Region:Global

Author(s):Dev

Product Code:KRAB6532

Pages:89

Published On:October 2025

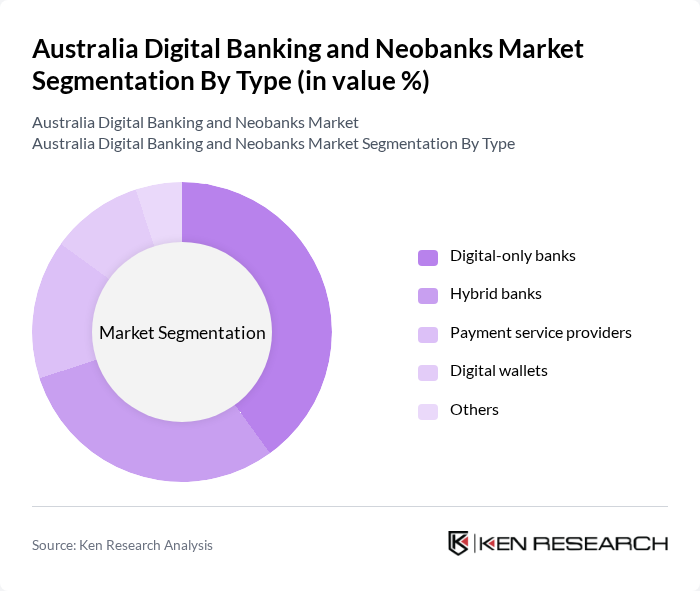

By Type:The market can be segmented into various types, including digital-only banks, hybrid banks, payment service providers, digital wallets, and others. Among these, digital-only banks are gaining significant traction due to their lower operational costs and ability to offer competitive interest rates and fees. Hybrid banks, which combine traditional banking services with digital offerings, are also popular as they cater to a broader audience. Payment service providers and digital wallets are increasingly used for their convenience and speed in transactions.

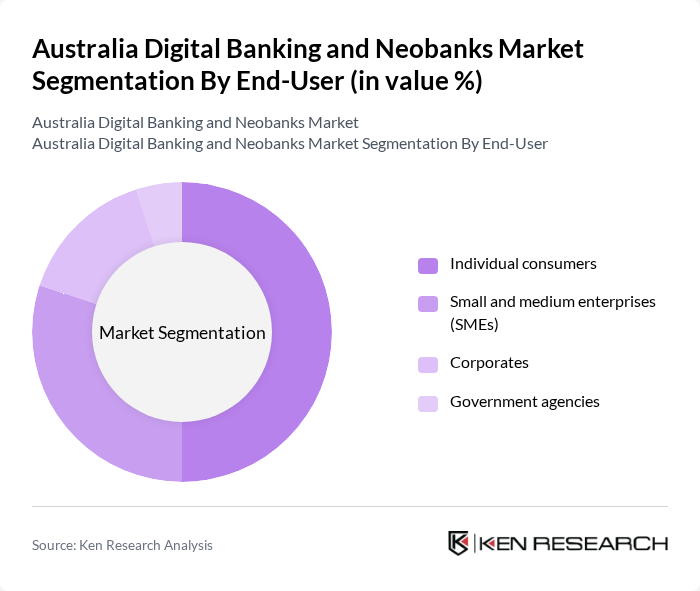

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), corporates, and government agencies. Individual consumers dominate the market as they increasingly prefer digital banking solutions for their convenience and accessibility. SMEs are also a significant segment, leveraging digital banking for efficient cash flow management and easier access to loans. Corporates and government agencies are gradually adopting these services, but their growth is slower compared to individual consumers and SMEs.

The Australia Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Afterpay Limited, Up Bank, Volt Bank, Xinja Bank, Judo Bank, 86 400, ING Australia, Commonwealth Bank of Australia, Westpac Banking Corporation, National Australia Bank, ANZ Banking Group, Bendigo and Adelaide Bank, Suncorp Group, Citibank Australia, HSBC Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia digital banking and neobanks market appears promising, driven by technological advancements and evolving consumer preferences. As more Australians embrace digital banking, the integration of artificial intelligence and machine learning will enhance personalized services, improving customer satisfaction. Additionally, the ongoing regulatory support for digital financial services will likely foster innovation. However, neobanks must navigate intense competition and cybersecurity challenges to maintain growth and build consumer trust in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks Hybrid banks Payment service providers Digital wallets Others |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Corporates Government agencies |

| By Service Offered | Savings accounts Loans and credit Investment services Insurance products |

| By Customer Segment | Millennials Gen Z Professionals Retirees |

| By Distribution Channel | Mobile applications Websites Third-party platforms Others |

| By Pricing Model | Subscription-based Transaction-based Freemium |

| By Geographic Presence | Urban areas Suburban areas Rural areas Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 150 | Retail Banking Customers, Neobank Users |

| Small Business Banking Preferences | 100 | Small Business Owners, Financial Managers |

| Fintech Adoption Trends | 80 | Fintech Start-up Founders, Industry Analysts |

| Regulatory Impact on Digital Banking | 60 | Compliance Officers, Regulatory Affairs Specialists |

| Customer Experience in Neobanks | 90 | Customer Service Managers, UX Designers |

The Australia Digital Banking and Neobanks Market is valued at approximately USD 10 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and consumer preferences for online financial services.