Region:Asia

Author(s):Geetanshi

Product Code:KRAD1287

Pages:86

Published On:November 2025

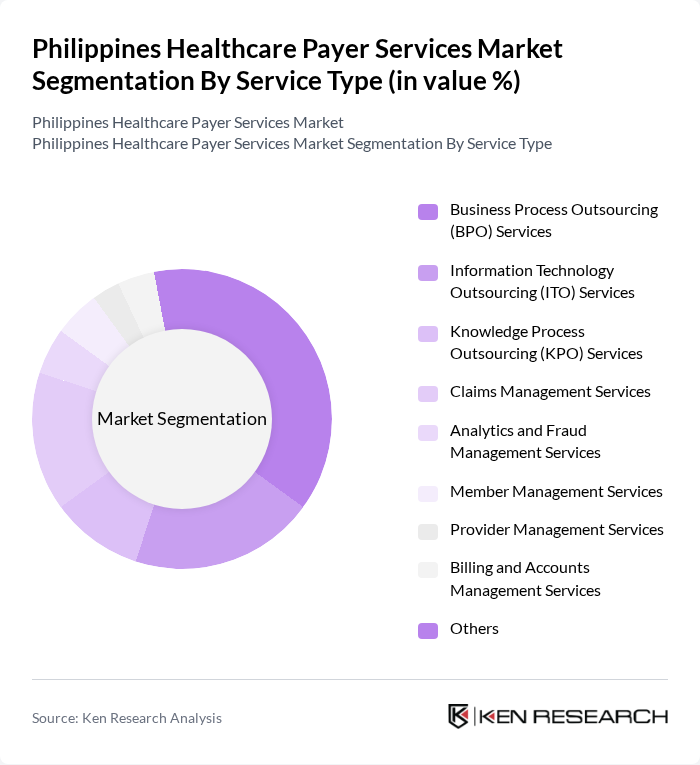

By Service Type:The service type segmentation includes various categories that cater to the diverse needs of healthcare payers. The subsegments are Business Process Outsourcing (BPO) Services, Information Technology Outsourcing (ITO) Services, Knowledge Process Outsourcing (KPO) Services, Claims Management Services, Analytics and Fraud Management Services, Member Management Services, Provider Management Services, Billing and Accounts Management Services, and Others. Among these,BPO Servicesdominate the market due to their ability to streamline operations, reduce administrative costs, and enable scalability for healthcare payers. The increasing integration of digital solutions, AI, and automation in BPO services is a key trend enhancing operational efficiency and accuracy .

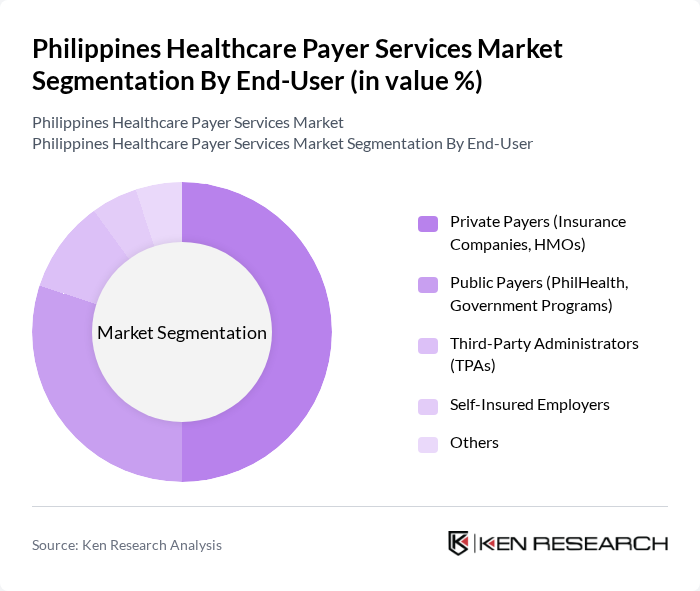

By End-User:The end-user segmentation encompasses various entities that utilize healthcare payer services. This includes Private Payers (Insurance Companies, HMOs), Public Payers (PhilHealth, Government Programs), Third-Party Administrators (TPAs), Self-Insured Employers, and Others.Private Payersare the leading segment, driven by the increasing number of health insurance policies, the growing demand for managed care services, and the expanding role of private health maintenance organizations (HMOs) in the Philippines. Public Payers, primarily PhilHealth, also represent a significant share due to the government’s universal health coverage mandate .

The Philippines Healthcare Payer Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as PhilHealth (Philippine Health Insurance Corporation), Maxicare Healthcare Corporation, Medicard Philippines, Inc., Intellicare (Asalus Corporation), CareHealth Plus Systems International, Inc., Pacific Cross Philippines, Cocolife (United Coconut Planters Life Assurance Corporation), Sun Life Grepa Financial, Inc., BPI AIA Life Assurance Corporation, Generali Life Assurance Philippines, Inc., FWD Life Insurance Corporation, AXA Philippines, Manulife Philippines, Allianz PNB Life Insurance, Inc., Insular Life Assurance Company, Ltd. (InLife) contribute to innovation, geographic expansion, and service delivery in this space.

The Philippines healthcare payer services market is poised for significant transformation driven by technological advancements and government initiatives. As digital health solutions become more prevalent, payers will increasingly adopt innovative technologies to enhance service delivery and patient engagement. Additionally, the focus on preventive healthcare will likely reshape payer strategies, encouraging partnerships with healthcare providers to promote wellness programs. These trends indicate a dynamic market landscape that will evolve to meet the changing needs of consumers and regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Business Process Outsourcing (BPO) Services Information Technology Outsourcing (ITO) Services Knowledge Process Outsourcing (KPO) Services Claims Management Services Analytics and Fraud Management Services Member Management Services Provider Management Services Billing and Accounts Management Services Others |

| By End-User | Private Payers (Insurance Companies, HMOs) Public Payers (PhilHealth, Government Programs) Third-Party Administrators (TPAs) Self-Insured Employers Others |

| By Application | Claims Processing Member Enrollment & Management Provider Network Management Billing & Accounts Management Analytics & Fraud Detection Customer Support/Contact Center Services Others |

| By Delivery Mode | On-site (Hospital/Clinic-based) Home-based Care Telehealth/Virtual Care Mobile Health Units Others |

| By Region | National Capital Region (NCR) Luzon (excluding NCR) Visayas Mindanao Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Health Insurance Providers | 100 | CEOs, Product Managers, Underwriters |

| Healthcare Service Providers | 80 | Hospital Administrators, Billing Managers |

| Government Health Agencies | 60 | Policy Makers, Health Program Directors |

| Patient Advocacy Groups | 40 | Advocacy Leaders, Community Health Workers |

| Healthcare Consultants | 50 | Healthcare Analysts, Market Researchers |

The Philippines Healthcare Payer Services Market is valued at approximately USD 4.2 billion, reflecting a significant growth driven by the demand for cost-effective healthcare solutions and the adoption of digital platforms.