Region:Asia

Author(s):Geetanshi

Product Code:KRAD7149

Pages:100

Published On:December 2025

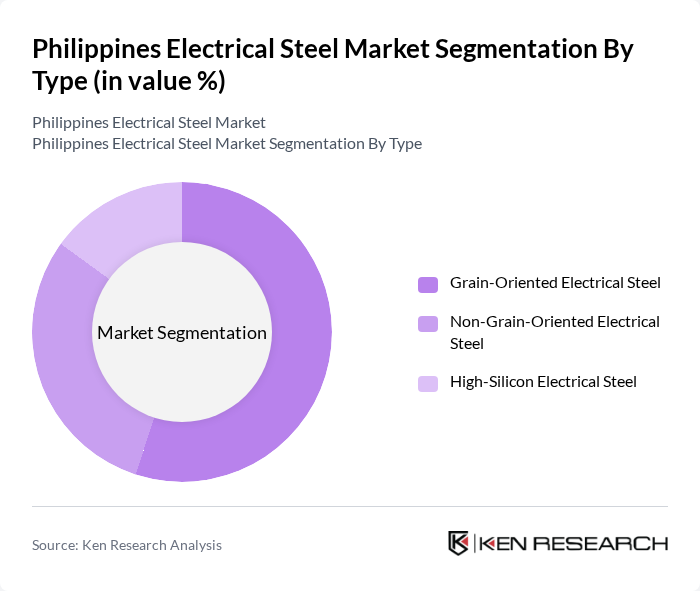

By Type:The electrical steel market can be segmented into three main types: Grain-Oriented Electrical Steel, Non-Grain-Oriented Electrical Steel, and High-Silicon Electrical Steel. Grain-Oriented Electrical Steel is primarily used in power and distribution transformers due to its superior magnetic flux density and low core loss characteristics. Non-Grain-Oriented Electrical Steel is utilized in various rotating machines, including motors, generators, compressors, pumps, and industrial drives, where isotropic magnetic properties are required. High-Silicon Electrical Steel is gaining traction in high-frequency and high-temperature applications, particularly in electric vehicle traction motors, high?efficiency industrial motors, and specialized power electronics-related components. In the Philippines, Non?Grain?Oriented grades account for a significant share of demand due to the large base of motors and industrial equipment, while Grain?Oriented grades remain critical for the growing installed base of power and distribution transformers.

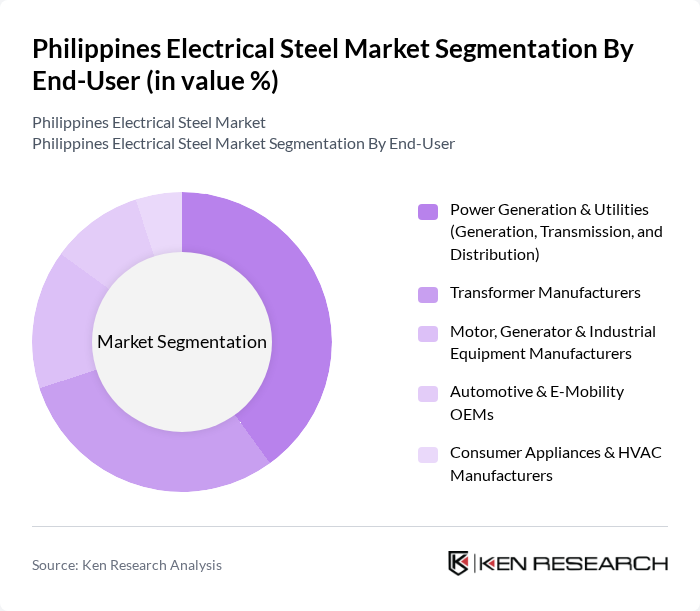

By End-User:The end-user segmentation of the electrical steel market includes Power Generation & Utilities, Transformer Manufacturers, Motor, Generator & Industrial Equipment Manufacturers, Automotive & E-Mobility OEMs, Consumer Appliances & HVAC Manufacturers, and Others. The Power Generation & Utilities segment is the largest consumer of electrical steel, driven by the increasing demand for energy-efficient power and distribution transformers, upgrades in transmission and distribution networks, and the integration of utility?scale solar, wind, and other renewable projects into the grid. Transformer Manufacturers follow closely, as they require high-quality Grain-Oriented and advanced high?permeability grades of electrical steel for low?loss transformer cores to meet energy-efficiency and reliability requirements of utilities and large industrial users. Motor, Generator & Industrial Equipment Manufacturers represent another important segment, supported by investments in industrial automation, pumps, compressors, and factory equipment, while Automotive & E?Mobility OEMs and Consumer Appliances & HVAC Manufacturers are emerging contributors as adoption of high?efficiency motors, air conditioners, and electric vehicle components gradually increases.

The Philippines Electrical Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Steel Corporation, JFE Steel Corporation, POSCO International Corporation, thyssenkrupp Electrical Steel GmbH, ArcelorMittal, Voestalpine AG, Baosteel Group Corporation, Shougang Group Co., Ltd., China Baowu Steel Group Corporation Limited, Tata Steel Limited, JSW Steel Limited, NatSteel Holdings Pte. Ltd., Kewei Steel Group Co., Ltd., SteelAsia Manufacturing Corporation, and local transformer and motor OEMs (e.g., First Philec, ELMACO) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines electrical steel market is poised for significant growth, driven by increasing investments in renewable energy and the expansion of manufacturing sectors. As the demand for energy-efficient solutions rises, manufacturers are likely to innovate and adopt advanced technologies in production. Additionally, the government's supportive policies will further enhance market dynamics, creating a favorable environment for local producers. The integration of smart technologies and sustainable practices will also play a crucial role in shaping the future landscape of the electrical steel market.

| Segment | Sub-Segments |

|---|---|

| By Type | Grain-Oriented Electrical Steel Non-Grain-Oriented Electrical Steel High-Silicon Electrical Steel |

| By End-User | Power Generation & Utilities (Generation, Transmission, and Distribution) Transformer Manufacturers Motor, Generator & Industrial Equipment Manufacturers Automotive & E-Mobility OEMs Consumer Appliances & HVAC Manufacturers Others |

| By Application | Power & Distribution Transformers Motors & Generators Inductors, Reactors & Static Equipment EV Traction Motors & On?board Chargers Others |

| By Source of Supply | Direct Imports from Mills (Asian & Global Producers) Purchases via Local Steel Service Centers / Traders Regional Re-exports (ASEAN Hubs such as Singapore & Vietnam) Others |

| By Distribution Channel | Direct Mill-to-OEM Contracts Local Distributors & Stockists EPC / Turnkey Project Procurement Online & E?procurement Platforms Others |

| By Product Grade | Conventional Grain-Oriented (CGO) High-Permeability Grain-Oriented (HGO) Non-Grain-Oriented – Semi-Processed Non-Grain-Oriented – Fully Processed Others |

| By Policy Support | Incentives for Power & Grid Modernization Projects Tax Incentives for Renewable & Energy-Efficient Equipment Import Duty & Trade Policy Support (e.g., ASEAN FTAs) R&D, Localization & Technology Upgradation Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electrical Steel Manufacturers | 70 | Production Managers, Quality Control Engineers |

| End-Users in Power Generation | 80 | Plant Managers, Electrical Engineers |

| Distributors and Wholesalers | 60 | Supply Chain Managers, Sales Directors |

| Research and Development Departments | 50 | R&D Managers, Product Development Engineers |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

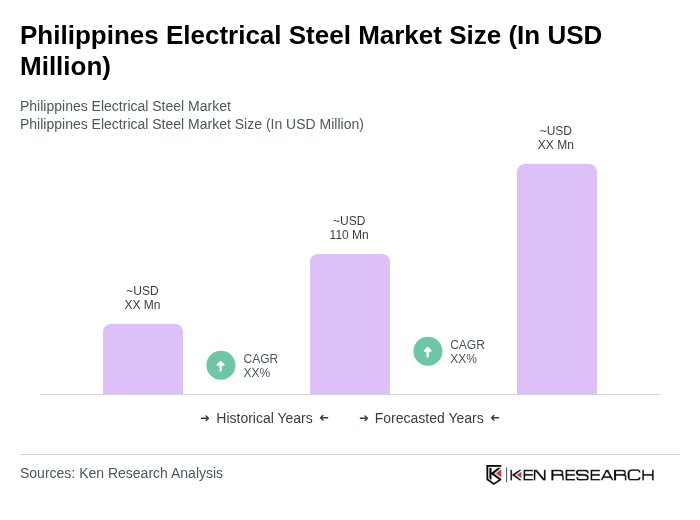

The Philippines Electrical Steel Market is valued at approximately USD 110 million, reflecting a five-year historical analysis. This growth is driven by increasing demand in power generation, automotive, and industrial applications, alongside government infrastructure initiatives.