Region:Asia

Author(s):Geetanshi

Product Code:KRAB1609

Pages:85

Published On:October 2025

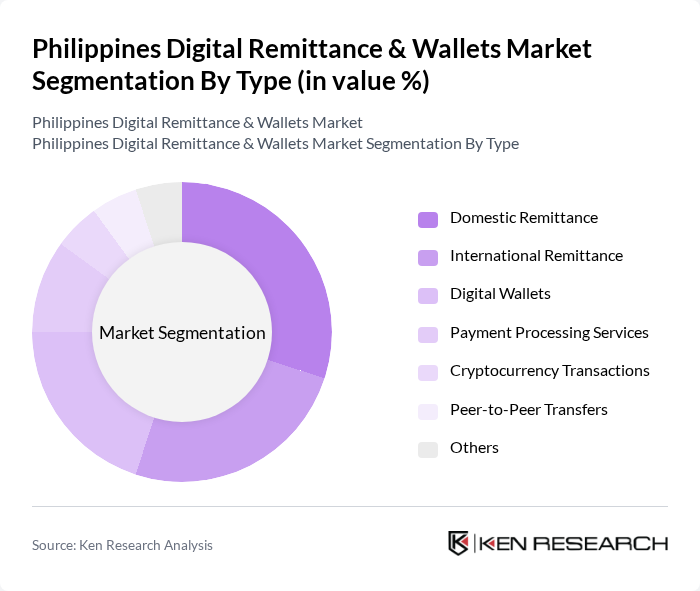

By Type:The market can be segmented into Domestic Remittance, International Remittance, Digital Wallets, Payment Processing Services, Peer-to-Peer Transfers, Bill Payment Services, Cryptocurrency Platforms, and Others. Domestic and international remittance channels cater primarily to OFWs and migrant workers, while digital wallets and payment processing services address the needs of urban consumers and businesses for seamless transactions. Peer-to-peer transfers and bill payment services are increasingly popular among younger, tech-savvy users, and cryptocurrency platforms are emerging as alternative channels for cross-border transfers and asset management. Each segment plays a distinct role in shaping market dynamics and responding to evolving consumer preferences .

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, Government Agencies, and Expatriates/Overseas Filipino Workers (OFWs). Individual consumers represent the largest segment, driven by widespread mobile adoption and the need for convenient financial services. SMEs and large corporations increasingly utilize digital wallets and payment platforms for operational efficiency, while government agencies leverage these tools for disbursement and collection. Expatriates and OFWs remain a critical segment, underpinning the international remittance market .

The Philippines Digital Remittance & Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as GCash, Maya (formerly PayMaya), Western Union, MoneyGram, Coins.ph, Remitly, Xoom (by PayPal), LBC Express, Cebuana Lhuillier, Smart Padala (by PayMaya/Maya), UnionBank of the Philippines, BDO Unibank, Rizal Commercial Banking Corporation (RCBC), EastWest Bank, Philippine National Bank (PNB), PeraHub, Brankas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines digital remittance and wallets market appears promising, driven by technological advancements and evolving consumer preferences. As smartphone penetration continues to rise, more Filipinos will access digital financial services. Additionally, the integration of artificial intelligence for fraud detection and enhanced user experience will likely become standard practice. The government's ongoing support for cashless transactions will further bolster market growth, creating a conducive environment for innovation and expansion in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Domestic Remittance International Remittance Digital Wallets Payment Processing Services Peer-to-Peer Transfers Bill Payment Services Cryptocurrency Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Expatriates/Overseas Filipino Workers (OFWs) |

| By Payment Method | Bank Transfers Mobile Payments Credit/Debit Cards Cash-in/Cash-out Services Digital Currencies |

| By User Demographics | Age Groups Income Levels Geographic Distribution Unbanked Population |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Use | Daily Users Weekly Users Monthly Users |

| By Customer Loyalty Programs | Reward Points Cashback Offers Referral Bonuses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Remittance Users | 100 | Regular users of remittance services, aged 18-55 |

| Overseas Filipino Workers (OFWs) | 80 | OFWs sending remittances back to the Philippines |

| Digital Wallet Users | 120 | Individuals using digital wallets for transactions |

| Financial Service Providers | 40 | Managers and executives from banks and fintech companies |

| Regulatory Bodies | 40 | Officials from government agencies overseeing financial services |

The Philippines Digital Remittance & Wallets Market is valued at approximately USD 162 billion, reflecting the combined value of remittance inflows and the rapid growth of digital wallet platforms, driven by the increasing number of Overseas Filipino Workers (OFWs) and digital payment adoption.