Region:Africa

Author(s):Dev

Product Code:KRAB4871

Pages:97

Published On:October 2025

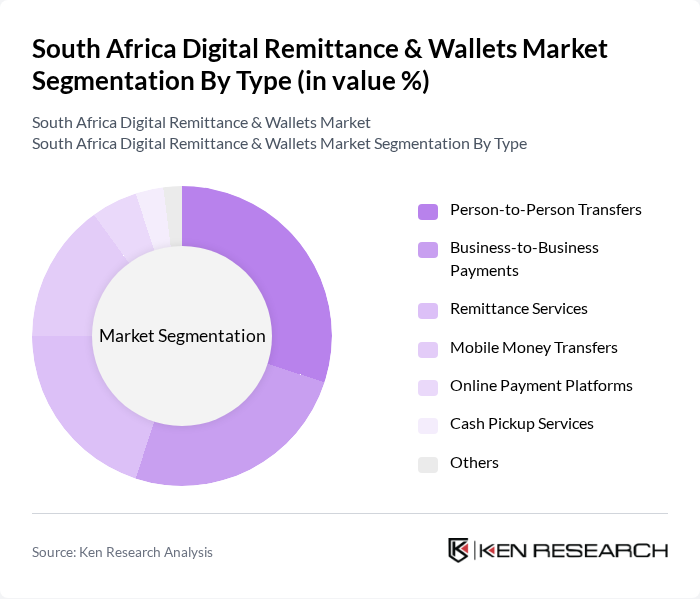

By Type:The segmentation by type includes a range of services tailored to diverse consumer needs. Subsegments comprise Person-to-Person Transfers, Business-to-Business Payments, Remittance Services, Mobile Money Transfers, Online Payment Platforms, Cash Pickup Services, and Others. Each subsegment plays a pivotal role in shaping market dynamics, with mobile money and digital wallets gaining traction among both urban and rural populations due to their accessibility and convenience .

The Person-to-Person Transfers subsegment leads the market, driven by the increasing number of individuals sending money to family and friends both domestically and internationally. This trend is supported by a growing migrant population in South Africa, who depend on these services for remittances. The convenience, speed, and lower transaction costs of digital transfers have made this option highly attractive to consumers, with mobile-based transactions now representing a significant portion of total activity .

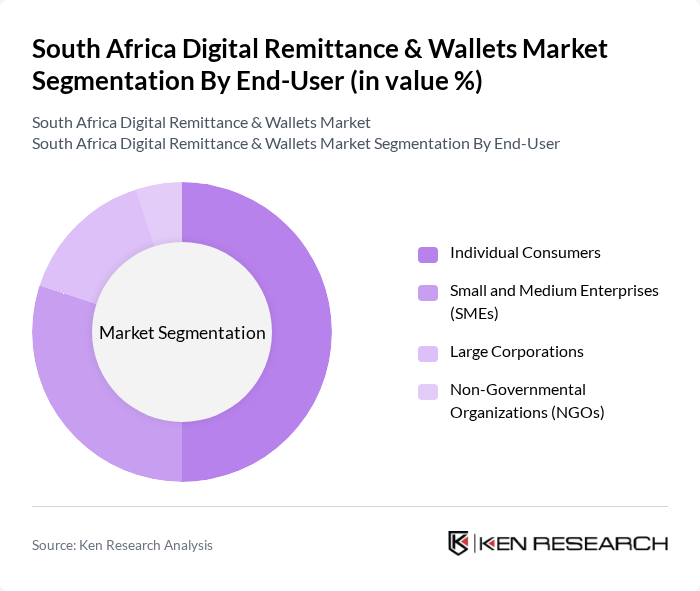

By End-User:The segmentation by end-user includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Each user category has distinct requirements influencing their adoption of digital remittance and wallet services. SMEs and NGOs increasingly leverage digital platforms for cost-effective, transparent, and rapid payments, while individual consumers drive overall transaction volume through personal remittances and daily digital wallet usage .

Individual Consumers comprise the largest segment, reflecting the growing need for personal remittances and the convenience of digital wallets. The surge in smartphone penetration and internet access has facilitated widespread adoption of digital transactions. Additionally, the expansion of e-commerce and digital bill payments has reinforced the dominance of this segment, with mobile wallets and fintech platforms increasingly preferred for their ease of use and security .

The South Africa Digital Remittance & Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as PayFast, Yoco, SnapScan, MoneyGram, Western Union, WorldRemit, Remitly, Mukuru, FNB (First National Bank), Standard Bank, Absa Bank, Capitec Bank, MTN Mobile Money, Vodacom M-Pesa, Zapper contribute to innovation, geographic expansion, and service delivery in this space.

The South African digital remittance and wallets market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The increasing adoption of mobile wallets and digital payment solutions is expected to reshape the financial landscape. Additionally, partnerships with local businesses will enhance service accessibility, while the integration of blockchain technology promises to streamline cross-border transactions. These trends indicate a robust growth trajectory, positioning South Africa as a leader in digital financial services within the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person Transfers Business-to-Business Payments Remittance Services Mobile Money Transfers Online Payment Platforms Cash Pickup Services Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets Cash Payments |

| By Transaction Size | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Geographic Reach | Domestic Transfers Regional Transfers International Transfers |

| By Customer Segment | Migrant Workers Students Abroad Expatriates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Remittance Users | 120 | Young Professionals, Migrant Workers |

| Rural Wallet Users | 90 | Small Business Owners, Farmers |

| Financial Service Providers | 80 | Product Managers, Marketing Directors |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

| Technology Innovators in Fintech | 70 | CTOs, Product Development Leads |

The South Africa Digital Remittance & Wallets Market is valued at approximately USD 330 million, reflecting significant growth driven by the adoption of digital payment solutions and mobile banking, alongside increasing demand for efficient cross-border remittance services.