Region:Middle East

Author(s):Dev

Product Code:KRAB6485

Pages:100

Published On:October 2025

By Type:The market is segmented into three main types: Digital-only banks, Hybrid banks, and Traditional banks with digital services. Digital-only banks are gaining traction due to their lower operational costs and customer-centric services. Hybrid banks combine traditional banking with digital offerings, appealing to a broader customer base. Traditional banks are increasingly enhancing their digital services to retain customers and compete effectively.

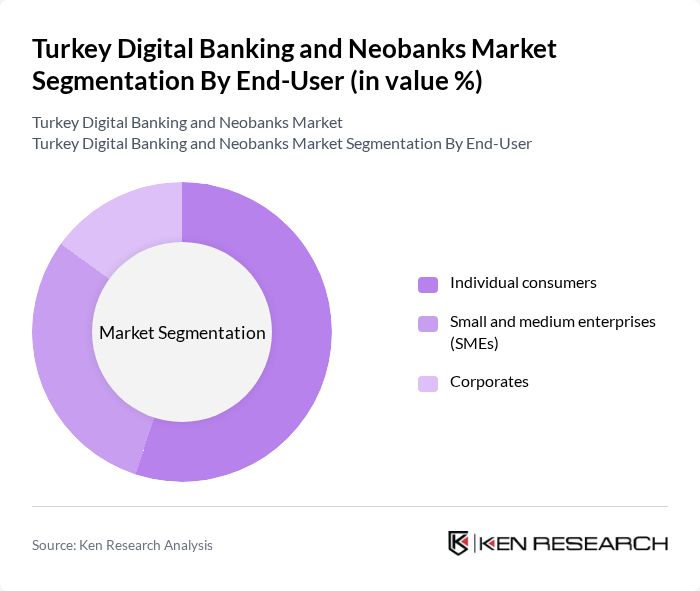

By End-User:The end-user segmentation includes Individual consumers, Small and medium enterprises (SMEs), and Corporates. Individual consumers are the largest segment, driven by the increasing use of mobile banking apps for personal finance management. SMEs are also adopting digital banking solutions to streamline operations, while Corporates leverage these services for efficient cash management and financial transactions.

The Turkey Digital Banking and Neobanks Market is characterized by a dynamic mix of regional and international players. Leading participants such as Garanti BBVA, ??bank, Yap? Kredi, QNB Finansinvest, DenizBank, Fibabanka, TEB, Anadolubank, Alternatifbank, Türk Ekonomi Bankas?, PTT Bank, Ziraat Bankas?, N Kolay, Papara, Ininal contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital banking and neobanks market appears promising, driven by technological advancements and evolving consumer preferences. As smartphone usage continues to rise, neobanks are likely to enhance their digital offerings, focusing on user-friendly interfaces and personalized services. Additionally, the increasing adoption of open banking and blockchain technology will foster innovation, enabling neobanks to create more secure and efficient financial solutions. This dynamic environment presents significant growth potential for both established and emerging players in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital-only banks Hybrid banks Traditional banks with digital services |

| By End-User | Individual consumers Small and medium enterprises (SMEs) Corporates |

| By Service Offered | Savings accounts Loans and credit services Investment services |

| By Customer Segment | Millennials Gen Z High-net-worth individuals |

| By Distribution Channel | Mobile applications Web platforms Third-party integrations |

| By Pricing Model | Subscription-based Transaction-based Freemium models |

| By Others | Niche banking services Community-focused banking Financial literacy programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Banking Customers | 150 | Individual Account Holders, Digital Banking Users |

| Small and Medium Enterprises (SMEs) | 100 | Business Owners, Financial Managers |

| Fintech Industry Experts | 80 | Consultants, Analysts, and Researchers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Neobank Customers | 120 | Tech-Savvy Users, Early Adopters |

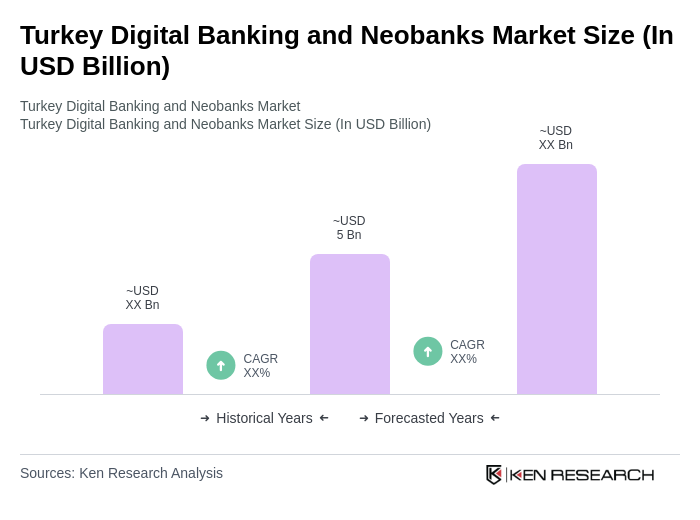

The Turkey Digital Banking and Neobanks Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing adoption of digital financial services and a shift towards online banking solutions among consumers.