Region:Europe

Author(s):Geetanshi

Product Code:KRAB4017

Pages:95

Published On:October 2025

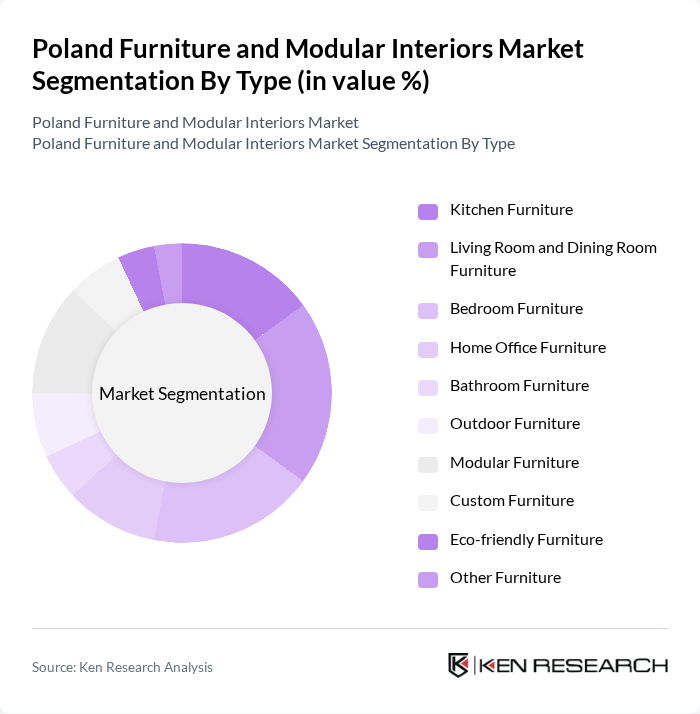

By Type:The furniture market is segmented into kitchen furniture, living room and dining room furniture, bedroom furniture, home office furniture, bathroom furniture, outdoor furniture, modular furniture, custom furniture, eco-friendly furniture, and other furniture. These segments reflect evolving consumer preferences for multi-functional, space-saving, and sustainable designs, with modular and eco-friendly furniture gaining traction due to environmental awareness and urban living trends .

By End-User:The market is segmented by end-users: residential (households), commercial (corporates, offices), hospitality (hotels, restaurants), government & public institutions, and educational institutions. Residential demand is driven by new housing developments and renovation activities, while commercial and hospitality segments focus on ergonomic, design-forward, and durable furniture solutions. Government and educational institutions prioritize standardized, functional, and cost-effective products .

The Poland Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA, Black Red White S.A., Forte S.A., Meble Wójcik, Kler S.A., Szynaka Meble, VOX, BODZIO, Paged Meble, Meble Bia?ystok, Meble Klose, Swarz?dz Home, Primavera Furniture, Meble Sadowski, Krysiak Furniture contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Poland furniture and modular interiors market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues, the demand for space-efficient and multifunctional furniture will rise. Additionally, the integration of smart technology into furniture design is expected to enhance user experience. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in the market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Kitchen Furniture Living Room and Dining Room Furniture Bedroom Furniture Home Office Furniture Bathroom Furniture Outdoor Furniture Modular Furniture Custom Furniture Eco-friendly Furniture Other Furniture |

| By End-User | Residential (Households) Commercial (Corporates, Offices) Hospitality (Hotels, Restaurants) Government & Public Institutions Educational Institutions |

| By Distribution Channel | Home Centers (e.g., IKEA, Black Red White, Agata) Specialty Furniture Stores Online Retail Supermarkets and Hypermarkets Direct Sales Wholesale |

| By Material | Wood Metal Plastic & Polymer Fabric Other Materials |

| By Price Range | Economy Mid-range Premium |

| By Design Style | Modern Traditional Contemporary Rustic |

| By Application | Home Decor Office Setup Outdoor Spaces Event Furnishing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 100 | Homeowners, Interior Designers |

| Commercial Modular Interiors | 60 | Office Managers, Facility Managers |

| Online Furniture Retail Trends | 50 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Preferences in Modular Design | 70 | Architects, Product Designers |

| Sustainability in Furniture Manufacturing | 40 | Environmental Managers, Production Managers |

The Poland Furniture and Modular Interiors Market is valued at approximately USD 11.6 billion, reflecting significant growth driven by consumer demand for home improvement, urbanization, and rising disposable incomes.