Region:Europe

Author(s):Shubham

Product Code:KRAB6552

Pages:92

Published On:October 2025

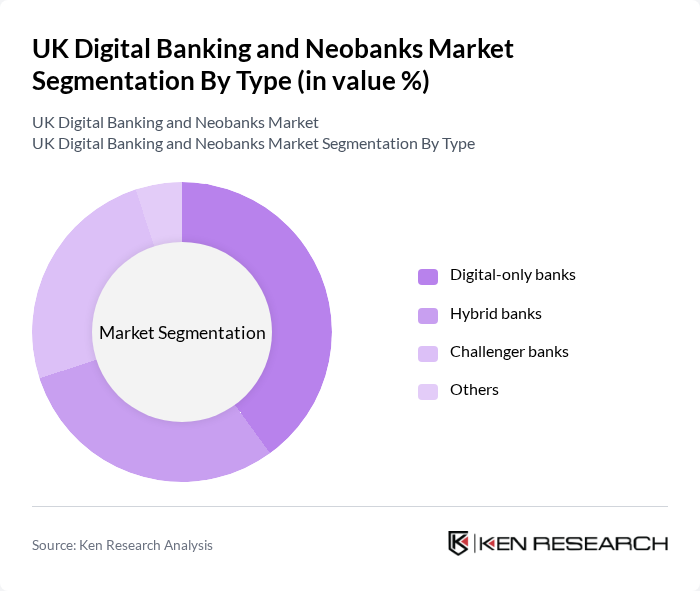

By Type:The market is segmented into various types, including digital-only banks, hybrid banks, challenger banks, and others. Digital-only banks are gaining traction due to their low operational costs and customer-centric services. Challenger banks are also emerging as significant players, offering innovative solutions that cater to specific customer needs. Hybrid banks combine traditional banking services with digital offerings, appealing to a broader audience.

By End-User:The end-user segmentation includes individual consumers, small and medium enterprises (SMEs), corporates, and others. Individual consumers dominate the market, driven by the increasing preference for mobile banking solutions and personalized financial services. SMEs are also a significant segment, as they seek cost-effective banking solutions to manage their finances efficiently.

The UK Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Monzo Bank, Revolut, Starling Bank, Atom Bank, N26, Tide, ClearBank, OakNorth Bank, Zopa, Curve, Cashplus, Soldo, Pockit, Revolut Bank UAB, Bó contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK digital banking and neobanks market appears promising, driven by technological advancements and evolving consumer preferences. As open banking initiatives gain traction, neobanks are expected to enhance their service offerings, fostering greater customer engagement. Additionally, the integration of AI and machine learning will enable personalized banking experiences, further attracting a diverse customer base. However, addressing cybersecurity and regulatory challenges will be crucial for sustained growth and consumer trust in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks Hybrid banks Challenger banks Others |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Corporates Others |

| By Service Offered | Personal banking services Business banking services Investment services Others |

| By Customer Segment | Millennials Gen Z Professionals Others |

| By Distribution Channel | Mobile applications Websites Third-party platforms Others |

| By Pricing Model | Freemium models Subscription models Transaction-based fees Others |

| By Geographic Presence | England Scotland Wales Northern Ireland |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Banking Usage | 150 | Retail Banking Customers, Digital Banking Users |

| Neobank Adoption Trends | 100 | Millennials, Gen Z Users, Tech-Savvy Consumers |

| Traditional Banks' Digital Transformation | 80 | Bank Executives, Digital Transformation Officers |

| Fintech Innovations and Impact | 70 | Fintech Entrepreneurs, Industry Analysts |

| Regulatory Impact on Digital Banking | 60 | Compliance Officers, Regulatory Affairs Specialists |

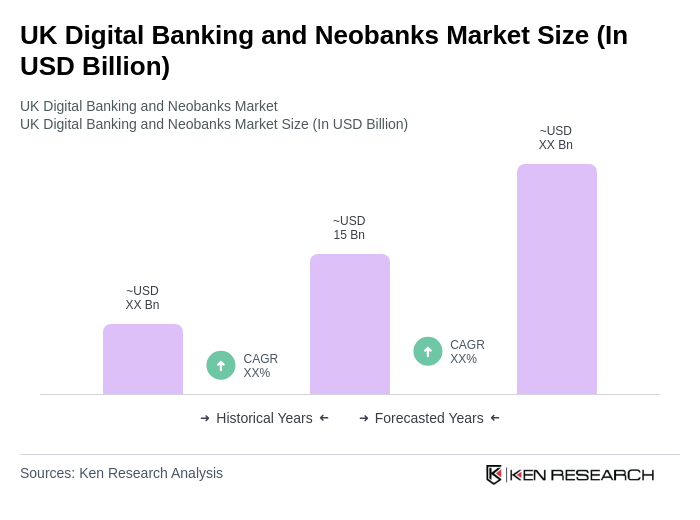

The UK Digital Banking and Neobanks Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital banking solutions and changing consumer preferences towards online banking services.