Region:North America

Author(s):Geetanshi

Product Code:KRAC9395

Pages:93

Published On:November 2025

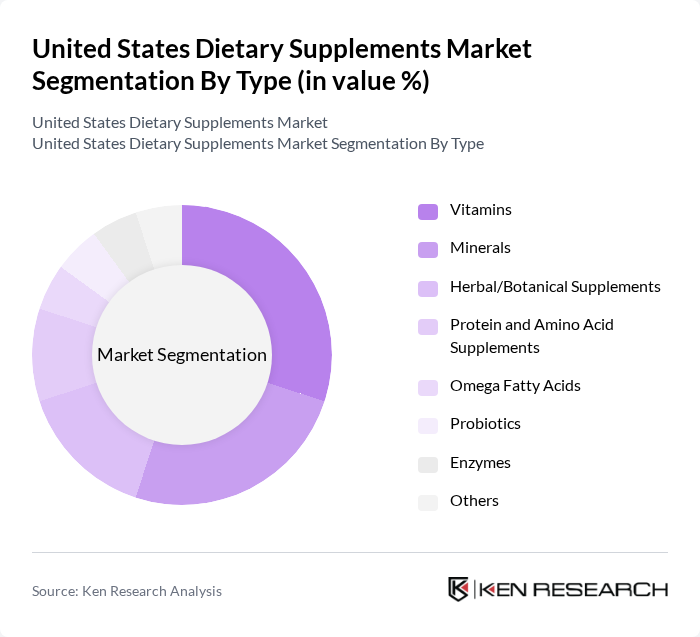

By Type:The dietary supplements market is segmented into various types, including vitamins, minerals, herbal/botanical supplements, protein and amino acid supplements, omega fatty acids, probiotics, enzymes, and others. Among these, vitamins and minerals remain the most popular due to their essential roles in maintaining health and preventing deficiencies. Growing consumer awareness of the benefits of these supplements, especially for immunity, bone health, and energy, has led to increased consumption, particularly among health-conscious and aging populations .

By Formulation:The market is also segmented by formulation, which includes tablets, capsules, powders, softgels, liquids, gummies, and others. Tablets and capsules are the most widely used forms due to their convenience and ease of consumption. Gummies have gained significant popularity, particularly among younger consumers, due to their appealing taste and chewable format. The rise of powders and liquids is also notable, driven by demand for customizable and on-the-go nutrition solutions .

The United States Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories, Glanbia Plc, The Archer-Daniels-Midland Company, Nature’s Sunshine Products, Inc., GlaxoSmithKline plc, Amway Corp., Herbalife International of America, Inc., GNC Holdings, Inc., Nature's Bounty Co., Garden of Life, LLC, NOW Foods, USANA Health Sciences, Inc., Optimum Nutrition, Inc., NutraBio Labs, Inc., MegaFood, Nature Made (Pharmavite LLC), Jarrow Formulas, Inc., BSN (Bio-Engineered Supplements and Nutrition), Bayer AG, Pfizer Inc., Ritual, Gaia Herbs, Nutraceutics Corp., XanGo, LLC, PharmaNutrics Himalaya Global Holdings Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the dietary supplements market in the United States appears promising, driven by ongoing trends in health consciousness and preventive healthcare. As consumers increasingly seek personalized nutrition solutions, companies are likely to invest in innovative product formulations and technology integration. Additionally, the expansion of e-commerce platforms will facilitate greater access to a diverse range of supplements, enhancing consumer choice and convenience. This dynamic environment presents significant opportunities for growth and market evolution.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal/Botanical Supplements Protein and Amino Acid Supplements Omega Fatty Acids Probiotics Enzymes Others |

| By Formulation | Tablets Capsules Powders Softgels Liquids Gummies Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Health Food Stores Pharmacies & Drugstores Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Athletes, Health-Conscious Individuals) Others |

| By Region | Northeast Midwest South West |

| By Price Range | Budget Mid-Range Premium Others |

| By Health Benefit | Immune Support Digestive Health Weight Management Energy and Endurance Bone & Joint Health Heart/Cardiovascular Health General Wellness Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Dietary Supplement Sales | 150 | Store Managers, Category Buyers |

| Online Supplement Purchases | 100 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Health Trends | 120 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 80 | Nutritionists, Physicians, Pharmacists |

| Regulatory Impact Assessment | 50 | Regulatory Affairs Specialists, Compliance Officers |

The United States Dietary Supplements Market is valued at approximately USD 57 billion, reflecting significant growth driven by rising health awareness, an aging population, and increased demand for preventive healthcare and personalized nutrition.