Philippines Furniture and Modular Interiors Market Overview

- The Philippines Furniture and Modular Interiors Market is valued at approximately USD 4 billion, based on a five-year historical analysis. This growth is primarily driven by increasing urbanization, rising disposable incomes, and a growing demand for both residential and commercial spaces. The market has seen a surge in consumer preferences for modular and customizable furniture solutions, reflecting a shift towards modern living and working environments. Additional growth drivers include the rapid expansion of e-commerce, rising internet penetration, and the popularity of tech-integrated and sustainable furniture designs .

- Key cities such as Metro Manila, Cebu, and Davao dominate the market due to their high population density, economic activity, and urban development projects. Metro Manila, being the capital, serves as a hub for furniture retailers and manufacturers, while Cebu and Davao are emerging as significant markets due to their growing middle class and increasing construction activities .

- The Furniture Industry Development Act, 2023, issued by the Department of Trade and Industry, mandates operational standards for local manufacturers, including the use of sustainable materials and eco-friendly production methods. The Act provides fiscal incentives for companies adopting green practices, requires compliance with minimum sustainability thresholds, and covers licensing for export-oriented manufacturers. This regulation aims to promote local furniture manufacturing and enhance sector competitiveness .

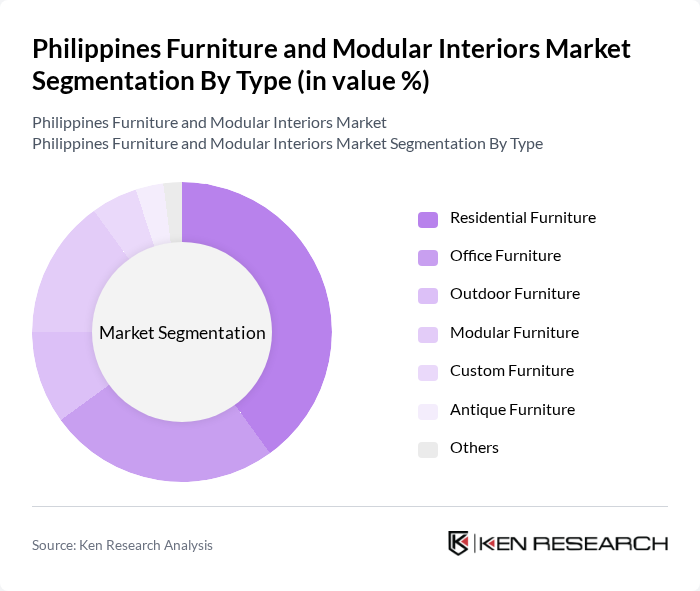

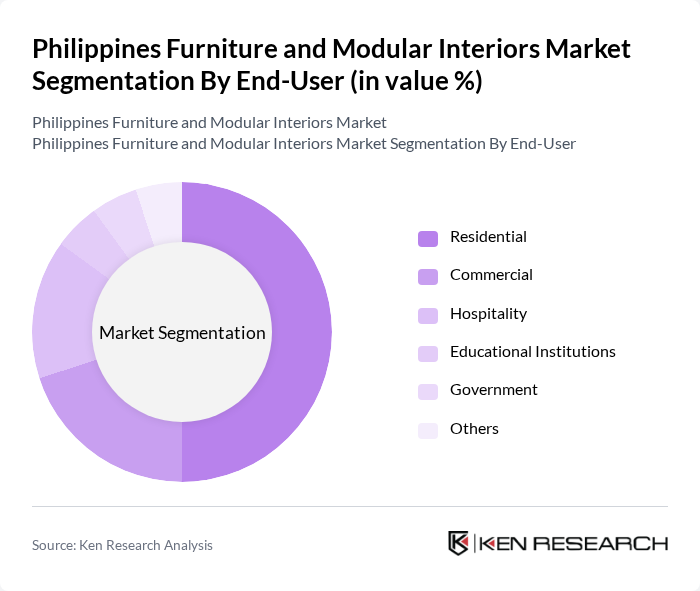

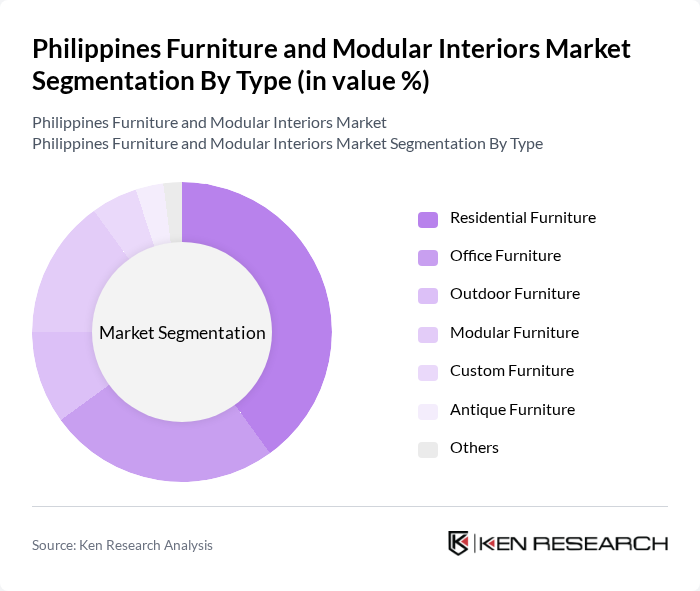

Philippines Furniture and Modular Interiors Market Segmentation

By Type:The market is segmented into residential, office, outdoor, modular, custom, antique, and others. Residential furniture remains the most dominant segment, driven by the increasing demand for home furnishings as more people invest in their living spaces. Modular and customizable furniture is gaining traction, reflecting consumer preferences for flexibility, personalization, and space optimization in both home and office environments. The rise of minimalist and multifunctional designs is notable among urban consumers .

By End-User:The end-user segmentation includes residential, commercial, hospitality, educational institutions, government, and others. The residential segment leads the market, driven by the growing trend of home improvement and interior design. The commercial sector is also significant, as businesses increasingly invest in ergonomic and aesthetically pleasing office furniture to enhance employee productivity and comfort. Hospitality and institutional buyers are also contributing to demand, especially for durable and design-forward products .

Philippines Furniture and Modular Interiors Market Competitive Landscape

The Philippines Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Philippines, Mandaue Foam Industries, Inc., Blims Fine Furniture, Our Home, Furniture Republic, Homeworks The Home Center, CITI Hardware, Philux, Inc., Muebles Italiano, Muebles de Bambú, Muebles Concordia, Pampanga Furniture Industries Foundation (PFIF), Mandaue City Woodworks, Designs Ligna, Mejore Furniture contribute to innovation, geographic expansion, and service delivery in this space.

Philippines Furniture and Modular Interiors Market Industry Analysis

Growth Drivers

- Rising Urbanization:The Philippines is experiencing rapid urbanization, with urban areas projected to house approximately 48% of the population in future, according to the World Bank. This shift is driving demand for furniture and modular interiors as urban dwellers seek efficient space solutions. The urban population is estimated at around 56 million in future, creating a significant market for furniture that caters to smaller living spaces and modern aesthetics, thus boosting sales in the sector.

- Increasing Disposable Income:The average disposable income in the Philippines is estimated at approximately PHP 150,000 per capita in future, based on available national statistics. This increase allows consumers to invest more in home furnishings and modular interiors. As more households enter the middle class, the demand for quality and stylish furniture is expected to grow, leading to a more competitive market landscape that encourages innovation and variety in product offerings.

- Expansion of E-commerce Platforms:E-commerce sales in the Philippines are estimated at PHP 270 billion in future, according to the Department of Trade and Industry. This growth is facilitating easier access to furniture and modular interiors for consumers, particularly in remote areas. The rise of online shopping is prompting traditional retailers to enhance their digital presence, thus broadening their customer base and increasing overall market penetration in the furniture sector.

Market Challenges

- High Import Tariffs:The Philippines imposes import tariffs on furniture that generally range from 3% to 15%, according to the Philippine Tariff Commission. Rates up to 30% are not typical for most furniture categories. This tariff rate impacts the cost structure for foreign manufacturers. Local manufacturers may benefit in the short term, but the lack of competition can stifle innovation and quality improvements in the long run.

- Supply Chain Disruptions:The ongoing global supply chain disruptions have led to delays and increased costs for raw materials. The average lead time for furniture production is estimated at 10 to 12 weeks in future, up from 8 weeks pre-pandemic, according to industry reports. These disruptions hinder manufacturers' ability to meet consumer demand promptly, resulting in lost sales opportunities and potential damage to brand reputation in a competitive market.

Philippines Furniture and Modular Interiors Market Future Outlook

The Philippines furniture and modular interiors market is poised for significant transformation as urbanization and disposable income continue to rise. In future, the focus on sustainability and ergonomic designs will likely shape consumer preferences, driving innovation in product offerings. Additionally, the integration of smart technology into furniture will cater to tech-savvy consumers, enhancing functionality and appeal. As e-commerce platforms expand, they will further facilitate market access, creating a dynamic environment for both established and emerging players in the industry.

Market Opportunities

- Growth in Modular Furniture Demand:The demand for modular furniture is expected to surge, with sales estimated at PHP 50 billion in future. This growth is driven by urban consumers seeking versatile and space-saving solutions. Manufacturers can capitalize on this trend by offering customizable options that cater to diverse consumer needs, enhancing market competitiveness and profitability.

- Expansion of Home Improvement Projects:With an estimated PHP 100 billion allocated for home improvement projects in future, there is a significant opportunity for furniture manufacturers. As homeowners invest in renovations and upgrades, the demand for stylish and functional furniture will increase. This trend presents a lucrative avenue for businesses to expand their product lines and target consumers looking to enhance their living spaces.