Region:Africa

Author(s):Shubham

Product Code:KRAB1214

Pages:91

Published On:October 2025

By Type:The furniture market in Nigeria is diverse, encompassing various types of products tailored to meet consumer needs. The major subsegments include Living Room Furniture, Bedroom Furniture, Office Furniture, Modular Office Solutions, Kitchen and Dining Furniture, Outdoor Furniture, Custom Furniture, Eco-friendly Furniture, and Others. Among these, Living Room Furniture is particularly dominant due to the increasing focus on home aesthetics and comfort, driven by urbanization and changing lifestyles. Consumers are increasingly investing in stylish and functional living spaces, leading to a surge in demand for sofas, coffee tables, and entertainment units.

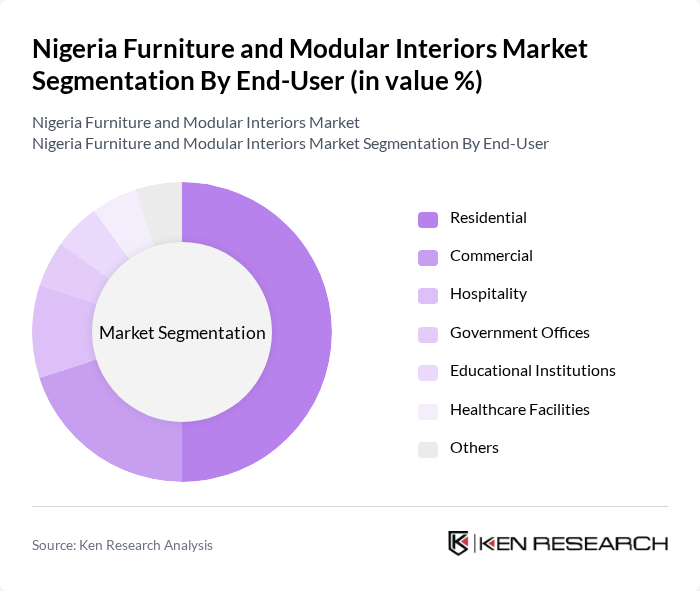

By End-User:The end-user segmentation of the furniture market in Nigeria includes Residential, Commercial, Hospitality, Government Offices, Educational Institutions, Healthcare Facilities, and Others. The Residential segment is the largest, driven by the growing middle class and increasing home ownership rates. Consumers are investing in quality furniture to enhance their living spaces, leading to a robust demand for various furniture types tailored for homes.

The Nigeria Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Nigeria, Mabeo Furniture, Tusk Furniture, Aso Rock Furniture, Office Furniture Nigeria, Tetra Furniture, Green Furniture, Konga Furniture, Jumia Furniture, A & A Furniture, Royal Furniture, Zenith Furniture, FURNITURE 360, Dura Furniture, Eko Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Nigeria furniture and modular interiors market is poised for significant transformation as urbanization continues to rise and disposable incomes increase. The shift towards online retailing will further enhance market accessibility, allowing consumers to explore diverse options. Additionally, the growing emphasis on sustainable materials and local manufacturing initiatives will likely reshape consumer preferences, driving demand for eco-friendly and locally produced furniture solutions. These trends indicate a dynamic market landscape that is adapting to the evolving needs of Nigerian consumers.

| Segment | Sub-Segments |

|---|---|

| By Type | Living Room Furniture Bedroom Furniture Office Furniture Modular Office Solutions Kitchen and Dining Furniture Outdoor Furniture Custom Furniture Eco-friendly Furniture Others |

| By End-User | Residential Commercial Hospitality Government Offices Educational Institutions Healthcare Facilities Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Showrooms Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material | Wood Metal Plastic Fabric Composite Materials Glass Others |

| By Design Style | Modern Contemporary Traditional Minimalist Industrial Others |

| By Application | Office Spaces Residential Spaces Public Spaces Retail Spaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 120 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 100 | Office Managers, Facility Coordinators |

| Modular Interiors Segment | 80 | Architects, Project Managers |

| Online Furniture Retail | 100 | E-commerce Managers, Digital Marketing Specialists |

| Furniture Export Market | 70 | Export Managers, Trade Analysts |

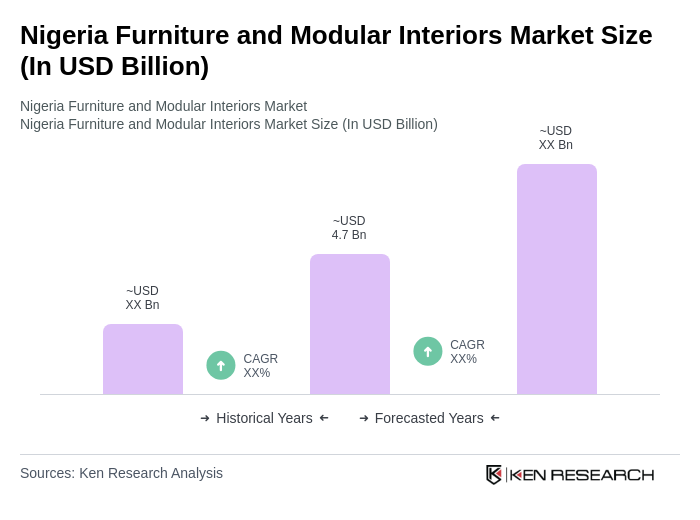

The Nigeria Furniture and Modular Interiors Market is valued at approximately USD 4.7 billion, reflecting significant growth driven by urbanization, rising disposable incomes, and a demand for modern and modular furniture solutions.