Region:Middle East

Author(s):Rebecca

Product Code:KRAC9729

Pages:80

Published On:November 2025

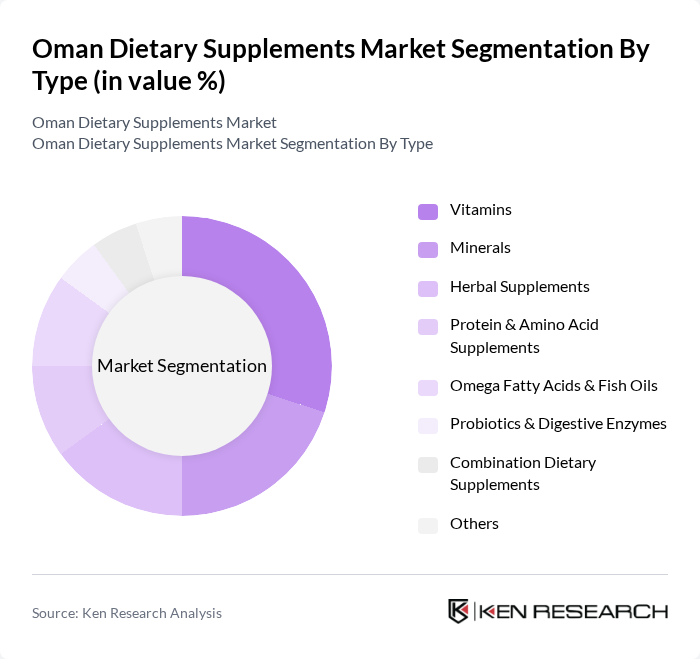

By Type:The dietary supplements market can be segmented into various types, including vitamins, minerals, herbal supplements, protein & amino acid supplements, omega fatty acids & fish oils, probiotics & digestive enzymes, combination dietary supplements, and others. Each of these subsegments caters to specific consumer needs and preferences, reflecting the diverse health and wellness trends in Oman. The vitamins segment is the fastest growing, driven by increased awareness of nutrient deficiencies and preventive health practices.

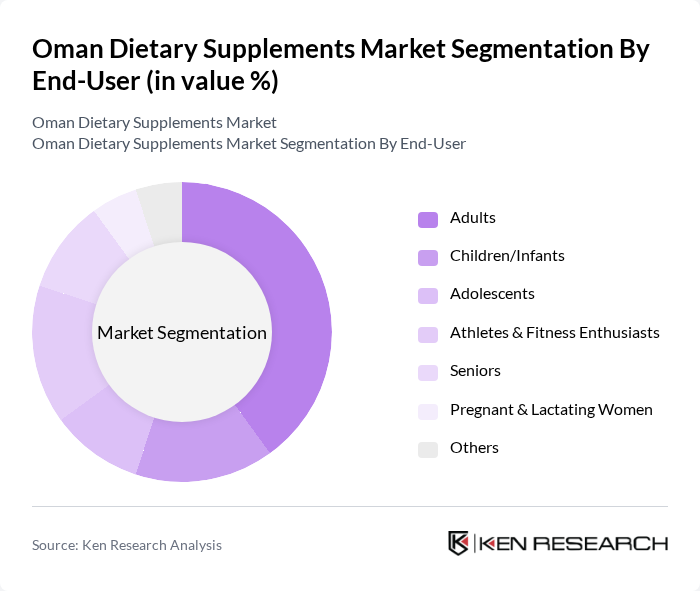

By End-User:The end-user segmentation includes adults, children/infants, adolescents, athletes & fitness enthusiasts, seniors, pregnant & lactating women, and others. Each group has distinct health requirements, influencing their purchasing decisions and the types of dietary supplements they prefer. Adults and athletes are the largest consumer groups, reflecting the growing focus on fitness, preventive health, and nutritional supplementation among working-age and active populations.

The Oman Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation (Nutrilite), GNC Holdings, Inc., Nature’s Bounty Co. (The Bountiful Company), USANA Health Sciences, Inc., Blackmores Limited, Swisse Wellness Pty Ltd., NOW Foods, Solgar Inc., Vitabiotics Ltd., Mega We Care Ltd., Nature Made (Pharmavite LLC), Jamjoom Pharma, Oman Pharmaceutical Products Co. LLC, Gulf Pharmaceutical Industries (Julphar) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman dietary supplements market appears promising, driven by increasing consumer interest in health and wellness. As the population ages, the demand for supplements tailored to specific health needs is expected to rise. Additionally, advancements in technology will facilitate personalized nutrition solutions, enhancing consumer engagement. The market is likely to see a shift towards sustainable practices, with brands focusing on eco-friendly packaging and sourcing, aligning with global trends in health and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein & Amino Acid Supplements Omega Fatty Acids & Fish Oils Probiotics & Digestive Enzymes Combination Dietary Supplements Others |

| By End-User | Adults Children/Infants Adolescents Athletes & Fitness Enthusiasts Seniors Pregnant & Lactating Women Others |

| By Distribution Channel | Pharmacies & Drug Stores Online Retail/E-commerce Supermarkets/Hypermarkets Health & Wellness Stores Direct Sales Others |

| By Formulation | Tablets Capsules Powders Liquids Gummies Soft Gels Others |

| By Age Group | Children (0-12 years) Adolescents (13-19 years) Adults (20-59 years) Seniors (60+ years) Others |

| By Health Benefit | Immune Support Digestive Health Joint & Bone Health Heart & Cardiovascular Health Weight Management Cognitive & Memory Support Energy & Vitality Others |

| By Packaging Type | Bottles Blister Packs Pouches Jars Sachets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Dietary Supplements | 100 | Store Managers, Sales Representatives |

| Consumer Preferences in Health Supplements | 100 | Health-conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 80 | Doctors, Nutritionists, Pharmacists |

| Market Trends in Herbal Supplements | 60 | Herbal Product Retailers, Alternative Medicine Practitioners |

| Online Purchasing Behavior | 60 | E-commerce Managers, Digital Marketing Specialists |

The Oman Dietary Supplements Market is valued at approximately USD 30 million, reflecting a significant growth trend driven by increasing health consciousness and lifestyle-related health issues among consumers.