UAE Dietary Supplements Market Overview

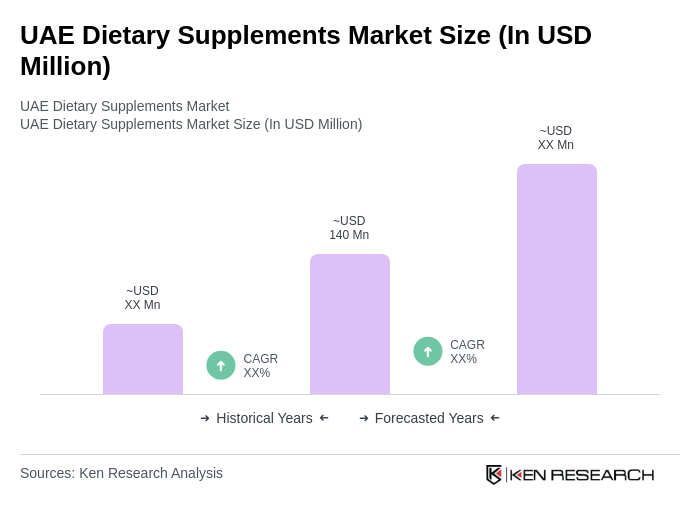

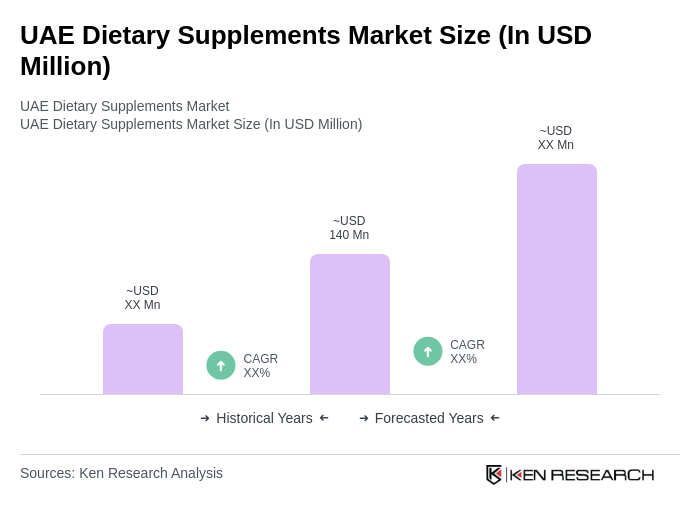

- The UAE Dietary Supplements Market is valued at USD 140 million, based on a five-year historical analysis. This growth is primarily driven by increasing health consciousness among consumers, a rise in lifestyle-related diseases, and a growing trend towards preventive healthcare. The demand for dietary supplements has surged as individuals seek to enhance their overall well-being and nutritional intake. Recent trends also highlight the influence of endorsements from healthcare professionals and social media influencers, as well as the expansion of product offerings tailored to specific health needs such as immunity, energy, and digestive health .

- Key cities dominating the market include Dubai and Abu Dhabi, which are known for their affluent populations and high disposable incomes. The presence of a diverse expatriate community also contributes to the demand for various dietary supplements, catering to different cultural preferences and health needs. Additionally, the UAE's strategic location as a trade hub facilitates the import of international brands .

- In 2023, the UAE government implemented the Ministerial Decree No. 14 of 2023 issued by the Ministry of Health and Prevention (MoHAP), mandating that all dietary supplements must be registered with MoHAP before being sold in the market. This regulation requires importers and manufacturers to submit detailed product information, including safety and efficacy data, for official approval prior to market entry, thereby ensuring product safety, efficacy, and quality, and enhancing consumer trust .

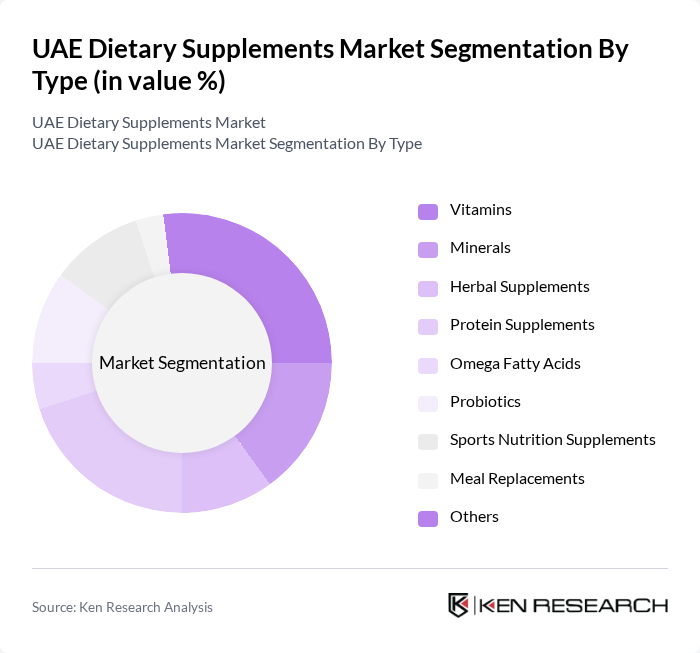

UAE Dietary Supplements Market Segmentation

By Type:The dietary supplements market can be segmented into various types, including Vitamins, Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Probiotics, Sports Nutrition Supplements, Meal Replacements, and Others. Each of these sub-segments caters to specific consumer needs and preferences, reflecting the diverse health and wellness trends in the UAE. Vitamins and protein supplements are among the most popular categories, driven by consumer focus on immunity, fitness, and overall well-being .

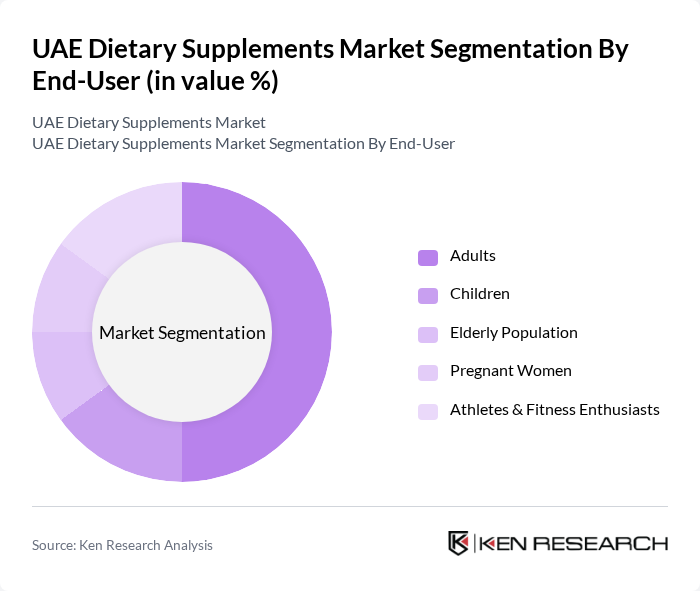

By End-User:The market can also be segmented based on end-users, which include Adults, Children, Elderly Population, Pregnant Women, and Athletes & Fitness Enthusiasts. Each segment has unique requirements and preferences, influencing the types of dietary supplements that are most popular among them. Adults represent the largest end-user segment, reflecting the high prevalence of preventive health practices and lifestyle management in this demographic .

UAE Dietary Supplements Market Competitive Landscape

The UAE Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Blackmores Limited, Nature's Bounty Co., USANA Health Sciences, Inc., Swisse Wellness Pty Ltd., Solgar Inc., NOW Foods, Garden of Life, LLC, MusclePharm Corporation, Optimum Nutrition, Inc., Nature Made, Glanbia Performance Nutrition (Optimum Nutrition, BSN, Isopure), Vitabiotics Ltd., Bayer Middle East FZE, Pfizer Gulf FZ LLC, Life Pharmacy Group (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

UAE Dietary Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The UAE has witnessed a significant rise in health awareness, with 70% of the population actively seeking information on nutrition and wellness. This trend is supported by government initiatives promoting healthy lifestyles, resulting in a 15% increase in dietary supplement consumption in recent periods. The World Health Organization reported that 60% of UAE residents are now prioritizing preventive health measures, further driving the demand for dietary supplements as part of their daily routines.

- Rising Demand for Preventive Healthcare:The UAE's healthcare expenditure is projected to reach AED 60 billion in the future, reflecting a growing focus on preventive healthcare. This shift is evident as 55% of consumers are now investing in dietary supplements to enhance their immune systems and overall health. The Ministry of Health and Prevention has also reported a 20% increase in the sales of vitamins and minerals, indicating a robust market response to preventive health strategies.

- Growth of E-commerce Platforms:E-commerce sales of dietary supplements in the UAE surged to AED 1.5 billion in recent periods, driven by the convenience of online shopping. With 85% of consumers preferring to purchase health products online, platforms like Amazon and local e-commerce sites have expanded their offerings. The UAE's internet penetration rate of 99% supports this trend, making online channels a critical driver for the dietary supplements market as consumers seek easy access to a variety of products.

Market Challenges

- Stringent Regulatory Compliance:The UAE's dietary supplement market faces challenges due to stringent regulatory compliance, with over 200 regulations governing product safety and labeling. The Ministry of Health and Prevention enforces these regulations, which can delay product launches by up to six months. Companies must invest significantly in compliance measures, which can increase operational costs by 30%, impacting their ability to compete effectively in the market.

- High Competition Among Brands:The dietary supplements market in the UAE is highly competitive, with over 300 brands vying for market share. This saturation leads to aggressive pricing strategies, with some brands reducing prices by 20% to attract consumers. Additionally, the presence of international brands complicates the landscape, as they often have larger marketing budgets, making it challenging for local brands to establish a foothold and maintain profitability.

UAE Dietary Supplements Market Future Outlook

The future of the UAE dietary supplements market appears promising, driven by evolving consumer preferences and technological advancements. As health consciousness continues to rise, the demand for innovative products, particularly those that are organic and plant-based, is expected to grow. Additionally, the integration of technology in product development, such as personalized supplements tailored to individual health needs, will likely reshape the market landscape, offering new avenues for growth and consumer engagement.

Market Opportunities

- Growth in Organic and Natural Supplements:The demand for organic and natural dietary supplements is on the rise, with sales increasing by 25% in recent periods. This trend is driven by consumer preferences for clean-label products, presenting an opportunity for brands to innovate and expand their offerings in this segment, potentially capturing a larger market share.

- Development of Personalized Supplements:The trend towards personalized nutrition is gaining traction, with 40% of consumers expressing interest in tailored supplements. Companies that invest in research and development to create customized products based on individual health profiles can tap into this lucrative market, enhancing customer loyalty and driving sales growth.