Turkey Digital Remittance & Wallets Market Overview

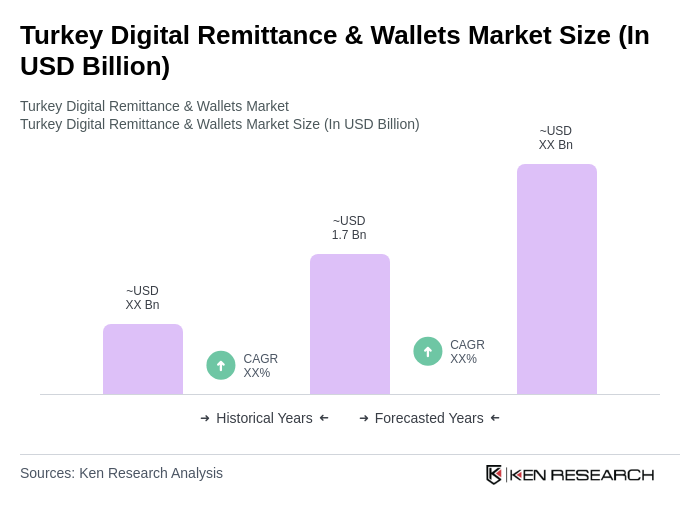

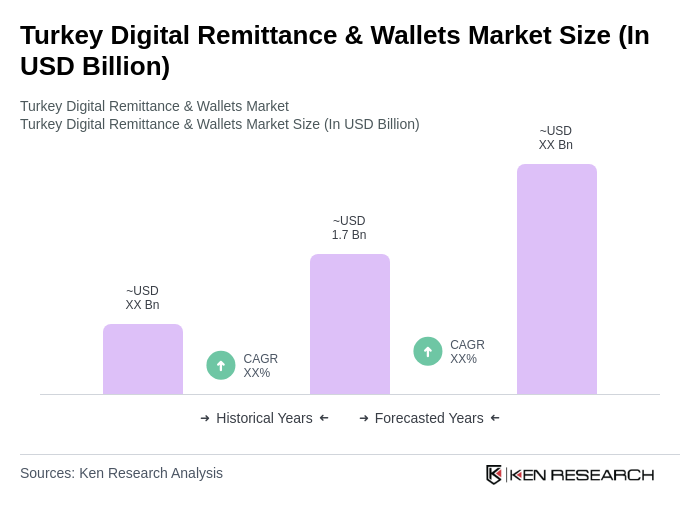

- The Turkey Digital Remittance & Wallets Market is valued at USD 1.7 billion, based on a five-year historical analysis. This growth is primarily driven by the rapid adoption of digital payment solutions, expansion of instant payment systems such as the FAST system, and a rising number of smartphone users. The surge in digital payment transactions—reaching over USD 63 billion in recent years—reflects the market’s expansion, as consumers increasingly prefer online platforms for their financial needs. Additional growth drivers include government-backed digital transformation initiatives and the rollout of national QR code standards, which have accelerated the shift toward cashless transactions and enhanced payment security .

- Istanbul, Ankara, and Izmir are the dominant cities in the Turkey Digital Remittance & Wallets Market. Istanbul, as the largest city and financial hub, attracts a significant number of international transactions. Ankara, the capital, features a growing population of tech-savvy users, while Izmir’s strategic location strengthens its role in cross-border remittances, making these cities pivotal in driving market growth .

- In 2023, the Turkish government implemented the Regulation on Payment Services and Electronic Money Institutions, issued by the Banking Regulation and Supervision Agency (BRSA). This regulation mandates that all digital wallet providers comply with strict anti-money laundering (AML) and know your customer (KYC) guidelines. Providers must verify user identities, monitor transactions for suspicious activities, and maintain robust compliance systems, thereby enhancing security and transparency in the digital financial ecosystem .

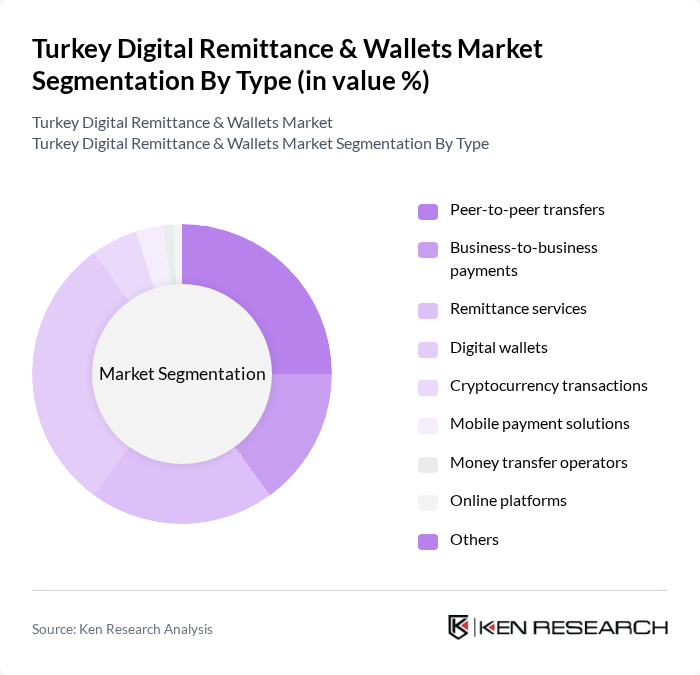

Turkey Digital Remittance & Wallets Market Segmentation

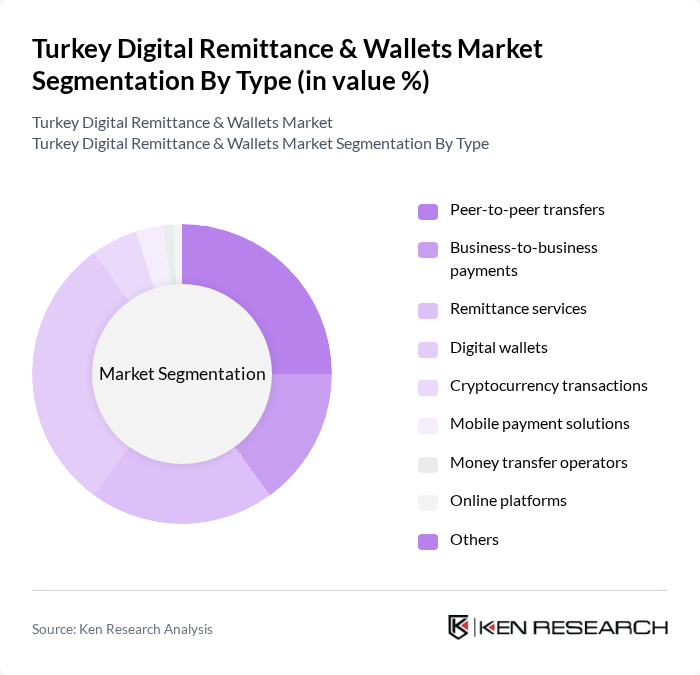

By Type:The market is segmented into peer-to-peer transfers, business-to-business payments, remittance services, digital wallets, cryptocurrency transactions, mobile payment solutions, money transfer operators, online platforms, and others. Digital wallets and peer-to-peer transfers remain particularly prominent, driven by their convenience, real-time transaction capabilities, and user-friendly interfaces. The FAST system and national QR code standards have further boosted adoption among both individual consumers and businesses .

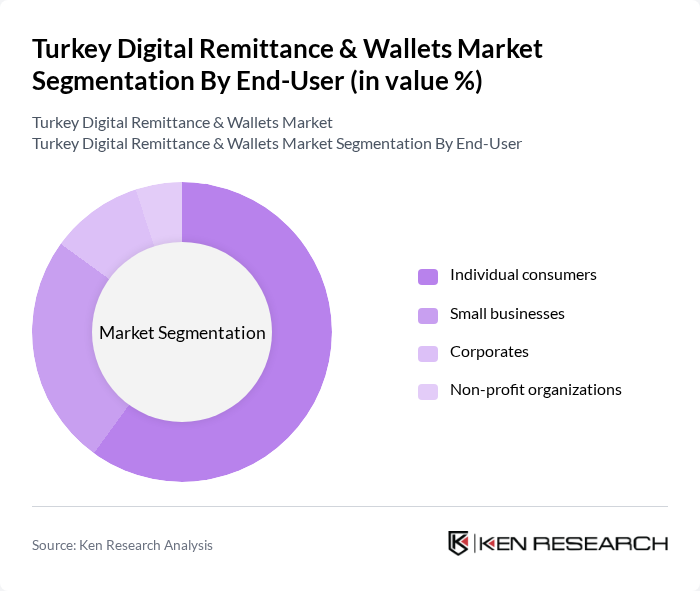

By End-User:The end-user segmentation includes individual consumers, small businesses, corporates, and non-profit organizations. Individual consumers dominate the market, driven by the increasing need for convenient and fast payment solutions. Small businesses are significant users, leveraging digital wallets and payment platforms to streamline transactions and enhance customer experiences. The proliferation of mobile payment solutions and instant transfer systems has further increased adoption among these segments .

Turkey Digital Remittance & Wallets Market Competitive Landscape

The Turkey Digital Remittance & Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Papara, Wise (formerly TransferWise), Western Union, PayPal, Ziraat Bankas?, Türkiye ?? Bankas?, Garanti BBVA, Yap? Kredi, DenizBank, Akbank, MoneyGram, Revolut, Paycell (Turkcell), Param, UPT (Universal Payment Transfer) contribute to innovation, geographic expansion, and service delivery in this space.

Turkey Digital Remittance & Wallets Market Industry Analysis

Growth Drivers

- Increasing Smartphone Penetration:Turkey's smartphone penetration reached 85%, with over 70 million users accessing mobile internet. This surge facilitates digital remittance and wallet services, as mobile devices become primary tools for financial transactions. The Turkish Statistical Institute reported that mobile banking transactions increased by 40% year-on-year, indicating a strong shift towards digital financial solutions. This trend is expected to continue, driving the adoption of digital remittance services among consumers and businesses alike.

- Rise in Cross-Border Transactions:Turkey recorded approximately $10.5 billion in remittances, primarily from expatriates. The World Bank projects that this figure will grow as more Turks seek to send money home. The increasing number of Turkish citizens living abroad, estimated at 6.5 million, drives demand for efficient remittance services. Enhanced digital platforms are emerging to cater to this need, providing faster and cheaper cross-border transactions, thus fueling market growth in the digital remittance sector.

- Growing Demand for Financial Inclusion:As of now, around 31% of Turkey's population remains unbanked, highlighting a significant opportunity for digital wallets and remittance services. The Turkish government aims to increase financial inclusion, targeting a substantial rise in banking penetration in future. Initiatives such as the Financial Literacy and Inclusion Strategy are expected to drive the adoption of digital financial services, particularly in underserved regions, thereby expanding the market for digital remittance and wallet solutions.

Market Challenges

- Regulatory Compliance Complexities:The Turkish digital finance landscape is heavily regulated, with stringent licensing requirements for digital wallets. The Central Bank of Turkey issued multiple regulations affecting digital payment providers in recent years. Compliance with these regulations can be costly and time-consuming, posing a significant barrier for new entrants and existing players looking to innovate. This complexity can hinder market growth and limit the availability of diverse financial services.

- Cybersecurity Threats:The rise in digital transactions has also led to increased cybersecurity threats. Reports indicate a significant increase in cyberattacks on financial institutions in Turkey, with notable breaches reported. This growing threat landscape raises concerns among consumers regarding the safety of their financial data. As a result, service providers must invest heavily in cybersecurity measures, which can strain resources and impact profitability, presenting a challenge to market expansion.

Turkey Digital Remittance & Wallets Market Future Outlook

The future of Turkey's digital remittance and wallets market appears promising, driven by technological advancements and evolving consumer preferences. As smartphone usage continues to rise, digital-only banking solutions are likely to gain traction. Additionally, the integration of artificial intelligence in customer service will enhance user experience, making transactions more efficient. The government's push for financial inclusion will further stimulate market growth, creating a conducive environment for innovative financial products tailored to diverse consumer needs.

Market Opportunities

- Adoption of Blockchain Technology:The integration of blockchain technology in remittance services can significantly reduce transaction costs and processing times. With Turkey's remittance market valued at approximately $10.5 billion, leveraging blockchain could streamline operations, enhance transparency, and attract more users seeking efficient solutions. This technological shift presents a substantial opportunity for service providers to differentiate themselves in a competitive landscape.

- Partnerships with Local Banks:Collaborating with local banks can enhance the credibility and reach of digital wallet services. Surveys indicate that a majority of Turkish consumers express a preference for using services backed by established financial institutions. By forming strategic partnerships, digital remittance providers can tap into existing customer bases, improve service offerings, and foster trust, ultimately driving market growth and customer retention.