COLTENE Holding AG, DMG Chemisch?Pharmazeutische Fabrik GmbH, Mitsui Chemicals, Inc., VOCO GmbH, Local Philippine Dental Distributors (e.g., DenPro Philippines, Metro Dental Supply) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines dental impression trays market is poised for growth, driven by increasing dental procedures and rising awareness of oral health. As technological advancements continue to reshape the industry, the shift towards digital impressions and customized trays will likely gain momentum. Furthermore, the expansion of dental clinics and the integration of eco-friendly materials will create new avenues for market players. By addressing challenges such as high material costs and access disparities, stakeholders can capitalize on emerging trends and enhance service delivery across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Disposable Dental Impression Trays Reusable Dental Impression Trays Custom-Made Dental Impression Trays Stock Dental Impression Trays |

| By End-User | Private Dental Clinics Public and Private Hospitals (Dental Departments) Dental Laboratories Dental Schools and Academic Institutes |

| By Material | Plastic (Thermoplastic/Polymer) Trays Metal (Stainless Steel/Aluminum) Trays Resin and 3D-Printed Tray Materials Other Materials (Silicone, Composite, Hybrid) |

| By Application | Orthodontics (Braces, Clear Aligners) Prosthodontics (Crowns, Bridges, Dentures) Implantology General and Preventive Dentistry |

| By Distribution Channel | Direct Tender and Institutional Sales Dental Product Distributors/Dealers Online Dental E?Commerce Platforms Retail Pharmacies and Medical Supply Stores |

| By Region | Luzon (Including Metro Manila) Visayas Mindanao |

| By Price Range | Budget (Low-Cost/Value Segment) Mid-Range Premium (Imported/Branded) Institutional and Bulk Purchase Packs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics | 120 | Dentists, Clinic Managers |

| Dental Laboratories | 80 | Lab Technicians, Operations Managers |

| Dental Supply Distributors | 60 | Sales Representatives, Product Managers |

| Dental Associations | 40 | Association Leaders, Policy Makers |

| Dental Equipment Manufacturers | 50 | Product Development Managers, Marketing Executives |

The Philippines Dental Impression Trays Market is valued at approximately USD 80 million, reflecting a five-year historical analysis. This growth is attributed to the rising prevalence of dental disorders and increased awareness of oral health among the population.