Region:Asia

Author(s):Shubham

Product Code:KRAD0884

Pages:85

Published On:November 2025

By Product Type:The dietary supplements market is segmented into various product types, including Vitamin and Mineral Supplements, Herbal/Botanical Supplements, Protein and Amino Acid Supplements, Probiotics, Omega Fatty Acids, Functional Supplements (e.g., Sports Nutrition, Weight Management), and Others. Among these, Vitamin and Mineral Supplements dominate the market due to their widespread acceptance and essential role in daily nutrition. Consumers increasingly prefer these supplements to fill dietary gaps and support overall health, with vitamins accounting for the largest share in retail sales.

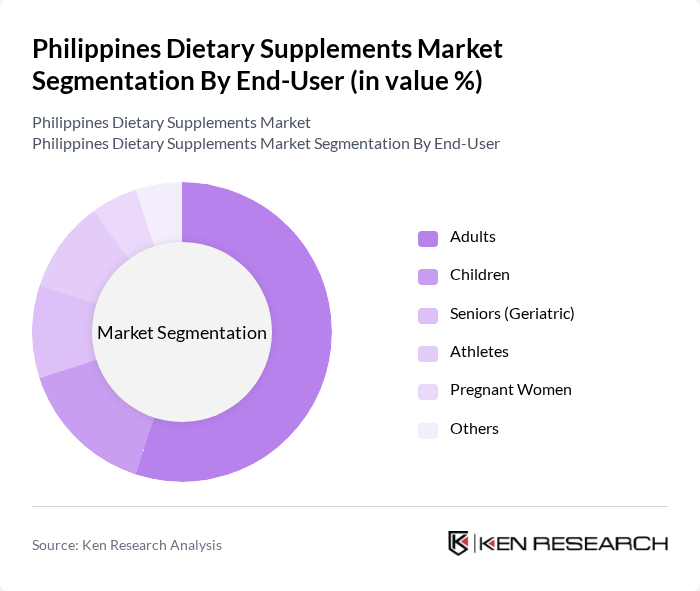

By End-User:The market is segmented by end-users, including Adults, Children, Seniors (Geriatric), Athletes, Pregnant Women, and Others. Adults represent the largest segment, driven by a growing awareness of health and wellness, as well as the increasing prevalence of lifestyle diseases. This demographic is actively seeking dietary supplements to enhance their health and prevent chronic conditions. The trend toward preventive healthcare and self-care is particularly strong among working-age adults in urban areas.

The Philippines Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Unilab, Inc., USANA Health Sciences, Inc., Herbalife International of America, Inc., Amway Corporation, GNC Holdings, Inc., Abbott Laboratories, Nestlé Health Science, Blackmores Limited, Swisse Wellness, Nature's Way, Glanbia plc, NOW Foods, Nutrilite, Pascual Laboratories, Inc., ATC Healthcare International Corp. contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines dietary supplements market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As personalized nutrition gains traction, companies are likely to invest in tailored products that meet individual health needs. Additionally, the rise of online health communities will foster greater consumer engagement and education, enhancing trust in dietary supplements. These trends indicate a dynamic market landscape, where innovation and consumer-centric strategies will be crucial for sustained growth and competitiveness in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Vitamin and Mineral Supplements Herbal/Botanical Supplements Protein and Amino Acid Supplements Probiotics Omega Fatty Acids Functional Supplements (e.g., Sports Nutrition, Weight Management) Others |

| By End-User | Adults Children Seniors (Geriatric) Athletes Pregnant Women Others |

| By Distribution Channel | Pharmacies and Drug Stores Supermarkets/Hypermarkets Online Channels Health Stores/Specialty Stores Direct-to-Consumer (DTC) / Multi-Level Marketing (MLM) Others |

| By Form | Tablets Capsules Powders Liquids Soft Gels/Gel Caps Gummies Others |

| By Application/Health Benefit | Immune Support Digestive Health Weight Management Bone & Joint Health Heart/Cardiovascular Health Sports Nutrition/Performance Others |

| By Age Group | Children (0-12 years) Teenagers (13-19 years) Adults (20-59 years) Seniors (60+ years) Others |

| By Packaging Type | Bottles Blister Packs Pouches Jars Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Feedback | 100 | Nutritionists, General Practitioners |

| Market Trends Analysis | 80 | Industry Analysts, Market Researchers |

| Regulatory Impact Assessment | 60 | Regulatory Affairs Specialists, Compliance Officers |

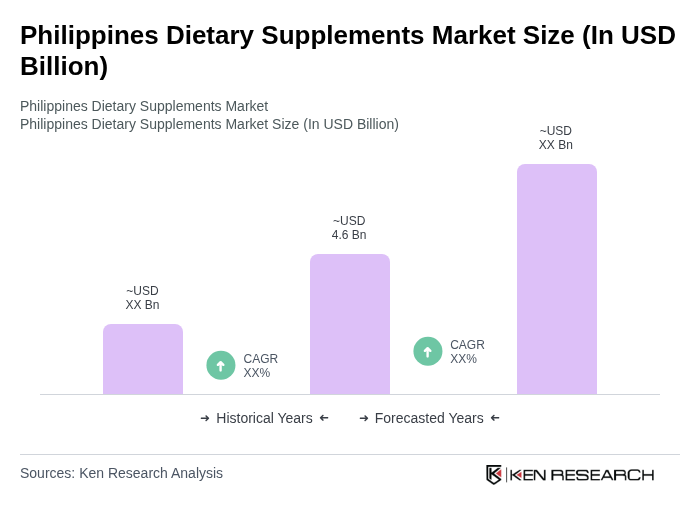

The Philippines Dietary Supplements Market is valued at approximately USD 4.6 billion, reflecting significant growth driven by increasing health consciousness, lifestyle-related diseases, and a trend towards preventive healthcare among consumers.