Region:Asia

Author(s):Shubham

Product Code:KRAB3165

Pages:84

Published On:October 2025

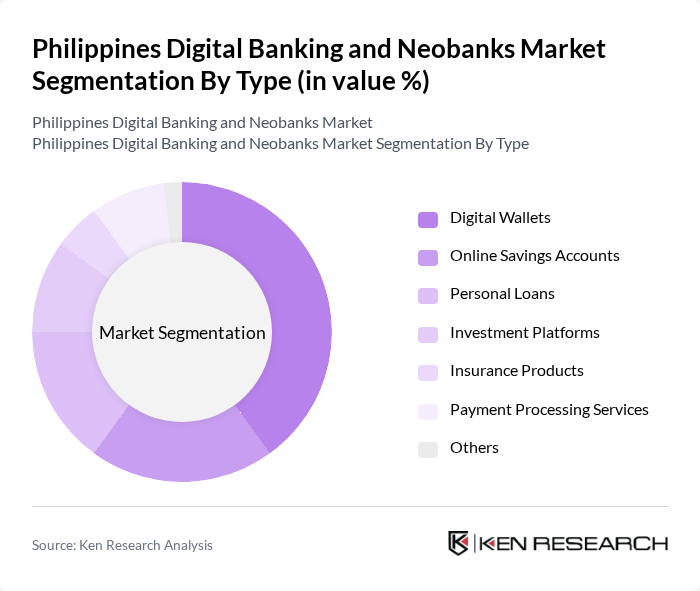

By Type:The market is segmented into various types, including Digital Wallets, Online Savings Accounts, Personal Loans, Investment Platforms, Insurance Products, Payment Processing Services, and Others. Among these, Digital Wallets have emerged as the leading sub-segment, driven by the increasing preference for cashless transactions and the convenience they offer to consumers. The rise of e-commerce and the need for quick payment solutions have further propelled the growth of digital wallets in the Philippines.

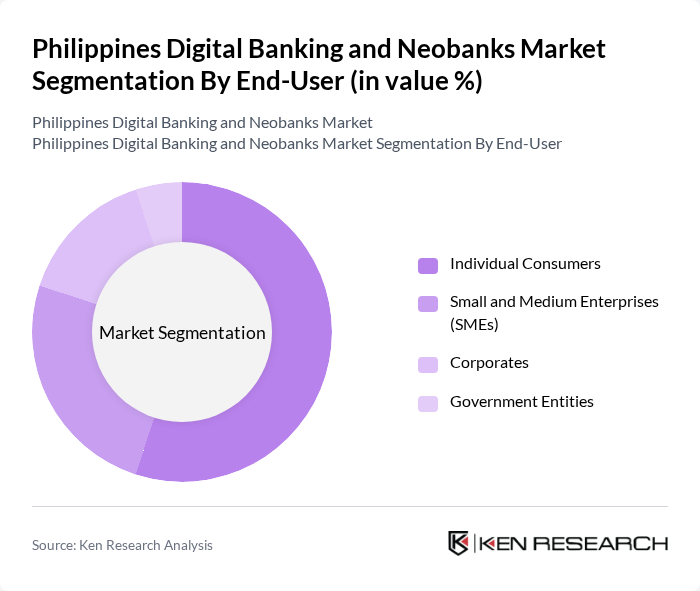

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individual Consumers dominate the market, driven by the increasing adoption of digital banking solutions for personal finance management. The convenience of accessing banking services through mobile applications and the growing trend of online shopping have significantly influenced consumer behavior, leading to a surge in digital banking usage among individuals.

The Philippines Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as GCash, PayMaya, UnionBank, RCBC, ING Bank, CIMB Bank, Grab Financial, EastWest Bank, Security Bank, Land Bank of the Philippines, BDO Unibank, Metrobank, Standard Chartered Bank, Philippine National Bank, Asia United Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines digital banking and neobanks market appears promising, driven by technological advancements and evolving consumer preferences. As the government continues to promote financial inclusion and digital literacy, more Filipinos are expected to embrace digital banking solutions. Additionally, the integration of AI and machine learning will enhance customer experiences, while open banking initiatives will foster innovation. These trends indicate a robust growth trajectory for the sector, positioning it as a key player in the financial landscape of the Philippines.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Wallets Online Savings Accounts Personal Loans Investment Platforms Insurance Products Payment Processing Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Service Channel | Mobile Applications Web Platforms Customer Support Centers |

| By Geographic Reach | Urban Areas Rural Areas |

| By Pricing Model | Subscription-Based Transaction-Based Freemium |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 150 | Millennials, Gen Z, and tech-savvy users |

| Small Business Banking Needs | 100 | Small business owners, financial managers |

| Regulatory Impact on Neobanks | 80 | Regulatory officials, compliance officers |

| Fintech Innovation Insights | 70 | Fintech entrepreneurs, product developers |

| Consumer Attitudes Towards Digital Payments | 120 | General consumers, digital payment users |

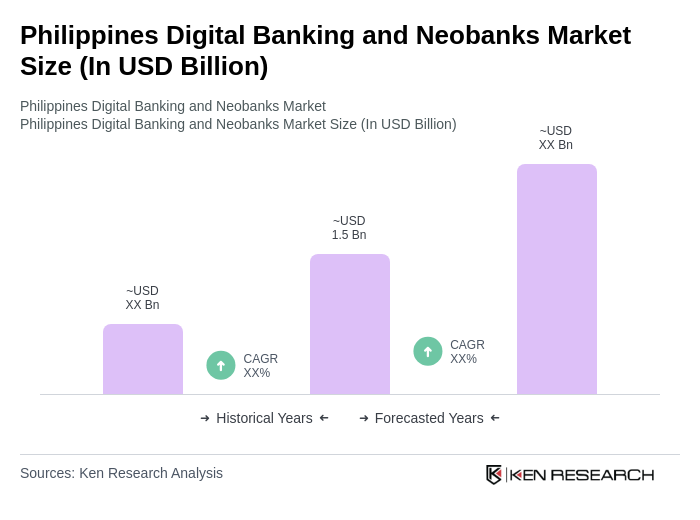

The Philippines Digital Banking and Neobanks Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and the rise of cashless transactions among a tech-savvy population.