Thailand Fountain Dispenser Equipment Market Overview

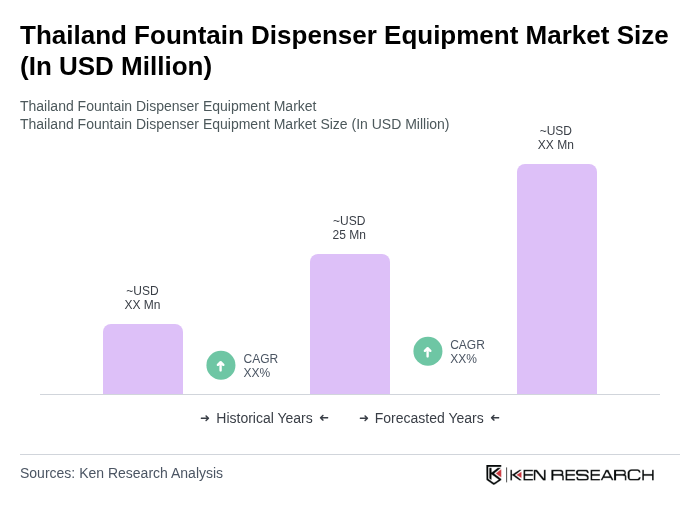

- The Thailand Fountain Dispenser Equipment Market is valued at USD 25 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for convenient beverage dispensing solutions in the food service industry, coupled with a rise in consumer preferences for self-service options in restaurants and fast food outlets.

- Key cities such as Bangkok, Chiang Mai, and Pattaya dominate the market due to their high population density and vibrant tourism sectors. The concentration of restaurants, cafes, and entertainment venues in these urban areas significantly boosts the demand for fountain dispenser equipment, making them critical hubs for market growth.

- The Food Act B.E. 2522 (1979) issued by the Ministry of Public Health governs food safety standards in the food service industry. This requires beverage dispensing equipment to comply with hygiene standards through sanitary material certification and regular inspections by local health authorities, ensuring safe operation and maintenance.

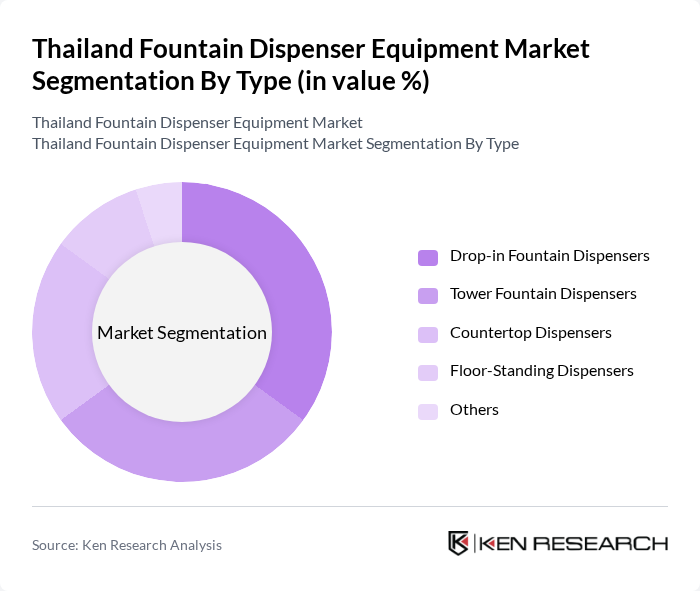

Thailand Fountain Dispenser Equipment Market Segmentation

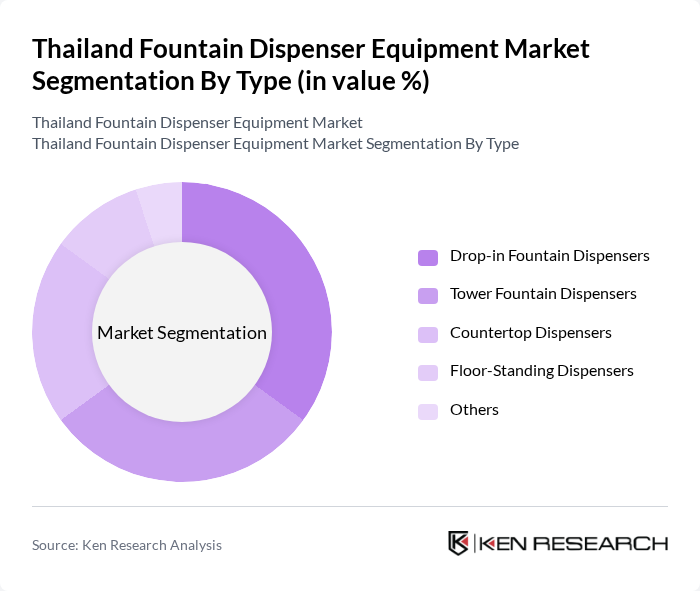

By Type:The market is segmented into various types of fountain dispensers, including Drop-in Fountain Dispensers, Tower Fountain Dispensers, Countertop Dispensers, Floor-Standing Dispensers, and Others. Among these, Drop-in Fountain Dispensers are particularly popular due to their space-saving design and ease of installation, making them a preferred choice for many establishments. Tower Fountain Dispensers also see significant usage in high-traffic areas, while Countertop and Floor-Standing options cater to different consumer needs.

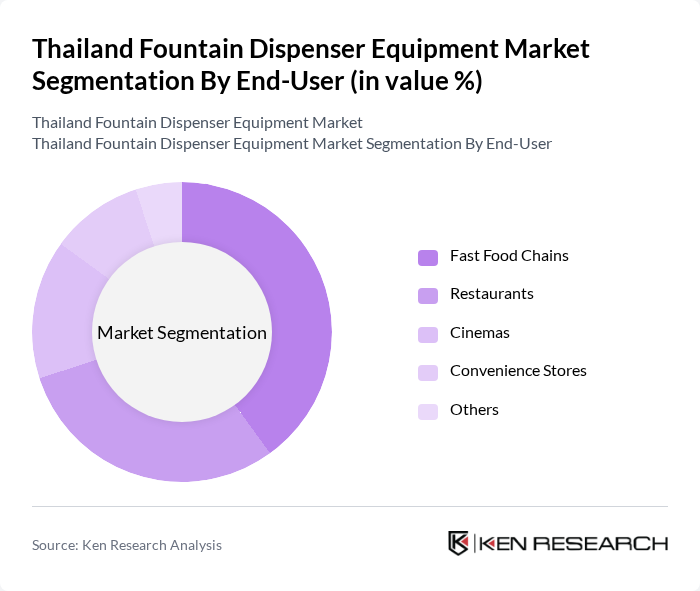

By End-User:The end-user segmentation includes Fast Food Chains, Restaurants, Cinemas, Convenience Stores, and Others. Fast Food Chains are the leading segment, driven by their need for efficient beverage service solutions that cater to high customer volumes. Restaurants also contribute significantly, as they increasingly adopt fountain dispensers to enhance customer experience. Cinemas and Convenience Stores are emerging segments, capitalizing on the trend of self-service beverage options.

Thailand Fountain Dispenser Equipment Market Competitive Landscape

The Thailand Fountain Dispenser Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Coca-Cola (Thailand) Ltd., Pepsi-Cola (Thai) Trading Co., Ltd., Fanta (Thailand) Co., Ltd., Thai Beverage Public Company Limited, Nestlé (Thai) Ltd., Red Bull (Thailand) Co., Ltd., Oishi Group Public Company Limited, Minor Food Group, Unilever Thai Trading Ltd., Thai Union Group Public Company Limited, S&P Syndicate Public Company Limited, CP Group, Berli Jucker Public Company Limited, TCC Group, Thai Beverage Can Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Fountain Dispenser Equipment Market Industry Analysis

Growth Drivers

- Increasing Demand for Beverage Dispensing Solutions:The Thai beverage market is projected to reach THB 1.5 trillion by future, driven by a growing consumer preference for convenience and variety. This surge in demand for beverage dispensing solutions is evident as establishments like restaurants and cafes increasingly adopt fountain dispensers to enhance customer experience. The rise in disposable income, which is expected to reach THB 35,000 per capita, further supports this trend, making beverage dispensing solutions more accessible to a broader audience.

- Rising Popularity of Self-Service Kiosks:The self-service kiosk segment in Thailand is anticipated to grow significantly, with an estimated increase of 20% annually through future. This trend is fueled by consumer preferences for quick service and customization options. As more businesses, particularly in the food and beverage sector, adopt self-service kiosks, the demand for fountain dispensers integrated with these systems is expected to rise. This shift not only enhances operational efficiency but also caters to the evolving consumer expectations for personalized beverage choices.

- Technological Advancements in Dispensing Equipment:The fountain dispenser equipment market is witnessing rapid technological advancements, with innovations such as touchless dispensing and smart technology integration. In future, it is projected that 50% of new installations will feature advanced technology, enhancing user experience and operational efficiency. These advancements not only improve hygiene standards but also allow for real-time inventory management, which is crucial for businesses aiming to optimize their operations and reduce waste in a competitive market.

Market Challenges

- High Initial Investment Costs:The initial investment for fountain dispenser equipment can be substantial, often exceeding THB 250,000 for high-quality systems. This financial barrier can deter small and medium-sized enterprises from adopting these solutions, limiting market growth. Additionally, the need for ongoing maintenance and potential upgrades adds to the overall cost, making it challenging for businesses to justify the expenditure, especially in a competitive landscape where profit margins are tight.

- Regulatory Compliance Issues:The fountain dispenser equipment market in Thailand faces stringent regulatory compliance requirements, particularly concerning health and safety standards. Businesses must adhere to regulations set by the Food and Drug Administration (FDA) of Thailand, which can be complex and time-consuming. Non-compliance can result in hefty fines, operational shutdowns, and damage to brand reputation, creating a significant challenge for companies looking to enter or expand within the market.

Thailand Fountain Dispenser Equipment Market Future Outlook

The Thailand fountain dispenser equipment market is poised for significant growth, driven by evolving consumer preferences and technological advancements. As the hospitality sector continues to expand, the integration of automated and smart dispensing solutions will likely become standard practice. Additionally, the increasing focus on sustainability will push manufacturers to innovate eco-friendly dispensing options. These trends indicate a dynamic market landscape where adaptability and innovation will be key to capturing emerging opportunities and addressing consumer demands effectively.

Market Opportunities

- Growth in the Hospitality Sector:The hospitality sector in Thailand is expected to grow by 15% annually, creating a substantial demand for fountain dispensers. This growth presents an opportunity for manufacturers to develop tailored solutions that cater to the unique needs of hotels and restaurants, enhancing customer satisfaction and operational efficiency.

- Innovations in Eco-Friendly Dispensing Solutions:With increasing consumer awareness regarding environmental issues, there is a growing demand for eco-friendly dispensing solutions. Companies that invest in sustainable materials and energy-efficient technologies can tap into this market segment, appealing to environmentally conscious consumers and gaining a competitive edge in the industry.