Region:Africa

Author(s):Rebecca

Product Code:KRAB1838

Pages:91

Published On:October 2025

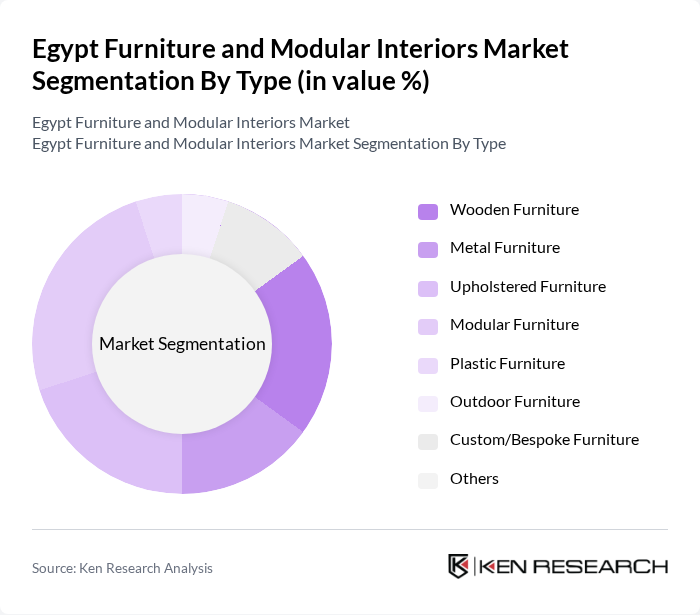

By Type:The market is segmented into wooden, metal, upholstered, modular, plastic, outdoor, custom/bespoke, and others. Wooden furniture remains the most dominant segment, valued for its traditional appeal and durability. Modular furniture is rapidly gaining traction due to its versatility, space-saving features, and adaptability to modern urban living. Consumer preferences are increasingly shifting towards multifunctional, aesthetically pleasing, and sustainable furniture, with a notable rise in demand for eco-friendly materials and customizable solutions .

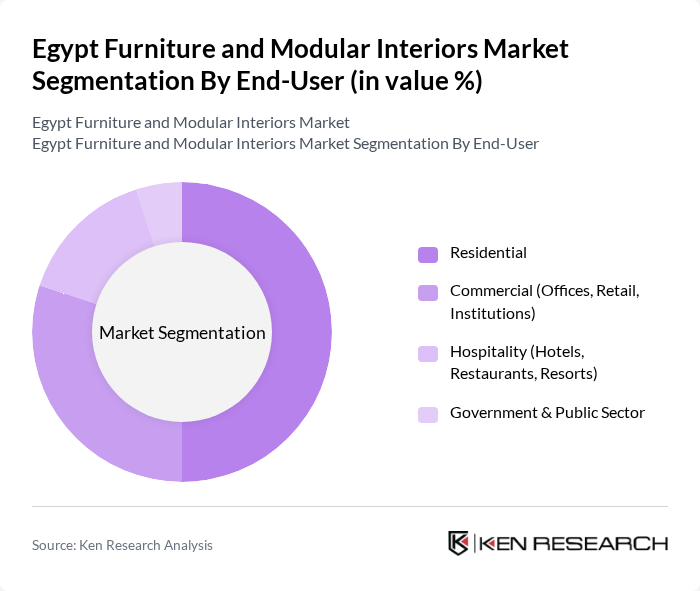

By End-User:The end-user segmentation includes residential, commercial, hospitality, and government/public sector. The residential segment dominates, driven by increasing home ownership, urban housing developments, and renovation activities. The commercial segment is significant, supported by the expansion of office spaces, retail outlets, and institutional projects. Trends indicate rising demand for stylish, functional, and ergonomic furniture in both residential and commercial applications, with a growing emphasis on sustainability and space optimization .

The Egypt Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Egypt, Mobica, Elhelow Group, Damietta Furniture City (DFC), El-Masria Furniture, El Dawlia Furniture, El Shamsi Furniture, El Araby Furniture, Habitat Egypt, In&Out Furniture, American Furniture, La Roche Egypt, El Maleka Furniture, El Fath Furniture, Al-Masriah Modular Interiors contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Egypt furniture and modular interiors market appears promising, driven by urbanization and rising incomes. As consumers increasingly seek innovative and customizable solutions, manufacturers are likely to invest in technology and design. Additionally, the integration of smart furniture features is expected to gain traction, aligning with global trends. The government's support for local manufacturing will further enhance competitiveness, positioning the market for sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Wooden Furniture Metal Furniture Upholstered Furniture Modular Furniture Plastic Furniture Outdoor Furniture Custom/Bespoke Furniture Others |

| By End-User | Residential Commercial (Offices, Retail, Institutions) Hospitality (Hotels, Restaurants, Resorts) Government & Public Sector |

| By Distribution Channel | Online Retail/E-commerce Offline Retail (Furniture Stores, Hypermarkets) Direct Sales (B2B, Project Sales) Showrooms & Experience Centers |

| By Price Range | Budget Mid-Range Premium/Luxury |

| By Material | Wood Metal Plastic Fabric/Upholstery Glass & Others |

| By Design Style | Contemporary/Modern Traditional/Classic Industrial Minimalist Other Styles |

| By Application | Living Room Bedroom Kitchen & Dining Office Setup Outdoor Spaces Event Furnishing Home Decor & Accessories |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Purchases | 120 | Homeowners, Interior Designers |

| Commercial Modular Interiors | 60 | Office Managers, Facility Coordinators |

| Consumer Preferences in Furniture Design | 90 | General Consumers, Trend Analysts |

| Retail Furniture Sales Insights | 50 | Retail Managers, Sales Executives |

| Market Trends in Modular Furniture | 40 | Product Designers, Market Researchers |

The Egypt Furniture and Modular Interiors Market is valued at approximately USD 2.7 billion, reflecting a robust growth trajectory driven by urbanization, rising disposable incomes, and increasing demand for modern and modular furniture solutions.