Region:Asia

Author(s):Rebecca

Product Code:KRAB4061

Pages:86

Published On:October 2025

By Application:The market is segmented into various applications, including home furniture, office furniture, hospitality, and others. Among these, home furniture is the leading segment, driven by the increasing trend of home decoration, renovation, and the adoption of multifunctional furniture suited for urban living. Consumers are increasingly investing in stylish, customizable, and functional furniture to enhance their living spaces. Office furniture follows closely, as businesses continue to invest in ergonomic and modern office setups to improve employee productivity and comfort, reflecting the ongoing shift toward flexible and hybrid work environments .

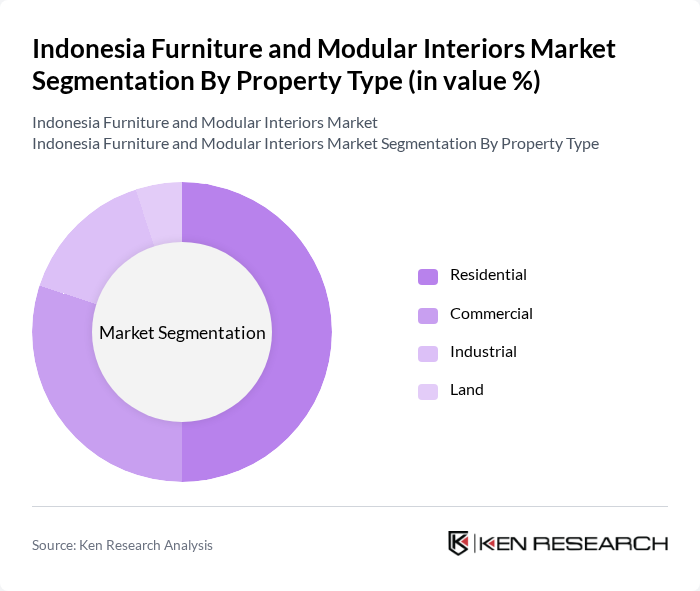

By Property Type:This segmentation includes residential, commercial, industrial, and land properties. The residential segment is the most significant, driven by the growing population, urbanization trends, and increased investment in housing development. As more people move to urban areas, the demand for residential furniture continues to rise. The commercial segment is also expanding, as businesses invest in modern office spaces, retail environments, and hospitality projects to attract customers and enhance employee satisfaction .

The Indonesia Furniture and Modular Interiors Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Indonesia, Fabelio, Informa, Ace Hardware Indonesia, Kawan Lama Group, Dekoruma, Livien Furniture, Atria Furniture, Olympic Furniture, Teak & Mahogany, Jepara Furniture, Ruparupa, Courts Indonesia, Mitra10, Blibli Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Indonesian furniture and modular interiors market appears promising, driven by urbanization and rising disposable incomes. As consumers increasingly prioritize sustainable and innovative designs, manufacturers are likely to adapt by incorporating eco-friendly materials and smart technology into their products. Additionally, the growth of e-commerce will continue to reshape consumer purchasing behaviors, making furniture more accessible. Companies that embrace these trends will be well-positioned to capture market share and drive growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Application | Home Furniture Office Furniture Hospitality Others |

| By Property Type | Residential Commercial Industrial Land |

| By Distribution Channel | Supermarkets Specialty Stores Online Others |

| By Material | Wood Metal Plastic Others |

| By Business Type | Sales Rental |

| By Mode | Online Offline |

| By Region | Java Sumatra Kalimantan Sulawesi Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 120 | Homeowners, Interior Designers |

| Commercial Furniture Sector | 90 | Office Managers, Facility Managers |

| Modular Interiors for Hospitality | 60 | Hotel Managers, Interior Architects |

| Export Market for Indonesian Furniture | 50 | Export Managers, Trade Representatives |

| Eco-friendly Furniture Segment | 40 | Sustainability Officers, Product Designers |

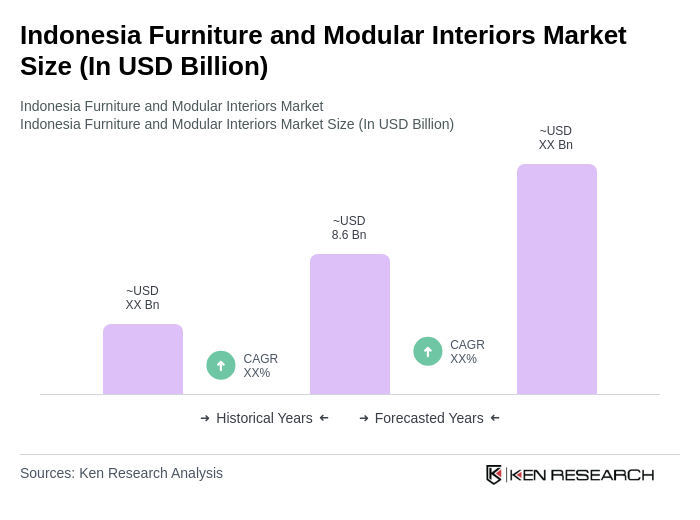

The Indonesia Furniture and Modular Interiors Market is valued at approximately USD 8.6 billion, driven by factors such as rising disposable incomes, urbanization, and government support for sustainable practices in the industry.