Region:Asia

Author(s):Geetanshi

Product Code:KRAE9775

Pages:93

Published On:December 2025

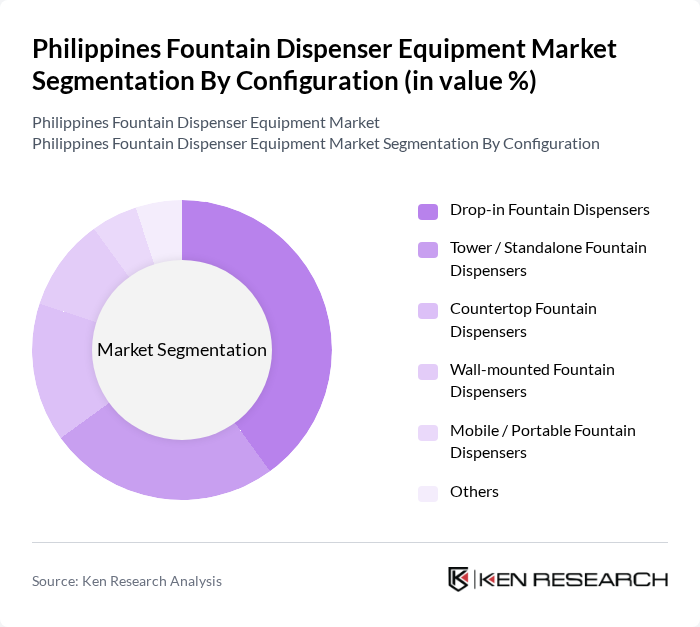

By Configuration:The market is segmented into various configurations of fountain dispensers, each catering to different consumer needs and preferences. The dominant configuration is the Drop-in Fountain Dispensers, which are favored for their ease of installation and versatility in various settings. Other configurations include Tower/Standalone, Countertop, Wall-mounted, Mobile/Portable, and Others, each serving specific market niches.

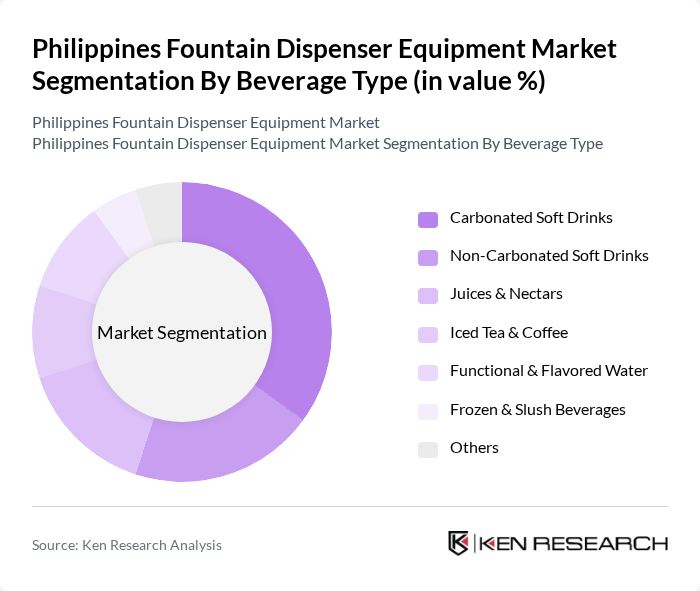

By Beverage Type:The fountain dispenser market is also segmented by beverage type, which includes a variety of options such as carbonated soft drinks, non-carbonated soft drinks, juices & nectars, iced tea & coffee, functional & flavored water, frozen & slush beverages, and others. Carbonated soft drinks dominate the market due to their popularity in foodservice establishments, while functional beverages are gaining traction among health-conscious consumers.

The Philippines Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as The Coca-Cola Company (Coca-Cola Beverages Philippines, Inc.), PepsiCo, Inc. (Pepsi-Cola Products Philippines, Inc.), Nestlé S.A. (Nestlé Philippines, Inc.), Universal Robina Corporation, San Miguel Corporation, Del Monte Pacific Limited (Del Monte Philippines, Inc.), Jollibee Foods Corporation, Max's Group, Inc., Starbucks Corporation (Starbucks Coffee Philippines), Dunkin’ Brands (Dunkin’ Donuts Philippines), Figaro Coffee Group, Inc., The Coffee Bean & Tea Leaf Philippines, Shakey’s Pizza Asia Ventures, Inc., Mang Inasal Philippines, Inc., and other local fountain dispenser OEMs and distributors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Philippines fountain dispenser equipment market appears promising, driven by technological innovations and evolving consumer preferences. As the hospitality sector continues to expand, the integration of smart technology and automated systems will likely enhance operational efficiency. Additionally, sustainability trends will push manufacturers to develop eco-friendly solutions, aligning with the increasing health consciousness among consumers. These factors will create a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Configuration | Drop-in Fountain Dispensers Tower / Standalone Fountain Dispensers Countertop Fountain Dispensers Wall-mounted Fountain Dispensers Mobile / Portable Fountain Dispensers Others |

| By Beverage Type | Carbonated Soft Drinks Non-Carbonated Soft Drinks Juices & Nectars Iced Tea & Coffee Functional & Flavored Water Frozen & Slush Beverages Others |

| By End-User Sector | Quick Service Restaurants (QSRs) Full-Service Restaurants Cafés & Coffee Chains Hotels & Resorts Cinemas & Entertainment Venues Convenience Stores & Petrol Stations Institutional (Schools, Offices, Hospitals) Others |

| By Technology | Mechanical / Manual Dispensers Semi-Automatic Dispensers Fully Automatic Dispensers Smart / IoT-Enabled Dispensers Energy-Efficient & Eco-Design Dispensers Others |

| By Distribution Channel | Direct Sales (OEMs) Distributors & Dealers Foodservice Equipment Integrators Online B2B Platforms Others |

| By Region | National Capital Region (NCR) Luzon (excluding NCR) Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Restaurant Sector Fountain Dispenser Usage | 100 | Restaurant Owners, Operations Managers |

| Café and Coffee Shop Equipment Preferences | 80 | Café Managers, Beverage Supervisors |

| Convenience Store Equipment Insights | 70 | Store Managers, Procurement Officers |

| Fast Food Chain Equipment Standards | 90 | Franchise Owners, Equipment Managers |

| Market Trends in Beverage Dispensing | 60 | Industry Analysts, Product Development Managers |

The Philippines Fountain Dispenser Equipment Market is valued at approximately USD 145 million, reflecting a significant growth trend driven by the increasing demand for convenient beverage dispensing solutions across various sectors, particularly in foodservice and retail.