Region:Asia

Author(s):Geetanshi

Product Code:KRAC8211

Pages:81

Published On:November 2025

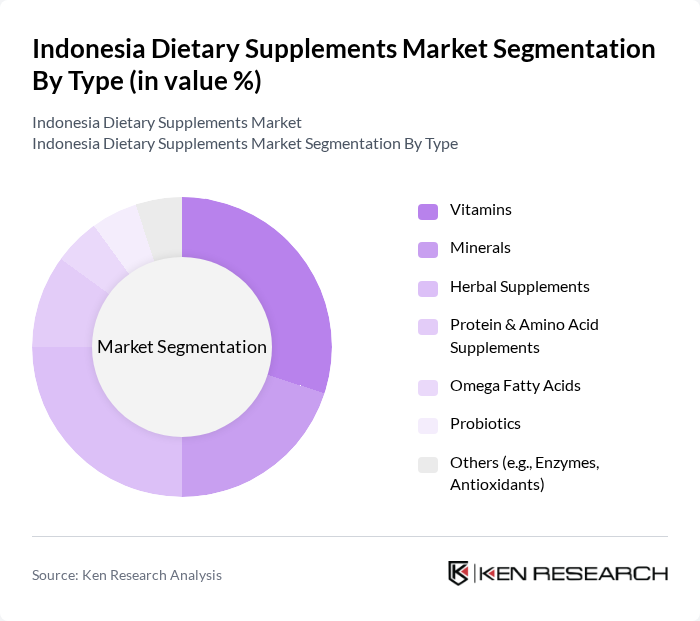

By Type:The dietary supplements market is segmented into various types, including Vitamins, Minerals, Herbal Supplements, Protein & Amino Acid Supplements, Omega Fatty Acids, Probiotics, and Others (e.g., Enzymes, Antioxidants). Among these, Vitamins and Herbal Supplements are particularly popular due to their perceived health benefits and natural origins. The increasing trend of self-medication, preventive healthcare, and personalized nutrition has led to a significant rise in the consumption of these products. The demand for protein and amino acid supplements is also growing, especially among younger consumers and fitness enthusiasts .

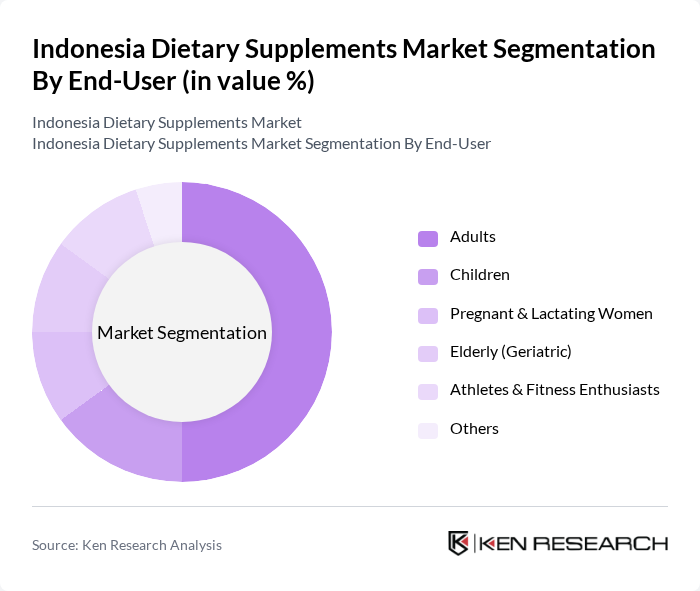

By End-User:The market is segmented by end-users, including Adults, Children, Pregnant & Lactating Women, Elderly (Geriatric), Athletes & Fitness Enthusiasts, and Others. Adults represent the largest segment, driven by a growing awareness of health and wellness, as well as the increasing prevalence of lifestyle-related diseases. The focus on fitness and nutrition among younger demographics has also led to a rise in demand for dietary supplements among athletes and fitness enthusiasts. Elderly consumers are increasingly seeking supplements for bone, joint, and cognitive health .

The Indonesia Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as PT Kalbe Farma Tbk, PT Industri Jamu dan Farmasi Sido Muncul Tbk, Herbalife Nutrition Indonesia, Amway Indonesia, Nutrilite Indonesia, PT Deltomed Laboratories, PT Nestlé Indonesia (Dancow, Milo, etc.), PT Unilever Indonesia Tbk, PT Darya-Varia Laboratoria Tbk, PT Soho Global Health Tbk, PT Phapros Tbk, PT Tempo Scan Pacific Tbk, PT Sarihusada Generasi Mahardhika, PT Bintang Toedjoe, and PT Kimia Farma Tbk contribute to innovation, geographic expansion, and service delivery in this space .

The future of the dietary supplements market in Indonesia appears promising, driven by a growing emphasis on preventive healthcare and the increasing integration of technology in product offerings. As consumers become more health-conscious, the demand for innovative and personalized supplements is expected to rise. Additionally, the expansion of e-commerce will continue to facilitate access to a broader range of products, enhancing consumer choice and convenience in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids Probiotics Others (e.g., Enzymes, Antioxidants) |

| By End-User | Adults Children Pregnant & Lactating Women Elderly (Geriatric) Athletes & Fitness Enthusiasts Others |

| By Distribution Channel | Online Retail (E-commerce, Marketplaces) Supermarkets/Hypermarkets Pharmacies/Drug Stores Health Food Stores Direct Sales (MLM, Direct-to-Consumer) Others (Clinics, Specialty Stores) |

| By Formulation | Tablets Capsules Powders Liquids Gummies Effervescent Tablets Others |

| By Age Group | Children (0-12 years) Teenagers (13-19 years) Adults (20-59 years) Seniors (60+ years) |

| By Health Benefit | Immune Support Digestive Health Bone & Joint Health Heart & Cardiovascular Health Weight Management Energy & Vitality Others (e.g., Cognitive Health, Skin Health) |

| By Packaging Type | Bottles Blister Packs Pouches/Sachets Jars Stick Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dietary Supplement Sales | 100 | Store Managers, Sales Representatives |

| Health Professional Insights | 80 | Nutritionists, Dietitians, Health Coaches |

| Consumer Purchasing Behavior | 120 | Health-Conscious Consumers, Fitness Enthusiasts |

| Online Dietary Supplement Market | 70 | E-commerce Managers, Digital Marketing Specialists |

| Regulatory Compliance Insights | 40 | Regulatory Affairs Managers, Quality Assurance Officers |

The Indonesia Dietary Supplements Market is valued at approximately USD 3.2 billion, reflecting significant growth driven by increasing health awareness, rising disposable incomes, and a trend towards preventive healthcare among consumers.