Region:Asia

Author(s):Shubham

Product Code:KRAA5441

Pages:90

Published On:September 2025

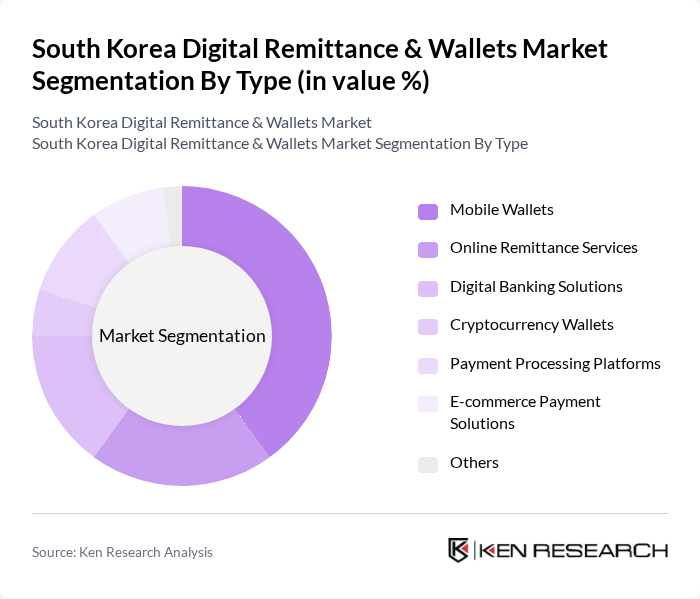

By Type:The segmentation by type includes various subsegments such as Mobile Wallets, Online Remittance Services, Digital Banking Solutions, Cryptocurrency Wallets, Payment Processing Platforms, E-commerce Payment Solutions, and Others. Among these, Mobile Wallets have emerged as the leading subsegment due to their convenience and widespread adoption among consumers for everyday transactions.

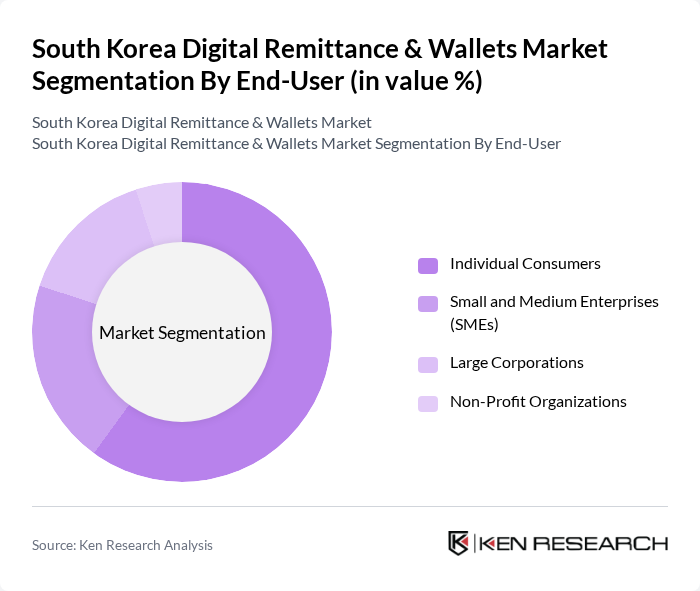

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Profit Organizations. Individual Consumers dominate this segment, driven by the increasing preference for digital payments for personal transactions and the convenience offered by mobile wallets and online remittance services.

The South Korea Digital Remittance & Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kakao Pay, Toss, Naver Pay, Payco, Samsung Pay, Western Union, MoneyGram, Remitly, Wise, Revolut, Alipay, WeChat Pay, Stripe, PayPal, Circle contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean digital remittance and wallets market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of AI and blockchain technology is expected to enhance transaction security and efficiency, attracting more users. Additionally, as the government continues to support cashless initiatives, the market will likely see increased participation from fintech startups, fostering innovation and competition. This dynamic environment will create new opportunities for growth and service diversification in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Wallets Online Remittance Services Digital Banking Solutions Cryptocurrency Wallets Payment Processing Platforms E-commerce Payment Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Profit Organizations |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cash Payments |

| By Transaction Type | Domestic Transactions International Transactions |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| By Customer Support | /7 Support Multilingual Support In-App Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Wallet Users | 150 | Frequent Users, Occasional Users |

| Remittance Service Providers | 100 | Product Managers, Business Development Executives |

| Fintech Industry Experts | 80 | Consultants, Analysts, Academics |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Consumer Advocacy Groups | 40 | Consumer Rights Advocates, Financial Educators |

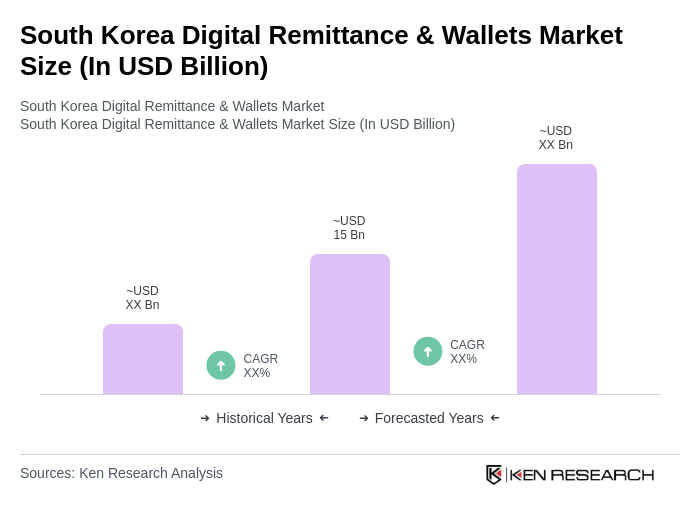

The South Korea Digital Remittance & Wallets Market is valued at approximately USD 15 billion, reflecting significant growth driven by the increasing adoption of digital payment solutions and the rise of e-commerce in the region.