Region:Asia

Author(s):Shubham

Product Code:KRAB1115

Pages:82

Published On:October 2025

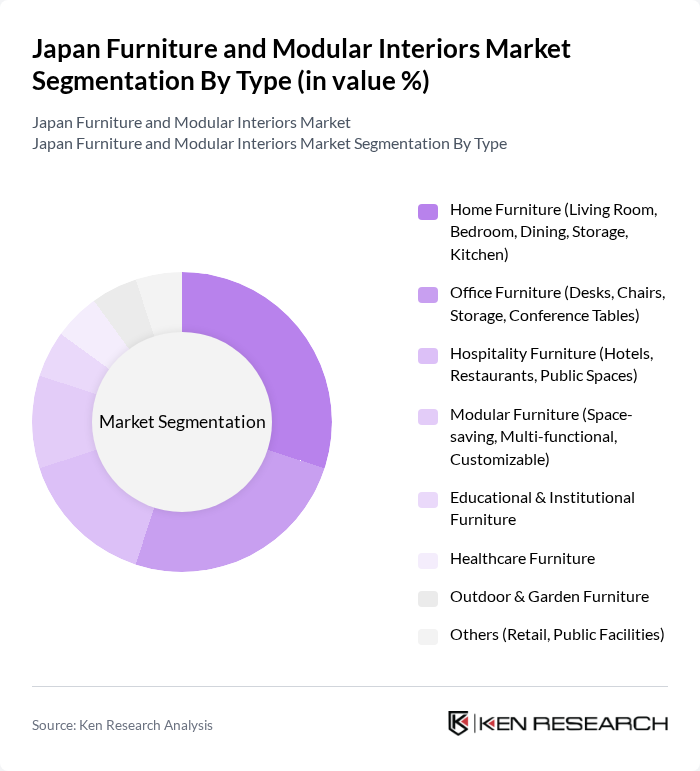

By Type:The market is segmented into various types of furniture, including home furniture, office furniture, hospitality furniture, modular furniture, educational and institutional furniture, healthcare furniture, outdoor and garden furniture, and others. Each sub-segment caters to specific consumer needs and preferences, reflecting the diverse applications of furniture in different environments. Home furniture remains the largest segment, driven by urban living, apartment lifestyles, and a focus on quality and design that reflects individuality and comfort. Office and educational furniture are gaining traction due to the adoption of hybrid work and learning models, while healthcare furniture is seeing increased demand from an aging population seeking ergonomic and supportive products. Modular and space-saving furniture is particularly popular in urban areas with limited living space.

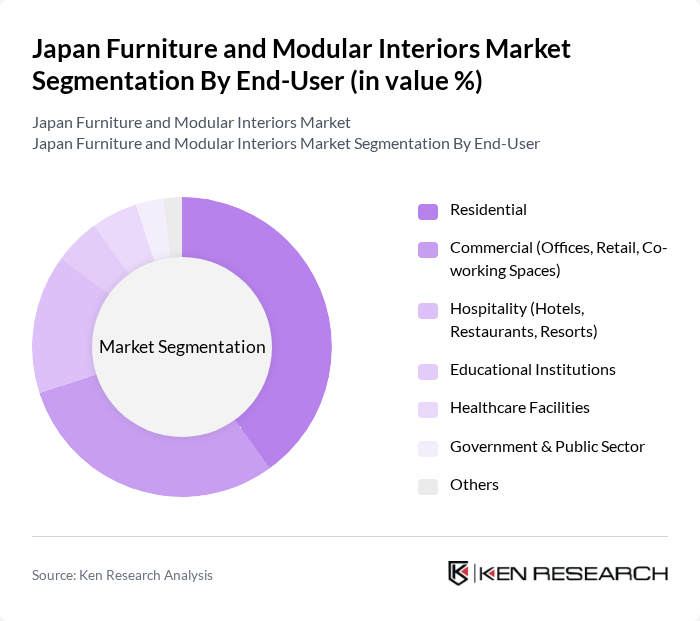

By End-User:The market is segmented by end-user into residential, commercial, hospitality, educational institutions, healthcare facilities, government and public sector, and others. This segmentation highlights the various applications of furniture across different sectors, catering to the specific needs of each user group. The residential segment is the largest, driven by urban growth and remodeling activity, while commercial and hospitality segments benefit from economic activity and tourism. Educational and healthcare segments are supported by demographic trends and institutional investments.

The Japan Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nitori Holdings Co., Ltd., Ryohin Keikaku Co., Ltd. (MUJI), IKEA Japan K.K., Takashimaya Co., Ltd., Francfranc Corporation, IDC Otsuka Furniture Co., Ltd., Yamazaki Co., Ltd. (Yamazaki Home), Karimoku Furniture Inc., Maruni Wood Industry Inc., Actus Co., Ltd., Seki Furniture Co., Ltd., Kaguya Co., Ltd., Okamura Corporation, Kokuyo Co., Ltd., Itoki Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan furniture and modular interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-saving and multifunctional furniture will likely increase. Additionally, the integration of smart technology into furniture design is expected to enhance user experience, making products more appealing. Companies that adapt to these trends and focus on sustainability will be well-positioned to capture market share and drive innovation in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Home Furniture (Living Room, Bedroom, Dining, Storage, Kitchen) Office Furniture (Desks, Chairs, Storage, Conference Tables) Hospitality Furniture (Hotels, Restaurants, Public Spaces) Modular Furniture (Space-saving, Multi-functional, Customizable) Educational & Institutional Furniture Healthcare Furniture Outdoor & Garden Furniture Others (Retail, Public Facilities) |

| By End-User | Residential Commercial (Offices, Retail, Co-working Spaces) Hospitality (Hotels, Restaurants, Resorts) Educational Institutions Healthcare Facilities Government & Public Sector Others |

| By Distribution Channel | Specialty Stores Mass Merchandisers & Department Stores Online Retail/E-commerce Direct Sales Wholesale/Distributors Others |

| By Material | Wood Metal Plastic & Polymers Fabric/Upholstery Glass Others (Bamboo, Composite, etc.) |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Design Style | Modern/Contemporary Traditional/Japanese Minimalism Scandinavian Rustic/Industrial Others |

| By Functionality | Multi-functional Space-saving/Folding Ergonomic Modular/Customizable Smart/Connected Furniture Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Modular Interiors | 80 | Office Managers, Facility Coordinators |

| Online Furniture Retail Trends | 60 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Modular Design | 90 | Architects, Product Designers |

| Sustainability in Furniture Manufacturing | 50 | Sustainability Managers, Product Development Managers |

The Japan Furniture and Modular Interiors Market is valued at approximately USD 22.6 billion, reflecting a robust growth driven by urbanization, residential developments, and a rising interest in home improvement and interior design.